He who lives by the crystal ball will eat shattered glass.

—Ray Dalio

In the 1960s, many baby boomers stood up to the elite establishment.

They rebelled with political activism and liberalism.

They sought to change politics, culture, and society. They wanted the world to be green, nuclear-free, and for all to live equitably.

They were the counter-culture…

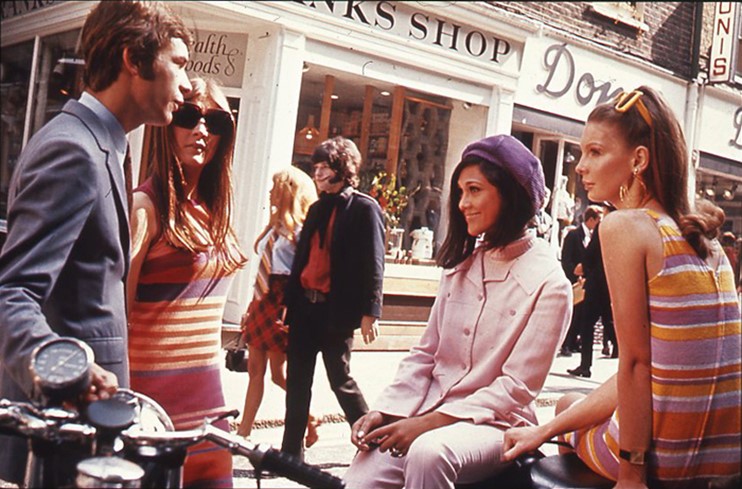

Carnaby Street, London, 1966. Epicentre of the Swinging Sixties.

Source: Wikimedia Commons

Today, their movement has been successful. At least in some part. Culture and media reflects its zenith: liberal socialism.

Yet they’ve also failed. Liberal values have gone too far. Socialism has ensconced privilege. There’s a new elite establishment.

But what are the hallmarks of this reign?

Marriage and faith are in sharp decline. Birth rates fall well below replacement. One-person households are the fastest-growing. Ordinary people can’t afford homes. Politics have splintered. Inequality has exploded. And some now see the West in terminal decline.

The final overreach of the Swinging Sixties is found in the Woke 2020s.

Wokeness — or acute political correctness and progressivism — are now mainstream. Left-wing politics carries its beacon in the name of fairness and virtue. This has infected government, legacy media, education, the bureaucracy, and corporate management to some degree.

If only it worked and we were all living in utopia. But it hasn’t worked, and here’s why: a free and open market knows what billions of people want. A bureaucrat with pen or podium knows only what they, and those like them, want.

Now the pendulum is swinging back like a hammer.

The new counter-culture

A crystal ball for the Left sees society increasingly ‘made fair, green, and tolerant of all’ by a beneficent state. You won’t need to own anything. The oppressed will rise up. Everyone will be happy.

The Covid-19 pandemic provided a foretaste of the sort of government control needed to bring equity to all. The public service inflated and expanded. Private business was pushed out. The cost of doing business, and hence prices, went up across the economy.

From 2020, monetary policy stepped in to support the pandemic response. The purchasing power of a dollar declined even further. Prices went up even more. The clever and wealthy bid up asset prices. Those without much capital floundered.

Unfortunately, this served to accelerate inequality. Society became more fractured, chaotic, and dangerous.

Well, enough is enough. Today, the counter-culture is rebelling. Fighting back, just as it did in the 1960s. But this time the rebels are calling for a return of freedom, true democracy, and conservative values that built the West’s success.

Of course, the left-wing elite establishment are having a fit. According to them, these new rebels are ‘far right’, bringing a tumult of disinformation.

But that establishment might be on the losing side.

A new renaissance is coming

If you spend any time on Elon Musk’s X (formerly Twitter), you’ll find a cacophony of voices decrying ‘woke socialism’ and calling for a return of free speech and the free market.

Musk reportedly bought Twitter to restore free speech and combat a ‘mind virus of wokeism’ infecting America.

Source: Image by Mohamed Hassan from Pixabay

Consequently, some media outlets have left X. Complaining that it is too right-wing or divisive. Here in New Zealand, some of those in question haven’t posted since April 2023, barely a year after Musk bought the platform.

But to suggest that X is some sort of haven for extremists is clearly wrong. As of 2023, there were over 550 million monthly users, with 58% under 35 years old.

Yes, some tweets could do with moderation. They could do with some balance. But there is a clear view on an emergent trend.

Having faced the trauma of a pandemic, when fear made the people sheep, it also made the government wolves. The trauma of that experience has raised scepticism and changed outlooks.

Loose money

The funding of the pandemic response joined mass loosening of the money supply. By some estimates, we’ve suffered a near 25% degradation in purchasing power in New Zealand over just three years.

Nobody completely escapes the claws of inflation in the short-term. It makes it expensive to live. Devastating if you own little. And punishing if you invest with leverage.

The 2020 pandemic and its response have been traumatic financially and psychologically.

But, as in the past, the human race has responded to trauma with resilience and fight. The pendulum swings back.

After World War II, we saw a period of great prosperity and a prolonged bull market.

Are we here again?

We’ve just been through one of the longest bear markets since that war. Who wants to relive the pain of 2022?

Now inflation is coming under control. Although we’re not out of the woods yet, interest rates are set to fall at some point. This will bolster businesses and households.

A swing to the right

Socialist or left-leaning governments around the world — from New Zealand, to Argentina, to Europe — are being cast aside.

China, once a beacon for the benefits of central planning, is now reeling from an economy unable to flex.

Worldwide phenomenon? Source: Reposted photo by Javier Milei on X.

Right-wing governments support the flexibility of the free market. Lower taxes. Deregulation. And, inevitably, curtailed inflation.

Lower interest rates and lighter regulation mean businesses can flex their muscles and bring down prices. In time, household formation is easier. People can have children. There is hope beyond woke nihilism. The world is saved from extinction.

Markets go on to deliver increased prosperity for those who wisely invest in their best offerings.

Will you join us in investing for the new renaissance?

If you are an Eligible or Wholesale Investor, Wealth Morning may be able to help you build a robust portfolio in your own managed account. We take on a limited number of clients for each market cycle.

For further details, do get in touch today.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.