Definition: Financial Freedom / Independence. ‘A state where an individual or household has accumulated sufficient financial resources to cover its living expenses without having to depend on active employment or work to earn money in order to maintain its current lifestyle.’

—Robin and Dominguez, 2018: Your Money or Your Life

Running Wholesale Portfolios for prosperous investors, I’m privy to different financial goals.

To my mind, the most satisfying aim is to become financially free. To live with financial independence.

This is a goal that usually needs more meat to sustain it.

If you have financial freedom, what will you do with that? What is the purpose that will give meaning to your life and newfound freedom?

Because this is no easy goal. In the wealthiest country in the world, by their own definition, only 1 in 10 Americans are living their definition of financial freedom.

Sure, that definition is going to be different for everyone. Here in New Zealand, I reckon financial freedom fires up from a passive income of around the average salary of $70,000.

There are two critical questions to provide you the impetus needed to reach this level. To sustain it or expand it:

1) What would be your driving purpose when active employment is a choice, not a necessity?

2) How will you reach and maintain passive income of $70,000+ per year?

Let’s start with the exciting question. Driving purpose.

McKinsey analysed people in their optimal state. Productive people with energy and self-confidence. They found in these people ‘an ironclad sense of meaning’. A belief that what they’re doing truly matters to themselves or to others they care about.

This is going to be different for everyone.

Example: My X friend at Dividend Hero has his heart set on a bucolic life…

Get rich then get off the grid pic.twitter.com/N7KJn9Y87n

— Dividend Hero (@HeroDividend) February 15, 2024

Source: Dividend Hero / X

Appealing?

I’d last about a week. I have no desire to raise chickens, suffer slow internet, or have to make my own cappuccinos day in and day out.

I like the grid. I value specialisation. So I’ll leave the power generation and distribution to Genesis and Vector.

But I know many readers who would find fulfilment sustaining and protecting their family off-grid.

In a disaster, I will run down my cans and collapse from caffeine withdrawal. They will prevail with hearty soups from the garden.

Further, going off-grid is a fast-growing trend. With solar prices falling 80% over the past decade, it’s now predicted around 12% of Americans could be living off-grid by 2025, which makes a solar company investment sound increasingly appealing. Fortunately, their withdrawal from utility businesses should be made up for by EV demand and electrification of heating.

Meanwhile travel is going off-grid too. A Booking.com survey of 24,000 travellers found that 55% wanted off-grid accommodation for their next trip.

Self-sufficiency is an honourable purpose with growing attraction.

This is a pull factor. A desire that pulls you toward financial freedom, provides motivation, and makes it easier to meet.

Other pull factors

I don’t want to go off-grid. But I do find meaning in managing money and putting it to work. That buys a pretty pleasant on-grid lifestyle. Family time. Other interests like travelling. And learning how little you know.

A revelation in our business has been the prevalence of older clients (80+) willing to embrace risk. They want to optimise their returns and leave a legacy. The saying ‘beware of an old man in a hurry’ may be more positive than negative. Hurry is purpose.

So, identify some pull factors of what you’d love to do with free time.

Whether it’s going off-grid, sailing into the sunset, spending half the year living la dolce vita in Italy, nurturing kids, grandkids, or pursuing inventions — it’s not hard to find pull factors for a financial freedom purpose.

There are also push factors

Having to show up to a job you don’t enjoy. Withdrawing from the sense of a growing tide of government control. This really got underway during the response to the Covid pandemic.

Whether you think one lockdown or several were justified or not, they were disturbing for many freedom-loving people.

There’s a beach near my home I associate with freedom. It’s usually relatively empty and provides a chance to cool your feet as you walk its length in the gentle lapping tide.

Cheltenham Beach, Devonport. Source: Tom Hall / Flickr

It now comes with a warning memory. The police guarding it during Covid lockdowns. You were allowed to exercise, but the beach was off-limits.

Following these lockdowns, searches for lifestyle property and off-grid situations boomed.

Risk to property rights?

The controls from 2020 to 2023 could have culminated in something further hazardous to freedom. The very real risk of a left-wing coalition agreement forcing a wealth tax.

The wealth tax would have attacked the essential freedom of property rights.

In a nutshell, if you have a farm with net assets of $5 million, you might need to hand over $125,000 every year to the government.

These days, many farms operate on tight margins. This would have destroyed the ability of some to operate. To produce food New Zealanders (and others around the world) depend on. Farmer’s property rights would be hampered. Free function of the market and access to competitively priced goods would be battered.

Such push factors caused many to consider not only financial freedom — but how that financial freedom could be derived.

While financial freedom could provide a buffer from cruel rules, such as Covid mandates, it may not protect your wealth from a wealth tax. That remaining threat reinforces an idea: A solid source of financial independence might be best derived from globally diversified assets.

Financial freedom from a diversified dividend portfolio?

Many New Zealanders have built financial independence from appreciation in property. With rental yields and mortgage finance now constrained, this looks challenging today.

My personal system to help deliver financial freedom looks like this: quality dividend-paying companies listed in developed markets around the world.

Now, some will say when you seek a decent dividend, you often give up capital growth. This may be true for technology stocks — which tend to carry more risk and volatility. But for steady assets like utilities, energy generators, REITS (real estate investment trusts), commodity businesses, auto manufacturers, banks, insurance and logistics companies — it may be possible to find both attractive income and potential capital growth.

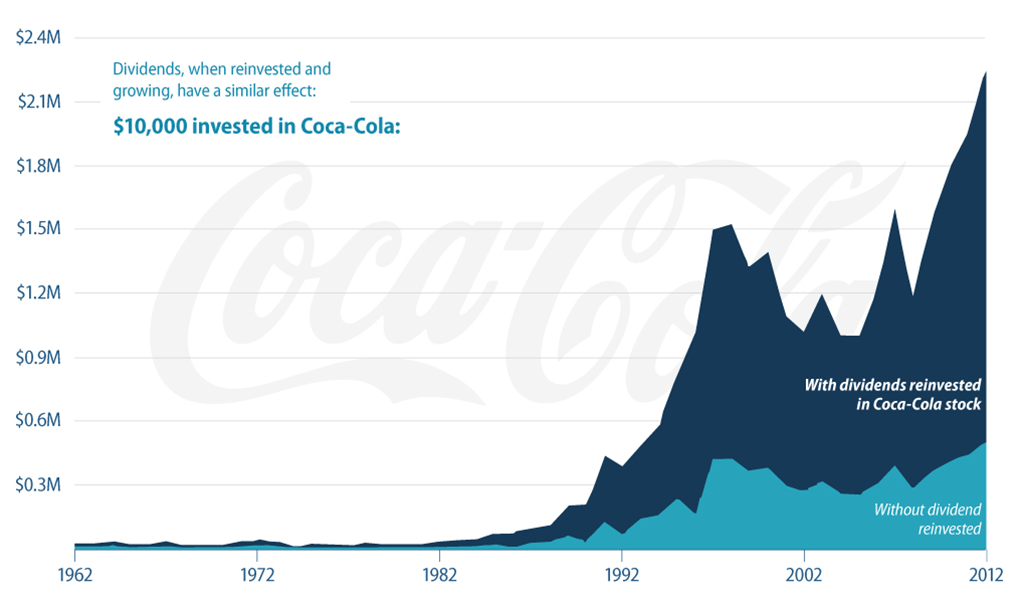

There is also the power of dividend reinvestment. (Where you put your dividends back into the market to compound). It has been estimated that some 40% of stock market returns since the 1930s has come from dividends. Though the real fuel is compounding.

Take a look at this example on reinvesting dividends from Coca-Cola [NYSE:KO]:

Source: Visual Capitalist

Of course, reinvestment would mean you can’t access the passive income along the way. So many investors choose to do that when the income is not needed.

The ideal scenario is to combine income with growth.

Take a look at Westpac Bank [ASX:WBC] in Australia. It pays a dividend of almost 6%, and its share price has grown 10% over the past month.

Or Genesis Energy [NZX:GNE] here in New Zealand. While the stock is down a little this past month, it projects a generous gross dividend of over 9%.

Now, extend this work to a wider variety of recovering industries in Europe, the UK, and North America. It is not hard to see how an experienced investor could build a diversified portfolio for long-run income and growth.

In the European property sector, for instance, we see a holding projecting a dividend of almost 10%. Yes, that comes with a little more risk, but also hefty potential upside if interest rates fall.

Remember: no dividend is guaranteed. Tower Insurance [NZX:TWR], for example, was paying reasonable dividends. Then cut them due to claims events.

So the work of building a passive income portfolio for financial freedom also needs to consider aspects like dividend cover and risk.

Passive income scenario

Here’s a promising situation we saw with one investor from 2020.

His portfolio performed well despite a very tough time in global markets:

| Date | Capital | Margin | Dividends p.a. | Current Yield % | Entry Yield % |

| 1 Jan 2020 (open) | $855,670 | $0 | $46,502 | 5.4% | 5.4% |

| 31 Mar 2020 | $645,202 | $0 | $46,533 | 7.2% | 5.4% |

| 31 Mar 2021 | $1,044,837 | –$50,648 | $33,784 (Covid) | 3.2% | 3.9% |

| 31 Mar 2022 | $1,249,570 | –$115,876 | $55,358 | 4.4% | 6.5% |

| 31 Mar 2023 | $1,421,702 | –$381,051 | $93,170 | 6.6% | 10.9%* |

*Past performance does not indicate the future.

Entry yield is calculated on the original capital sum (excluding any margin).

- Yes, he did start with a decent sum ($855,670) in 2020.

- He had to ride out some volatility. His portfolio dropped from $855,670 to $645,202 after Covid lockdowns hit.

- The value of his positions in the market grew following the Covid recovery (after March 2020).

- That financial year, many businesses in lockdown slashed dividends. His portfolio income dropped from $46,533 to $33,784.

- With low interest rates in 2021 to 2023, he also used some broker margin to add to the portfolio. The interest cost for FY 2023 was about $7,000 — though interest costs have increased a lot since this period.

- Yet, by 2022, dividend income was over $55,000. And last financial year over $93,000 as dividends surged back.

- Net of interest cost, the income for the 2023 financial year was over $85,000. He reached his first financial independence goal.

- This portfolio now has projected income of over $100,000. It is well diversified outside of New Zealand with holdings in Australia, US, UK/Europe.

The powerful point is that you may buy a stock with an entry yield of, say, 5%. Over time, if the dividend increases, your yield on entry could end up higher.

For example, let’s imagine that you buy a company offering a dividend of 5%. The business expands, and over time, they increase that dividend by 50%. You’ve now got an entry yield of 7.5%.

This is one way that investors are building financial freedom for the long run.

And that desire is being driven by various aspirations. From going off-grid, choosing your work, leaving a legacy, or not having to make your own cappuccinos.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice, nor any recommendation on any company. Readers should seek independent financial advice for their own situation.)

(Wealth Morning Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. If you would like to request a free consultation on this service, please click here.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.