People understand the world by stories. They’re what logically make sense to us. These stories have good guys and bad guys. Heroes and villains.

Stories. though, may not be the best way to understand the world of finance. Financial situations are often complex and nuanced.

So, it was with great interest that I watched Tucker Clarson interview Vladimir Putin the other week.

I wanted to see this and think about it unfiltered. Before other media or voices weighed in.

Ep. 73 The Vladimir Putin Interview pic.twitter.com/67YuZRkfLL

— Tucker Carlson (@TuckerCarlson) February 8, 2024

While the Russian history lesson was outside my sphere, Mr Putin’s comments on the US dollar made me sit up with interest.

He discussed the fact that America’s economy was strong, growing at about 2.5%. And that inflation was only running at around 3%.

Yet, between these facts, was a diatribe on the grave mistake of US (and European) sanctions against Russia.

Putin, without notes, recounts figures:

‘Before the war, the US dollar and euro was used in about 80% of foreign transactions in Russia. The US dollar accounted for about 50% of transactions with other countries.

‘Now it has decreased by 13% while the use of other currencies has increased.

‘Our transactions in yuan accounted for about 3% [in 2022]. Today, 34% of our transactions are made in rubles and about as much, a little over 34%, in yuan.’

Yet my impression is that I’m watching a sidelined and somewhat bitter man, albeit with legitimate grievances.

There is a touch of envy when he talks of US dollar inflation now at only ~3%, quite good for a large country like America.

The Russian ruble experienced inflation of 11.9% in 2022 and 7.4% in 2023. Ruble weakness has worsened, even though The Bank of Russia is expected to hold its key rate at 16% this month. The Bank’s inflation target is 4%, twice that of America’s Federal Reserve.

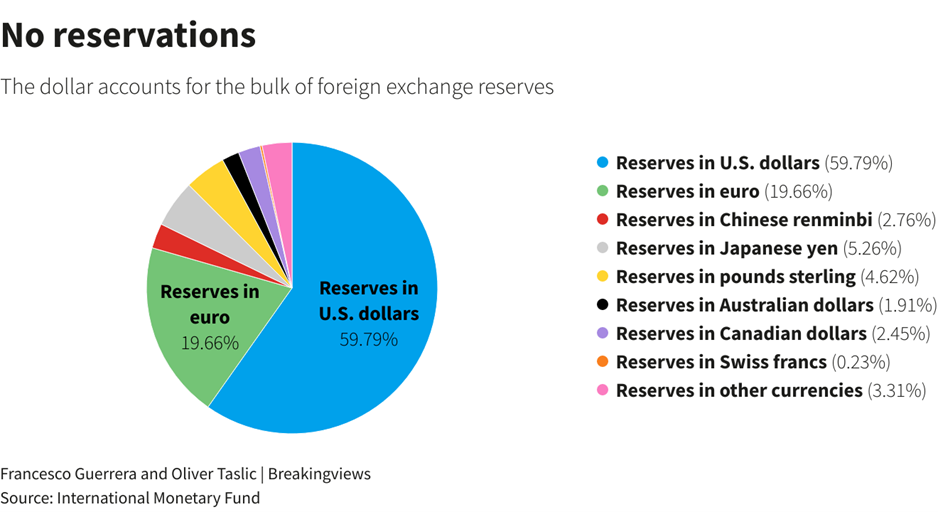

Global currency reserves, as of March 2023. Source: Reuters

While Putin’s point is that weaponisation of the dollar in the form of sanctions has actually hurt America, the real message I get is that he’d much prefer things to be how they were before.

The ruble is clearly volatile, particularly under sanctions. The yuan, as an alternative, carries more risk as the currency of a communist nation.

In the past, the Chinese government has not hesitated to manipulate the yuan when needed. In 2019, in response to the Trump tariffs, it was substantially devalued.

In January this year, consumer prices in China fell 0.8%. Deflation could further weaken an already weak yuan. Yet, despite a bargain currency, the Chinese stock market has fallen by around half since early 2021.

Give me US dollars any day

No currency is perfect. Since the end of the gold standard, I’ve heard many claims that the US dollar in particular is in danger of collapse.

Those who believe this and sip the fear elixir tell me: ‘It’s time to buy Bitcoin, gold, or [insert favoured precious metal of the day].’

Agreed, Bitcoin has had a good run from its early days. But it carries considerable risk without any yield. Financial regulators don’t seem to like it and could well find ways to choke its growth.

Gold has been a fairly reliable hedge against inflation, going back to biblical times. But again, it is an asset without yield, without holding income.

In 2014, when I was sitting at a global trading desk, a Kiwi dollar was worth 80 to 85 cents US. Today, an NZ dollar is only worth 60c to 62c US.

Sitting in my trading account, I would rather have a reserve of US dollars, compared to any other currency. In recent times, this also goes for the euro.

These two currencies make up the lion’s share of global reserves. Any drop in preference from the US currency has mainly occurred due to the growing role of the euro.

When it comes to holding a currency in reserve to trade in world markets, you want the most reliable currency out there.

No major currency is backed directly by gold anymore. Currencies are backed by the governments that issue them.

The US government is backed by the world’s largest pool of wealthy taxpayers. And it is checked by the firm hand of the Federal Reserve, laser-focused on 2% inflation.

This does not mean that holding US dollars (or any currency) will not subject you to harsh loss of purchasing power over the years.

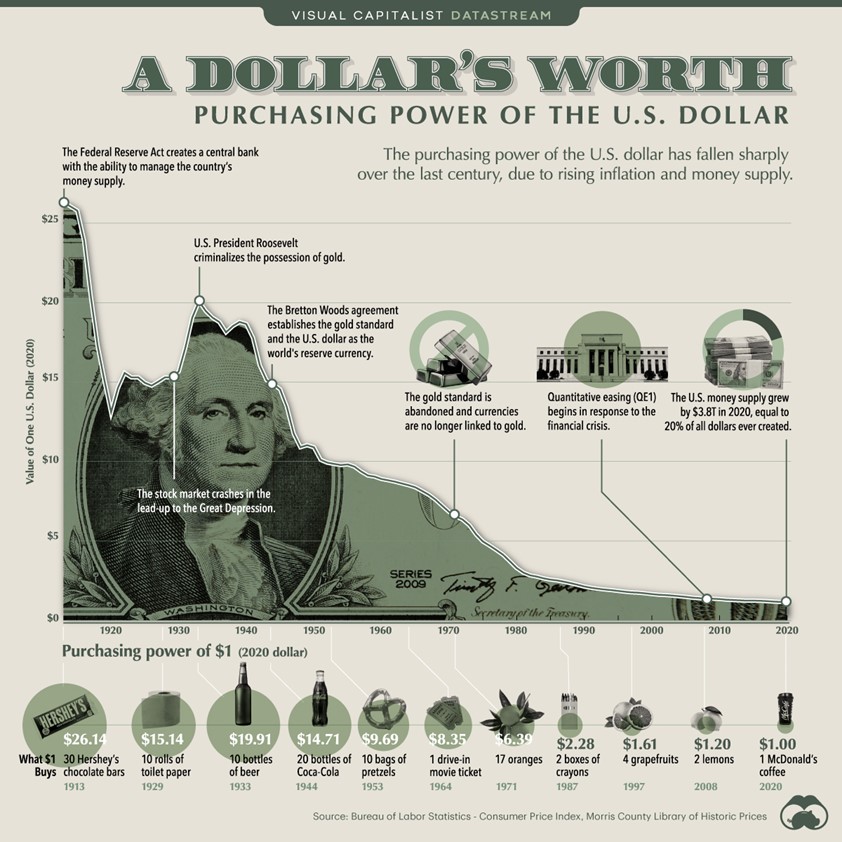

Take a look at what’s happened to the global reserve currency over the past century:

Source: Visual Capitalist

How could you protect yourself from this?

Yes, gold would be one way. But I doubt that would have been as effective as the stockbrokers’ way.

If you invested USD $100 in the S&P 500 at the start of 1933, you’d have $1,541,057 at the end of 2023, assuming you reinvested all dividends.

A return on investment of 11.22% per year. Yes, probably enough to beat inflation quite well over the long run.

Well, if that doesn’t spur you to invest, I’m not sure what will.

Further, very seasoned investors like Warren Buffett who have selected quality businesses at value have managed to beat the S&P 500.

Had you invested $100 in Berkshire Hathaway in 1965 when Warren took over the company, you would have over $2.5 million today. That’s compound annual gains of more than 20% — well over the S&P 500 (which posted only 10.5% average annual gains over the same period including dividends).

So, there’s this enticing story that Putin’s Russia is doing fine

This story says that the US dollar will collapse, and we should go to gold. That the American Empire is due to collapse on debt and ‘doctored denarius’, as the Romans did centuries before.

Putin does give the perceptive insight that the Roman Empire took centuries to collapse.

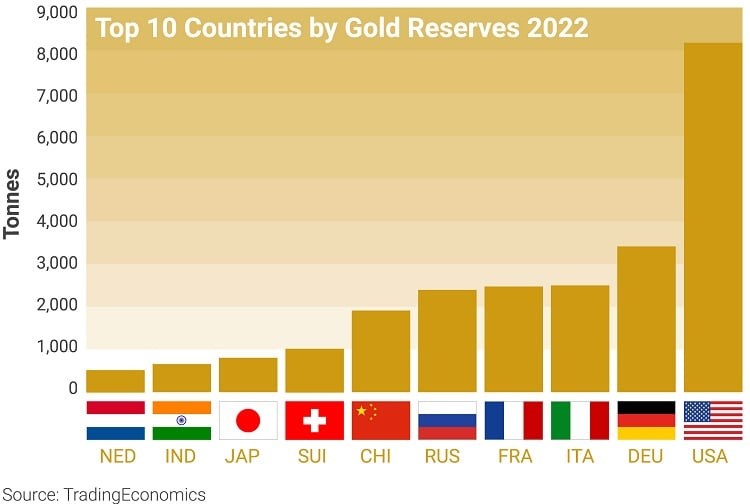

By my estimations, the American dollar is a very young star in a world of uncertain money. The US still holds by far the largest reserve in gold at 8,100 tons.

Source: BullionBy

Following an economically destructive pandemic response, the American economy and stock market is flexing back with remarkable growth. This is underpinned by new technology in areas as diverse as AI, biotech, and new transport.

So, what of Ukraine?

Putin says they are ready for talks. That must be welcome. Could Mr Trump be the better negotiator in that area? He claims so.

As for Ukraine, it became an independent country in 1991. While the history is complex, on a simplistic front, to allow it to be invaded without upping the negotiation ante could have consequences. Not least sending signals to other such situations around the world. Like Taiwan.

The Tucker Carlson interview is worth a watch. For me, it was eye-opening to see a world leader like Putin recount pretty much the same data all investors have access to.

The danger for leaders (and investors) is when you create a story around such data that suits your situation, fears or wishes.

Nobody owns the truth. It’s there to be sought.

Will you join us in investing to protect your wealth?

If you are an Eligible or Wholesale Investor, Wealth Morning may be able to help you build a robust, global portfolio in your own managed account.

We take on a limited number of clients for each market cycle.

For further details, do get in touch today.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Past performance does not indicate the future. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.