Bitcoin has reached a new high, over USD $73,000.

Physical gold has also hit a record high.

There are varying views why. The ongoing presence of inflation in many countries is often cited. But this is showing every sign of being tamed.

The dramatic slowdown in Chinese equity and property markets is likely a key driver. So, too, is a looming US presidential election that could be even more punishing.

Outside of the US, where a soft landing is in view, safe-haven assets are seeing strong demand. Further, strong US interest rates and booming local stock markets mean a lot of American money is staying at home. While global money hungers for other vehicles.

Disruptive tech investor Cathie Wood sees ‘a bull case scenario’ where BTC could reach $1.5 million by 2030. This would give it a market cap of more than $30 trillion. Larger than the current US economy.

ARK Invest (Cathie’s fund) sees Bitcoin ticking many boxes:

- Safety and capital preservation — no one can confiscate it.

- Diversification — it’s uncorrelated with other assets and markets.

- Long term horizon — price appreciation.

- Liquidity — 24/7 trading access.

- Inflation hedge — Bitcoin is capped at 21 million coins.

Elizabeth Castle, Jersey, Channel Islands. Source: Bitcoin Fund Prospectus 2016

In 2016, I was working for the world’s first Bitcoin fund. Bitcoin had just surpassed USD $500.

There was an ATM machine in our building where you could buy Bitcoin. We had a photo of Elizabeth Castle on our prospectus.

Back then, our focus on Bitcoin was on its potential as an uncorrelated asset and its prospect of mainstream adoption as a currency and global remittance system. We believed this would lead to long-term price appreciation.

That year, the fund returned over 70%. Pitch book in hand, I went to see some of the family offices on the island. In one case, visiting a modern steel-and-glass building in St Helier, juxtaposed with antique furniture from the family’s 19th century shipping fleet.

But with millions under management, these offices were more concerned with loss than gain.

I got the message loud and clear. They would rather earn 8% on a long-short strategy in public equities (where the downside is protected), than potentially 100% on some newfangled digital gold.

Fair enough. It’s hard to protect wealth from the unrelenting erosion of purchasing power, let alone shoot for ambitious gains.

I thought of this the other day. We received an approach from some Swiss fund managers. There was the same concern with downside protection.

Bitcoin: big upside, big downside?

In finance, the only free lunch is diversification. The nub of investing comes down to risk.

How much risk are you willing to take on the downside to get the upside of potential growth and income? What alternatives do you have?

As Wholesale Portfolio Managers, our chief job description is ‘risk manager’.

What is the best return we can generate with the least risk?

This is akin to how fast a driver can take a corner on a race track. Get it wrong or find an oil slick — and both the driver and his car can be wiped out.

Singapore F1, 2017. Source: Robert Nightingale / Flickr

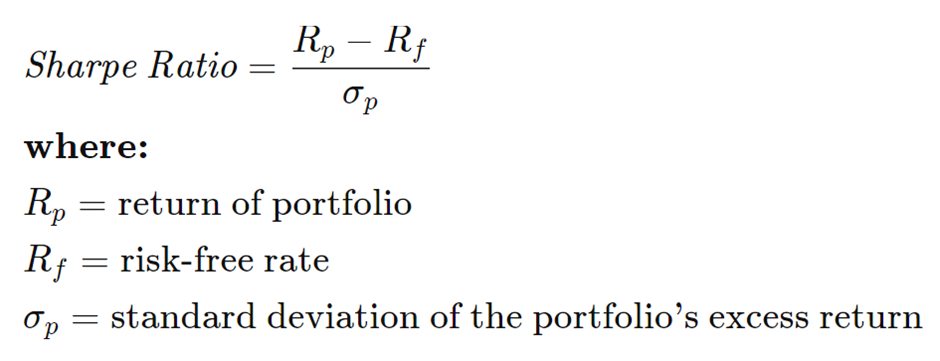

There’s a useful ratio in finance called the Sharpe ratio. It’s a measure of the level of risk and volatility accepted to deliver investment returns.

Generally, the higher the Sharpe ratio, the more attractive the risk-adjusted return. A ratio above 1 means there is some ‘excess return’ relative to the volatility.

Source: Investopedia

Source: Investopedia

What is most useful is considering the Sharpe ratio of an investment over time.

If it can consistently yield above 2, this suggests the manager is adept at generating very good returns in relation to the risk they take. (Of course, it can only measure past returns, which does not indicate the future.)

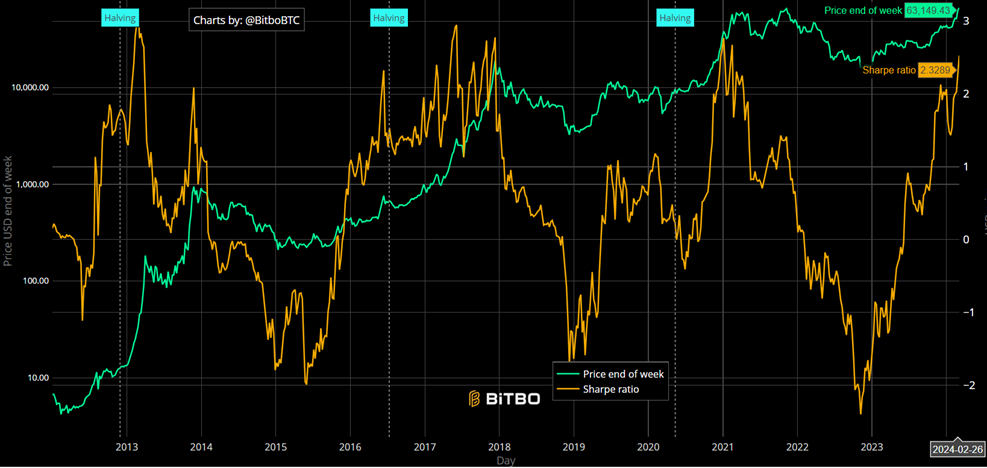

A potential warning bell with Bitcoin is the Sharpe ratio has been all over the place:

Source: Bitbo Charts

But I didn’t need this chart to tell me something that is instinctive.

There is opportunity for big gains. And for big losses.

In 2016, I could tolerate the potential loss of USD $500 on a Bitcoin. At ~$70,000 the stakes are much higher.

Back then, we thought Bitcoin would become more of a mainstream means of payment and transfer. That utility and adoption would drive steady appreciation.

The reality is that it is too slow to transact for everyday payments. But far beyond that, it has become a speculative instrument. A bet on its short supply, its halving (which reduces mining reward), its use in ETFs, a global digital gold, and so forth.

Besides, nobody would want to spend a currency that is meant to appreciate.

As Bitcoin lacks utility as a currency, a wise investor has to consider the ultimate downside. The worst possible risk.

Deep State CBDCs vs Bitcoin

If I were a regulator, I would hate Bitcoin (and other unregulated cryptocurrencies). They take money out of the regulated financial system. They expose naive and vulnerable investors to scams and high levels of risk. They can enable crime and are difficult to locate, let alone confiscate.

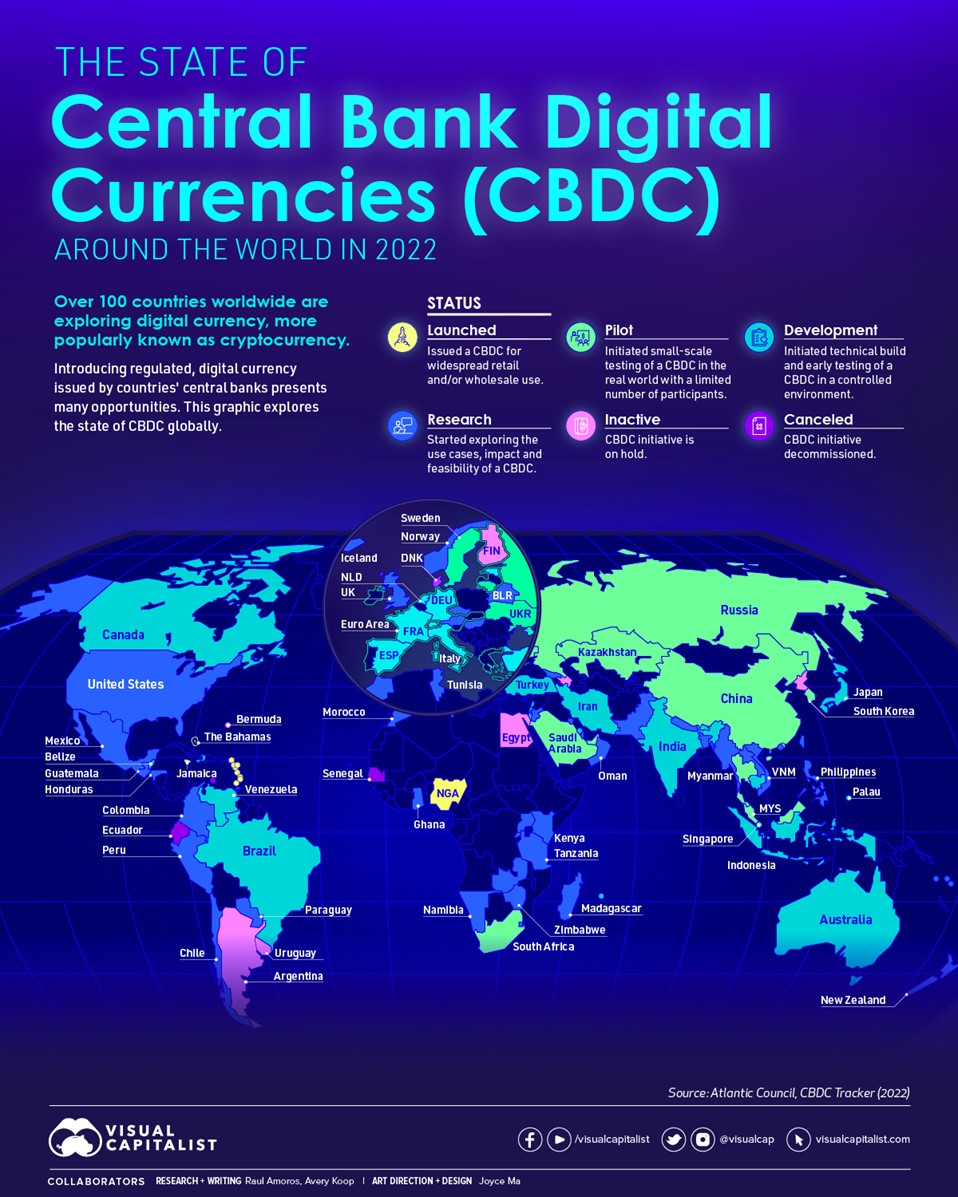

Central banks around the world are working on their own digital currencies: CBDCs (Central Bank Digital Currencies). These aim to provide electronic versions of local fiat currencies.

Source: Visual Capitalist

Here in New Zealand, the Reserve Bank is working through a 4-stage process to potentially issue a CBDC over the next several years. It is currently at stage 2 (high-level design options, cost-benefit analysis, and feedback).

My initial thought was that this could be a useful option. A CBDC would empower access to money outside of the banking system.

Then I recalled the abuses of power during Covid. Excessive lockdowns. Vaccine mandates — when other testing options could have been available. And of financial concern, the freezing of bank accounts tied to protests in Canada.

Yes, some of these measures are now subject to inquiries. They were only rolled out under emergency-use provisions.

But what if we were to find ourselves with an exceptionally authoritarian government? Would they strangle physical cash? Use CBDCs to punish disruptive members of the populace? The tools would be in place.

Of course, for CBDCs to have resounding power, you’d need to also deal with their competition. Other digital currencies. Most magnificently, Bitcoin.

When you have a centralised digital currency, you don’t want to encourage the use of a decentralised one.

‘Oh, but they won’t be able to touch Bitcoin’, some will say. ‘It’s on the blockchain. They would have to do it transaction by transaction.’

It seems unlikely that Bitcoin would be banned in democratic countries. Rather, regulators could simply turn the thumbscrews on its access and adoption.

Here, there are many approaches. Regulating exchanges and transmitters. Requiring all nodes to have licenses.

Whether resistance will grow or regulatory measures would work is unpredictable.

Crypto trading and mining have been technically banned in China since 2021. China’s central bank announced that all transactions of cryptocurrencies are illegal.

Yet there is evidence that many Chinese are managing to move money into crypto via various loopholes. This has grown with the meltdown of equity and property assets in China over the past few years.

There is also evidence that since the Chinese ban in 2021 and notable exchange failures, Bitcoin fell quite precipitously and didn’t catch a bid again until 2023.

In fact, from November 2021 to November 2022, Bitcoin fell over 74% — from $64,400 to $16,400.

Source: Google Finance

This is the sort of potential volatility that requires close understanding on the downside, as well as the upside.

Who is buying Bitcoin now and why? We know China is adding to their gold reserves as a hedge against turmoil in other markets. Are reserves in crypto being added to for similar reasons? Did recent banking troubles fuel further interest? Has the scar of failed exchanges healed?

At $500, the downside per coin is digestible. At $70,000, the brew is much headier.

Cathie and ARK seem to see Bitcoin ticking many of their boxes.

I’m a risk-wary, income-hungry investor. Yet my tick boxes are along similar lines:

- Margin of safety — is there a backstop when the worst happens?

- Diversification — can I be across different asset markets?

- Long-run growth — how much future growth can I get compared to the risk of drawdown?

- Liquidity — can the assets be bought and sold as opportunity or need presents?

- Hedge — can the assets eventually grow and yield faster than inflation?

- Income — can this generate a reliable and growing stream of passive income?

I’m also looking for intrinsic value.

The existence of a profitable business using capital and assets to generate value and return.

When assembling a portfolio of stocks in such companies, the downside is a lot more predictable.

Going beyond this depends on your appetite for risk and your courage in speculation.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Please seek independent financial advice in relation to your own situation.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.