In the business world, the rearview mirror is always clearer than the windshield.

—Warren Buffett

Artificial intelligence. Robotics. Automation.

These are the big buzzwords that you keep hearing about in the media.

But is it all hot air and shallow hype? Or could this actually be the start of a Fourth Industrial Revolution?

Source: Image generated by OpenAI’s DALL-E

Well, here’s what the experts are saying:

- The International Monetary Fund believes that 40% to 60% of jobs around the world could be affected by the rise of AI.

- We may see a new era of greater efficiency and productivity. But this could come at a high social cost. We may experience disruption on a large scale. It might feel like a sucker punch. Are we prepared for it?

- For example, imagine this. A young person is enrolling in university. He wants to study for a career that he’s deeply passionate about. It’s a three-year course. He works incredibly hard. He does all the right things. He becomes a straight-A student.

- However, by the time he graduates from uni, he suddenly discovers that his dream job has been taken over by AI. Well, gosh. It’s as if the carpet has been rudely pulled out from under his feet. It’s emotionally devastating, isn’t it?

In 1965, Gordon Moore — the former CEO of semiconductor giant Intel — made a prediction. He suggested that the power of computers would double once every 24 months. The compounding effect would eventually snowball:

- So, now, I have this sneaking feeling — just based on a hunch — that more things could happen in the next 20 years than in the last 200.

- In fact, we may be approaching the point of what some scientists are calling a ‘technological singularity’. This is where the average AI could become smarter than the average human.

- Still, given the frenzied pace of change that threatens to overwhelm us, is there a silver lining to be found? Is there a reason for us to feel hopeful about the future?

Here’s the long-term investment scenario

Source: Image generated by OpenAI’s DALL-E

Of course, I’m humble enough to admit that I don’t have a crystal ball. I’m certainly no prophet. The best I can do is look back at history and study it. And here’s what I’m seeing:

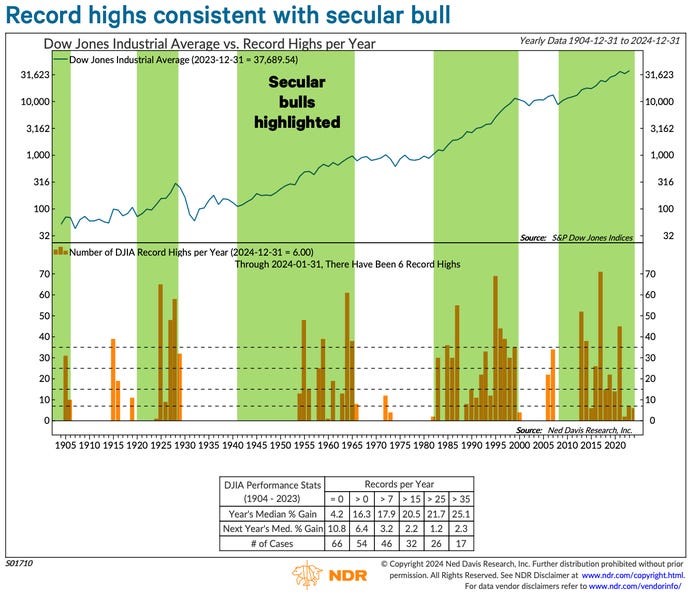

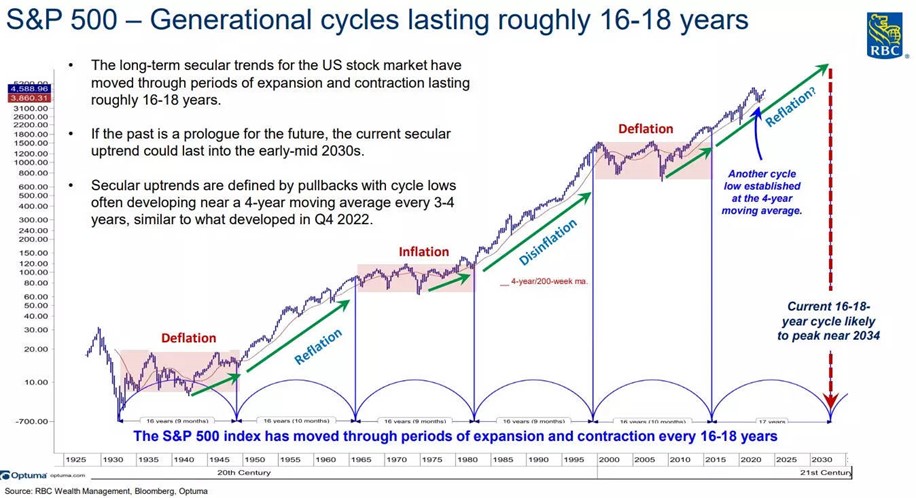

- What intrigues me is the idea of a secular bull cycle. This is a prolonged period of rising asset prices, driven by strong economic and social forces. This market has the potential to last years or even decades. Yes, pullbacks and corrections may happen during this time — but the prevailing long-term trend is usually upward.

- For example, one of the most powerful secular bulls happened from the 1940s to the 1960s. With America leading the way, this was a time when the market was boosted by technological innovation, increasing productivity, and a sustained period of rising corporate profits. Indeed, the post-World War II era was a golden age.

- Later on, the secular bull showed up again during the 1980s and 1990s. As the Cold War drew to a close, we saw trade barriers coming down. Once more, under American leadership, a new globalised economy began to take root and flourish. The internet emerged from its infancy. Prosperity accelerated.

Source: Insider

Source: Insider

So, here’s the trillion-dollar question now:

- In the 2020s, are we seeing a new secular bull cycle move the needle on the market with renewed strength?

- Could artificial intelligence, robotics, and automation become the next key driver of innovation?

- Are we about to climb to the next level?

In August 2019, American bank JP Morgan made this bold prediction:

We believe that a new secular bull market for equities began in February 2016. Our analysis finds that annualized total returns should average in the double digits until 2033–2035.

Interestingly enough, JP Morgan made this prediction *before* the Covid pandemic and *before* our current inflationary struggle:

- So, given the serious disruption that we’ve experienced, does their long-term bull thesis remain intact? Well, some would argue yes.

- Over the past five years, Nvidia [NASDAQ:NVDA] — the American tech company that’s become the darling of artificial intelligence — has seen its share price soar by over 1,700%.

- At its current valuation, Nvidia alone is worth as much as the entire Chinese stock market. It’s staggering, isn’t it? This one American company is worth as much as 2,500 Chinese companies.

- All this is happening because we are being promised a revolution. A brave new frontier of productivity gains, problem-saving abilities, and economic growth. Yes, some existing jobs may come under threat — but the hope is that new jobs will emerge in due time.

- To add to this, favourable monetary policy may also act as nitro fuel, juicing up the secular bull. This may come in the form of interest-rate cuts, which may encourage borrowing and investing in the market, lifting asset prices.

- As of January 2024, investors have stockpiled over USD $6 trillion in cash. This money is currently sitting in bonds, term deposits, and saving accounts. As interest rates start to soften, you might expect these funds to shift back into stocks.

Now, of course, there will be sceptics. Not everyone believes that this bull cycle is valid at all. In fact, they actually criticise it:

- For instance, British investor Jeremy Grantham has dismissed AI as an overhyped bubble. He says it’s heavily overbought, and he expects the bubble to pop soon. Furthermore, he doesn’t believe that AI will have much impact on our economy, at least in the short-term.

- Maybe he’s right. Maybe he’s not. However, history can offer us a broader view of technology here.

- For example, let’s look back on the 20th Do you remember the Wright Brothers? Yes, they were brilliant American inventors. They carried out the first test flight of an engine-powered aircraft, the Wright Flyer, in 1903.

- Later, NASA took America to the next frontier: spaceflight. With courage and ingenuity, they carried out the first manned landing on the Moon, Apollo 11, in 1969.

- Now, think about it. What’s the time gap between these two revolutionary events? Why, a mere 66 years.

- This is astonishing, isn’t it? It goes to show that progress can be wildly unpredictable. Sometimes there’s a huge leap forward. Sometimes it can happen a lot quicker than the experts generally assume.

So, is the next American-led secular bull already underway? What will it mean for the market in the years and decades ahead?

- Perhaps we just don’t have the benefit of hindsight to grasp the big picture just yet.

- Perhaps, in the fullness of time, all will be revealed.

- But I believe one thing will always hold true — human resilience and innovation will keep surprising us. Expect the unexpected.

We want to hear from you

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you. We’re eager for your feedback:

- If you have enjoyed this article, please consider leaving us a review.

- Let us know what you liked. Let us know what inspired you. Let us know if it’s made you a better investor.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.