I’m a millennial.

I was born in the 1980s.

I haven’t been around very long.

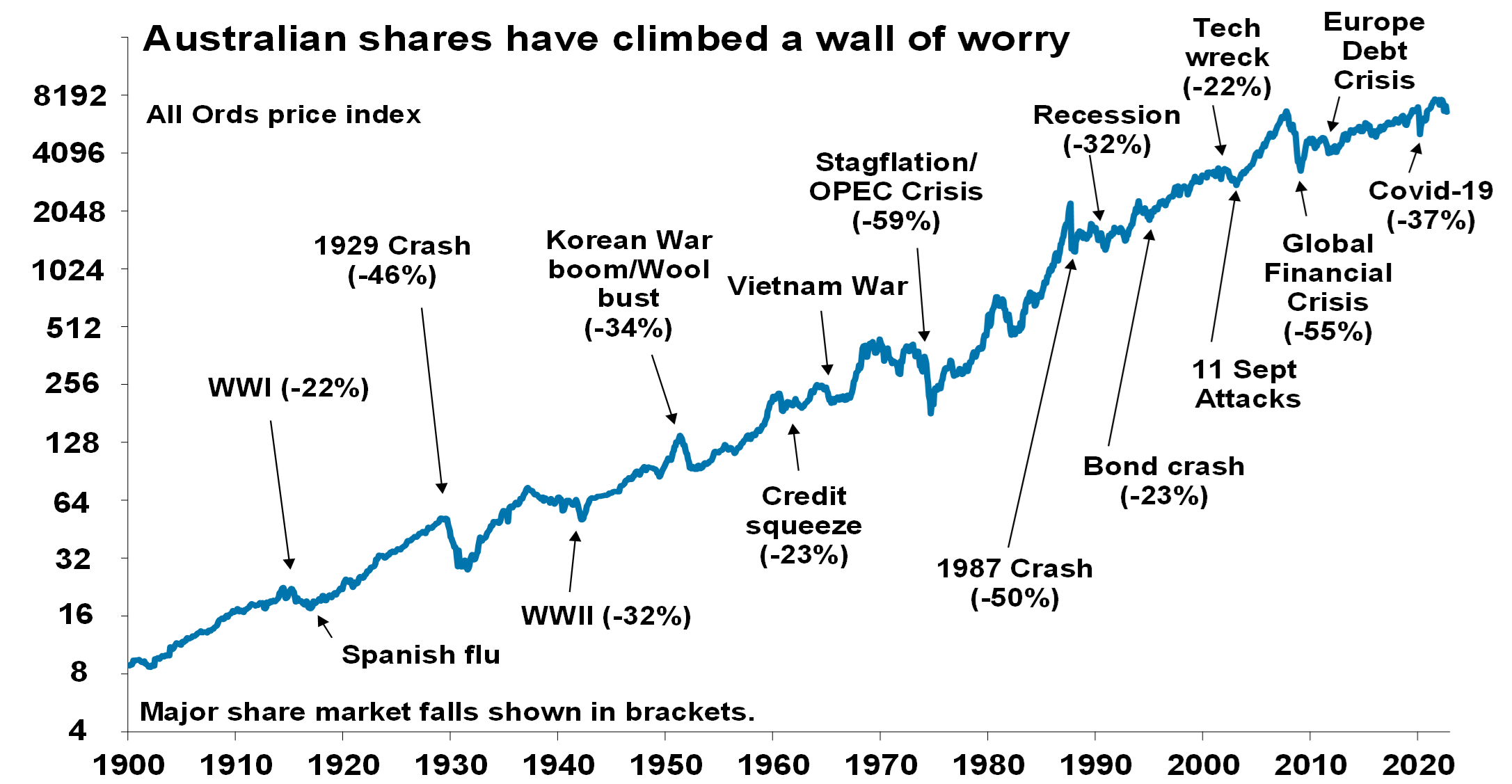

And yet, in my relatively short life, I’ve already seen five major events that have stirred up an incredible amount of fear. Here’s how they played out:

- The hole in the ozone layer. We were told to panic. UV radiation was surging through our atmosphere and hitting us at an unprecedented rate. It was only a matter of time before our planet’s ecosystem was destroyed.

- The Y2K bug. We were told to panic. As the new millennium rolled around, computers everywhere would crash because of two missing digits. It was only a matter of time before we fell back into the Dark Ages.

- The War on Terror. We were told to panic. Radical Islam was an existential threat, and sleeper cells had infiltrated every level of our society. It was only a matter of time before a dozen 9/11-style attacks hit us.

- The Global Financial Crisis. We were told to panic. Subprime mortgages were experiencing a meltdown, and the radioactive poison was spreading. It was only a matter of time before our banking system collapsed entirely.

- The Covid pandemic. We were told to panic. A new virus was crossing borders like wildfire, and it was supremely deadly. It was only a matter of time before it came for you and your family.

Now, look at all these events. Study them closely. You will start to see a pattern, don’t you?

- It’s all about fear. Again and again, we were told that our Western civilisation was on the brink of annihilation. An apocalypse awaited us. The end of days.

But today, in retrospect, ask yourself these questions:

- Was the fear exaggerated?

- Was the fear oversold?

- Was the fear just plain wrong?

Of course, whenever a crisis happens, it’s natural for us to feel scared:

- We’re desperate for a sense of direction. So we turn to our leaders. Our politicians. Our policymakers.

- But when we don’t get a result that satisfies us, we become frustrated. We might blame our leaders for doing too little. It feels like they are not being decisive enough in addressing the problem. They are moving at a snail’s pace. There is no sense of urgency. Why aren’t they reacting? What on earth are they waiting for?

- But then again…the opposite also holds true. Perhaps we might blame our leaders for doing too much. They are being too forceful, too frantic. They have a big hammer, and they are going around, swinging it with wild abandon. The violence they inflict leaves a trail of collateral damage. They are hunting for nails even though there may actually be none. Gosh, why on earth are they being so obsessive? Where is their sense of proportion?

- Well, uh-huh. Yes, indeed. That’s the dilemma we face, isn’t it? For every person who thinks the government is doing too little, I can guarantee you, there’s always going to be someone else who thinks the government is doing too much.

- In fact, some people with an anarchist streak believe that governments on both the Left and the Right are always evil and oppressive. Therefore, our entire political system should be dismantled entirely. Smash the state.

- But…are such sentiments actually reasonable? Are such emotions fair? What is the truth, really?

Well, the truth may not be as dramatic as you think. In fact, it’s far simpler. British author Alan Moore has spent his entire career exploring conspiracies. And with a touch of dark humour, he explains:

‘The main thing that I learned about conspiracy theory is that conspiracy theorists believe in a conspiracy because that is more comforting. The truth of the world is that it is actually chaotic. The truth is that it is not The Illuminati, or The Jewish Banking Conspiracy, or the Grey Alien Theory. The truth is far more frightening — nobody is in control. The world is rudderless.’

So, is this true? Is no one actually in control? Is the world rudderless?

- Well, let’s consider this important point. Our leaders are not gods. They are not deities. They are not supervillains.

- They are human. Painfully so. And because of this, they come with their fair share of human frailties and failings.

- Ultimately, what really drives them is this inescapable fact: the fog of war.

Source: Image generated by OpenAI’s DALL-E

What can you do as an investor?

I love this kind of humility from Buffett. It’s great because it speaks to an essential truth:

- Rational investing depends entirely on an investor’s ability to master his own fear.

- This is the best way — perhaps the only way — for him to navigate short-term uncertainty.

- Because, ultimately, it’s the long-term picture beyond the fog that matters the most…

It’s time to have your say

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them:

- Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback It encourages us. It helps us to do better. It helps us to reach further:

- So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time.

- Thank you so much in advance for your kindness and generosity. Your readership keeps us going!

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.