Are you a religious person?

Do you believe that the human experience is prearranged, preordained, fated?

Or…do you believe that destiny is like dough? Continuously shaped and moulded as we move along?

Well, here’s how the great religions see it:

- The Abrahamic faiths — Judaism, Christianity, Islam — believe that the passage of time is linear. It begins with the creation of the world. It is defined by human frailties and moral questions. Then it ends with a final reckoning that promises judgment, salvation, and paradise. So, ultimately, time moves in a straight line.

- Meanwhile, the Dharmic faiths — Hinduism, Buddhism, Sikhism — believe that the passage of time is non-linear. Yes, there are still human struggles to contend with: greed, jealousy, fear. But the grand finale is not fixed and signposted. Instead, there’s rebirth. Reincarnation. The journey starts all over again. So, ultimately, time moves like a circular wheel.

Of course, depending on what your cultural background is, you might already have a strong opinion about which belief system you prefer:

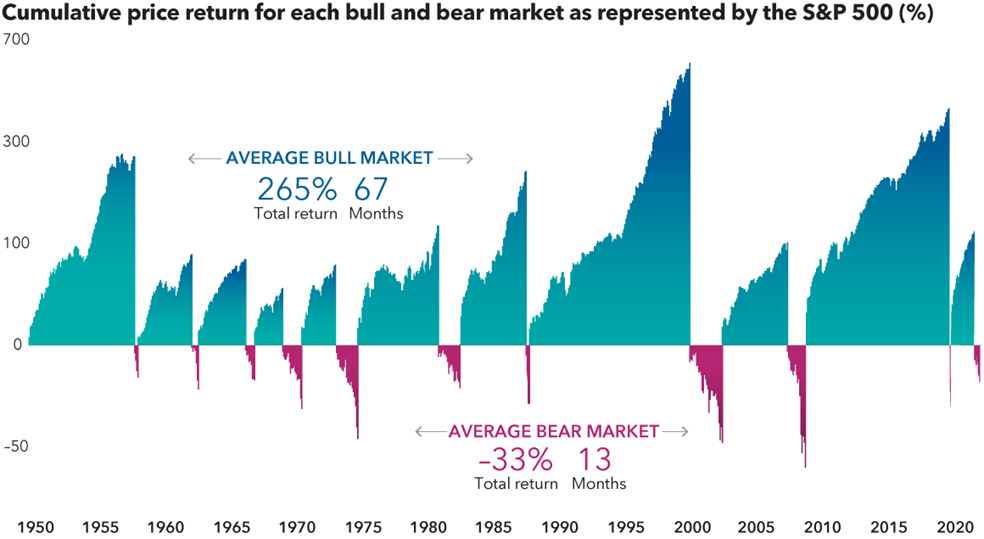

- However, if you’re a long-time investor, here’s what you will notice about the stock market — it doesn’t move in a straight line. Instead, it moves in terms of cycles.

Source: Capital Group

Here are some key points to understand:

- Since 1949, the average bull market has lasted roughly five years.

- Meanwhile, the average bear market lasts roughly one year.

- Over the long run, bull markets are stronger than bear markets.

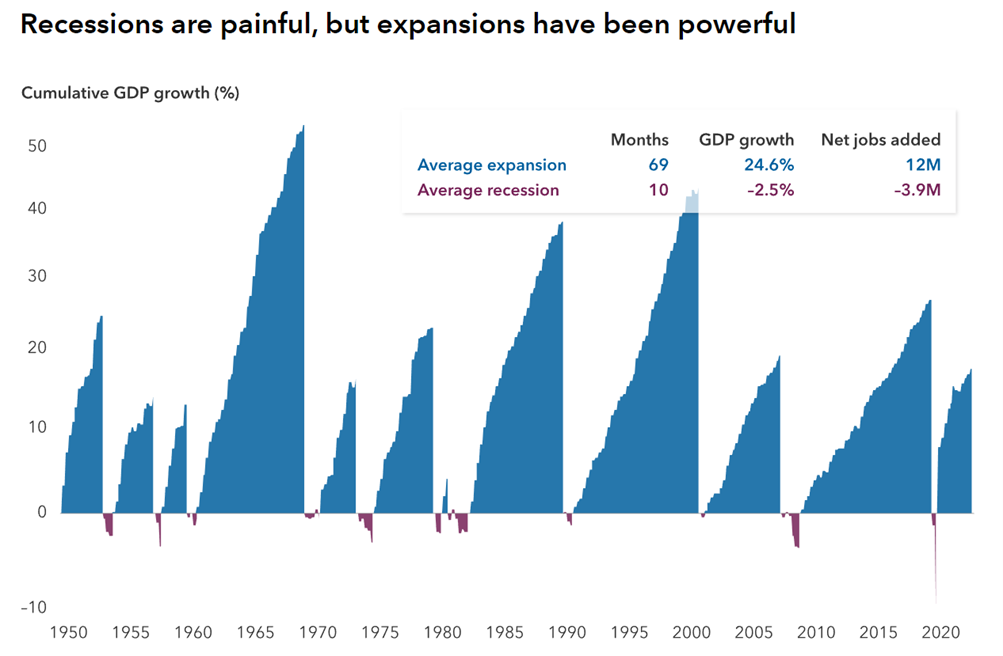

And yet…our human negativity bias is a strange thing to behold:

- From March 2009 to December 2021, we experienced the longest economic boom since the Second World War. The S&P 500 index enjoyed a compounded gain of over 500%. But, apparently, no one noticed this.

- Then, from January 2022 to October 2022, we experienced a relatively brief correction. From peak to trough, the S&P 500 fell almost 25%. Everyone immediately noticed this and freaked out. They couldn’t stop talking about it.

It would seem that the search for enlightenment — for nirvana — remains elusive for most people:

- Sadly, they will never attain it. Simply because they cannot — or will not — rise above their negativity bias.

Source: Capital Group

This is the turning point

So, how can you be better? How can you be smarter? How can you set yourself apart from the rest of the herd? Well, legendary investor Sir John Templeton has some wise words for you:

‘The four most dangerous words in investing are: this time it’s different.’

His logic is rebellious. Contrarian. But it’s informed by history:

- The worst time in the market can often prove to be the best time to invest.

- That is, if you have courage. If you have enlightenment. If you have nirvana.

Right now, my colleague Simon Angelo and I believe that we’re likely on the verge of a new cycle:

- It’s about rebirth. Rejuvenation. Resurrection. Like it always has been.

- Of course, past performance is no guarantee of the future. There’s no crystal ball. But we believe that this moment of moments could be hugely decisive anyway.

So, right now, here’s what you need to think about:

- Is the fear overdone?

- Is it actually creating pockets of value in the market?

- Are there quality assets that are now available at discounted prices?

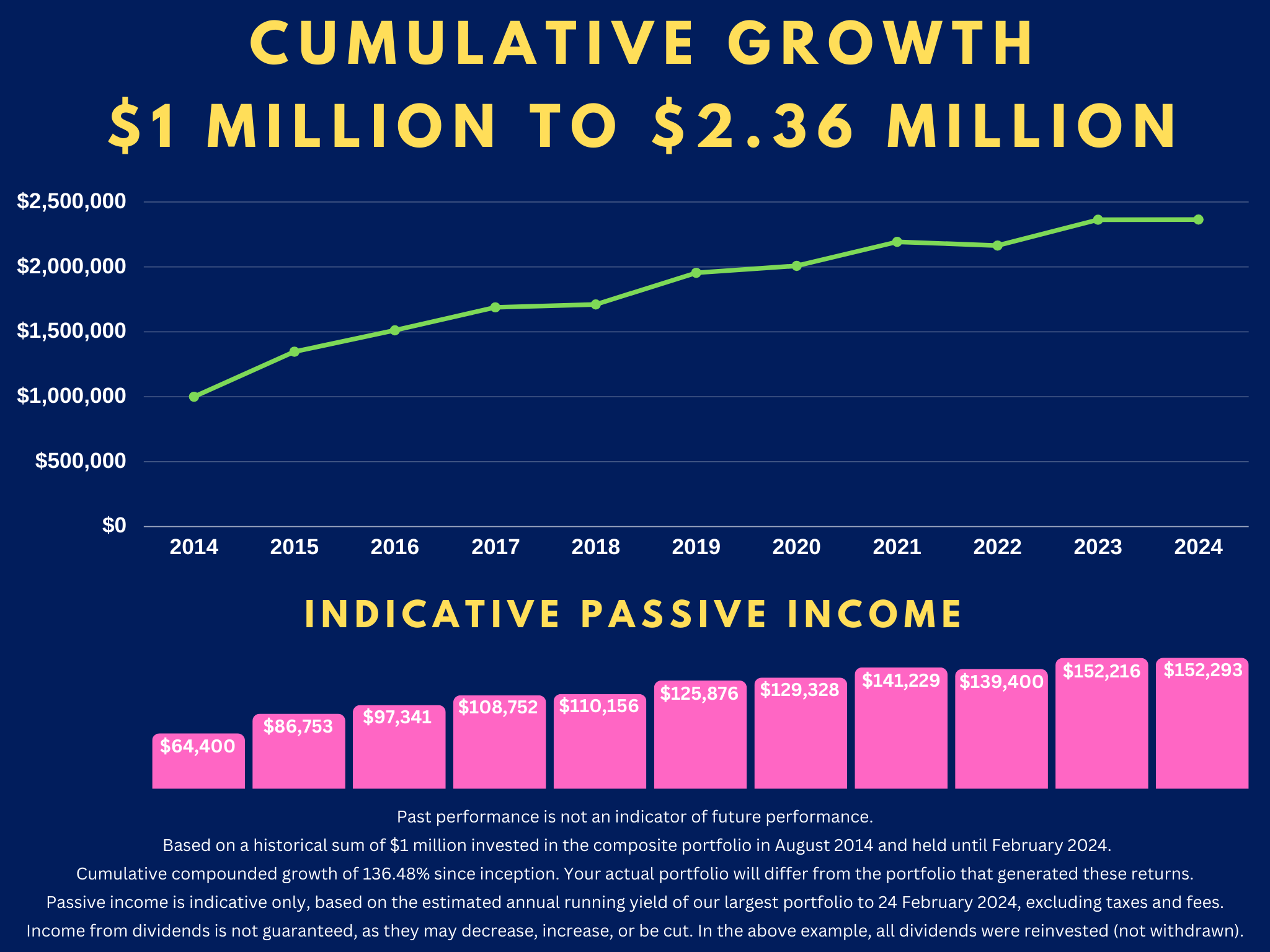

Our Wealth Morning Managed Accounts Service might be worth exploring:

- It’s designed for Eligible and Wholesale Investors who need a Quantum Income Strategy to protect and grow their wealth.

- For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions).

- Do you need help? Rest assured, we’re here for you.

Regards,

John Ling

Analyst, Wealth Morning

(Past performance is no indicator of the future. This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.