I will tell you how to become rich. Close the doors.

Be fearful when others are greedy. Be greedy when others are fearful.

—Warren Buffett

Human nature is a funny thing, isn’t it?

I have observed that people will go through a lot of inconvenience just to avoid inconvenience.

They will go through a lot of trouble just to avoid trouble.

Indeed, they will go through a lot of pain just to avoid pain.

Psychologists and economists have a name for this strange phenomenon. They call it ‘loss aversion’. Here’s what it means:

- Just imagine this. One day, you wake up. You suddenly discover that you have enjoyed a stroke of good luck. You have won $1,000 in a lottery game. Hip hip hooray! Good for you!

- However, the opposite can also happen. Just imagine this. One day, you wake up. You suddenly discover that you have suffered a stroke of bad luck. You have lost $1,000 because of a government fine. Well, hot damn! This is very bad!

- In both cases, it’s the same amount of money. One represents the upside, while the other represents the downside.

- However, what is intriguing is that the $1,000 fine will have a bigger emotional impact on you than the $1,000 prize.

- In other words, you are more likely to grieve the $1,000 loss than you are to celebrate the $1,000 gain.

In fact, you may actually go through the classic five stages of grief:

- Denial.

- Anger.

- Bargaining.

- Depression.

- Acceptance.

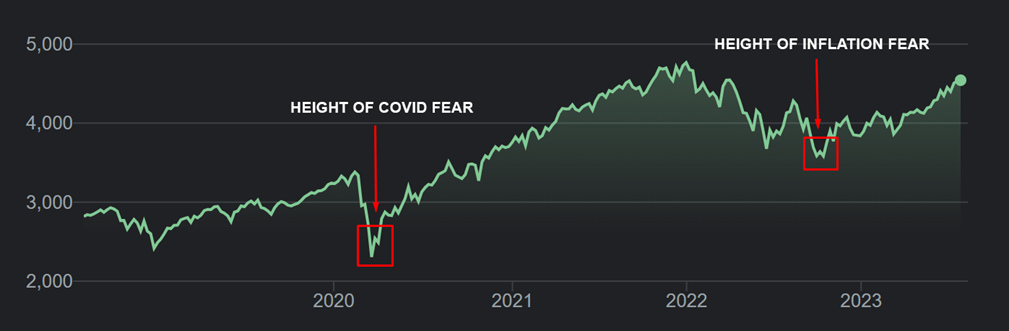

These stages of grief can feel so intense, they may actually serve to amplify your perception of financial pain. It is for this reason that we saw the stock market take a tumble during two difficult periods in our recent history:

Source: Google Finance

- Yes, for sure, investors will go through a lot of inconvenience just to avoid inconvenience.

- They will go through a lot of trouble just to avoid trouble.

- Indeed, they will go through a lot of pain just to avoid pain.

But is behaving like this actually helpful in the long run? Well, let’s take a closer look at the Covid pandemic in 2020. Perhaps we can learn a lesson from this:

- Among the Kiwis who found themselves caught up in the turmoil was a 67-year-old investor. He shall remain anonymous. But here’s the most important thing that you need to know about him: he was close to retirement, and he was debt-free.

- Logically speaking, he was on solid financial footing. He was in a better position than most of his fellow citizens. He could afford to wait this storm out.

- Unfortunately, the constant torrent of fearful headlines was impossible to ignore. His emotions eventually got the better of him. When he saw that his KiwiSaver balance had plummeted due to Covid, he panicked. And he made a rash decision.

- He liquidated his KiwiSaver account in a hurry. He cashed out, and he withdrew from the market. He locked himself into a term deposit with a 2.8% return for six months.

- He decided that he wanted to see things calm down before he did anything else.

Was this a wise move? Well, just consider how things played out globally:

- From 14 February, 2020 to 20, March 2020, the S&P 500 index plunged over 30%. This felt terrifying at the time.

- But then, from 20 March, 2020 to 14 December, 2021, the S&P 500 rebounded. It quickly recovered its losses, climbing over 100%. It was breathtaking to see.

- This was the shortest bear market in history. It lasted just 33 days before the trend suddenly reversed, and we experienced a bull market.

Of course, in retrospect, this investor had made a tragic mistake:

- By impulsively exiting the market, he locked in his losses. Worse still, he missed out on the rally.

- He had committed his money into a term deposit at rock-bottom interest rates for six months. But six months might as well be an eternity.

- By the time he realised his error, it was already too late. Much of the gains in the market were already snapped up.

Now, you might think that this investor’s kneejerk reaction to Covid fear is a one-off incident. Surely human beings can’t be that foolish again? But, sadly, they are. In fact, right now, we’re actually seeing a similar response to interest-rate fear:

Source: Visual Capitalist

- As we speak, there’s over $6 trillion of cash being parked in bonds, term deposits, and savings accounts.

- Of course, this is understandable, given that we have experienced the most aggressive rate-hiking cycle since 1988. It’s shocking, yes! Ask anyone who holds a mortgage what a burden this feels like.

- So, as a consequence, people have pulled their money out of the stock market. They have socked it into places where they believe they can benefit from a safer yield. They are doing this because they really want to avoid the pain.

- However, let’s look beyond the short-term jitters. Let’s look at the long-term horizon. You will find that all cycles will eventually turn, as they must. So, when interest rates eventually start to soften and drift downward, what do you think will happen next?

Well — ding, ding, ding — congratulations. You’ve guessed right:

- When interest rates are no longer as attractive, that mountain of $6 trillion cash will have to be redeployed. It’s only rational, isn’t it?

- After all, there’s an inverse relationship between interest rates and the stock market. When rates go up, the market goes down. And when rates go down, the market goes up.

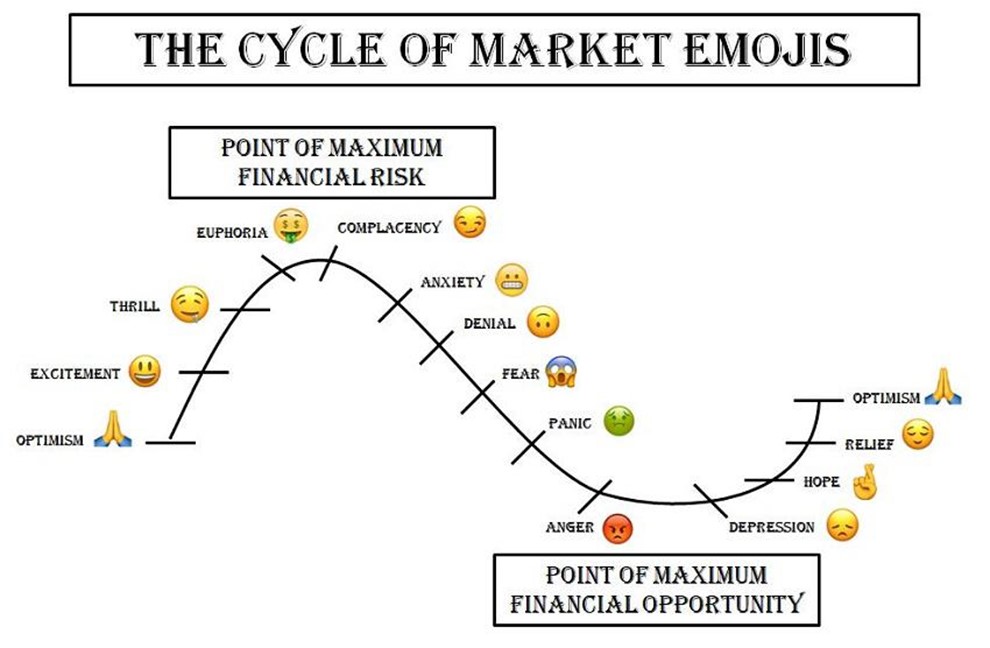

- But hold on. Wait. You haven’t accounted for one important factor. You see, human beings have a habit of being irrational. And, yes, they will do irrational things.

- For instance, I believe that there are people right now who will almost certainly cling on to fear beyond all reason. And in doing so, they will self-sabotage their own financial health.

- How? Well, here’s how. They will choose to wait and wait. They will choose to procrastinate and procrastinate. They will do this for one year; two years; three years. Until interest rates have fallen so much that they no longer have any choice but to take action and finally enter the stock market.

- Tragically, by this point, it’s already too late. Most of the good bargains on the market will be snapped up. And value will be much harder to find.

Source: Forbes

Jean de la Fontaine once said: ‘A person often meets his destiny on the road he took to avoid it.’

- Because of this, some investors will be ahead of the curve.

- Because of this, some investors will be behind the curve.

- And, yes, as sure as the sun rises, there will be winners and losers during the next market cycle.

It’s time to have your say

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them:

- Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback It encourages us. It helps us to do better. It helps us to reach further:

- So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time.

- Thank you so much in advance for your kindness and generosity. Your readership keeps us going!

Regards,

John Ling

Analyst, Wealth Morning

(This article is commentary and the author’s personal opinion only. It is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please consult a licensed Financial Advice Provider.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.