The superior man understands what is right.

The inferior man understands what will sell.—Confucius

China was our friend.

In 1972, this was the message that President Richard Nixon gave the world when he landed in Beijing.

If you were alive back then, you will remember how big of a deal this was.

It represented a cultural exchange. A thawing of diplomatic ties. And, more importantly, a geopolitical chess move.

Nixon wanted to drive a wedge between China and Soviet Union. By all accounts, he succeeded. He befriended the Chinese, while isolating the Soviets.

Some historians believe that this was a masterstroke by Nixon. It was a cunning decision that may have contributed to the Soviet Union collapsing in 1991.

Nixon shakes hands with Chinese leader Mao Zedong. Source: Wikimedia Commons

However, don’t forget about the law of intended consequences. With the Cold War over, the Chinese-American relationship only accelerated:

- In 2001, China joined the World Trade Organization, backed by intense American lobbying.

- This stamp of approval created something of a gold rush, with China being seen as an attractive destination for Western investors.

- They loved China’s vast untapped market and large population base. So, in a blink, they poured their money in. No questions asked.

The economic transformation was swift:

- China soon became the factory for the world, powered by masses of cheap labour on assembly lines. From toys to clothes to televisions, Chinese workers could churn them out at astronomical speed.

- Next, China started spending heavily on shiny new infrastructure. They were building bridges and highways and cities on a scale that you could barely imagine.

Their brute-force approach to modernisation was stunning. They called this ‘socialism with Chinese characteristics’:

- By 2003, Goldman Sachs predicted that China’s progress was unstoppable. The country had become a juggernaut. It was on the verge of overtaking America soon. This news caused quite a stir. Existential fear in the West rose to an all-time high.

- However, in 2012, former Australian prime minister John Howard pushed back on such expectations. He had a contrarian viewpoint. He said: ‘China will grow old before she grows rich.’

Source: Image generated by OpenAI’s DALL-E

Howard’s comment sounded flippant at the time. Was he serious? Well, as it turns out, Howard was absolutely right:

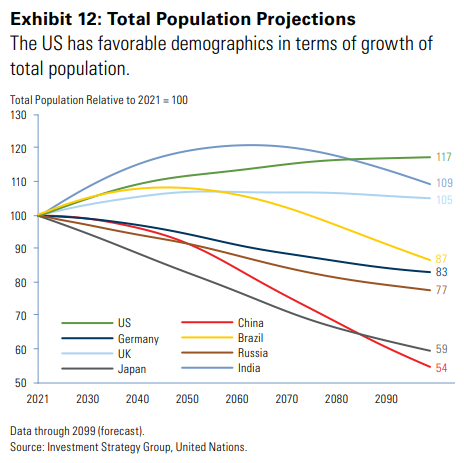

- Today, the Chinese economy has suddenly reversed course. It now appears to be on the verge of a demographic collapse.

- How come? Well, you can blame the so-called 4-2-1 problem. At the moment, Chinese families are now largely made up of four grandparents, two parents, and one child.

- The impact of this is severe. For two years in a row, the Chinese death rate has climbed, while the birth rate has fallen. In other words, more people are dying compared to babies being born.

- The labour-intensive industries that have driven China’s growth are now at risk of unravelling. You can already see the country’s factories running out of young workers to staff the assembly lines. Such shortages may push up wages. This, in turn, may reduce Chinese competitiveness in the long-term.

- Even more troublingly, some estimates suggest that Chinese society could actually shrink in half by the end of this century. This means that the country’s population base of 1.4 billion could dwindle to just 525 million.

Of course, China is heavily reliant on trade. And once upon a time, globalisation favoured China. But now, in a turnaround, de-globalisation is punishing China. Here’s why:

- China used to the largest source of imports for the United States. But in recent times, Chinese dominance has been absolutely smashed.

- Today, you will find that the European Union, Mexico, and Canada have overtaken China to become the largest import-trading partners for America.

- Once first on the list, China has now slipped unceremoniously to fourth place. This is bad news because America is the largest consumer market in the world. If China’s share of that economic pie is diminishing, then its long-term prosperity could be slipping away as well.

Source: Visual Capitalist

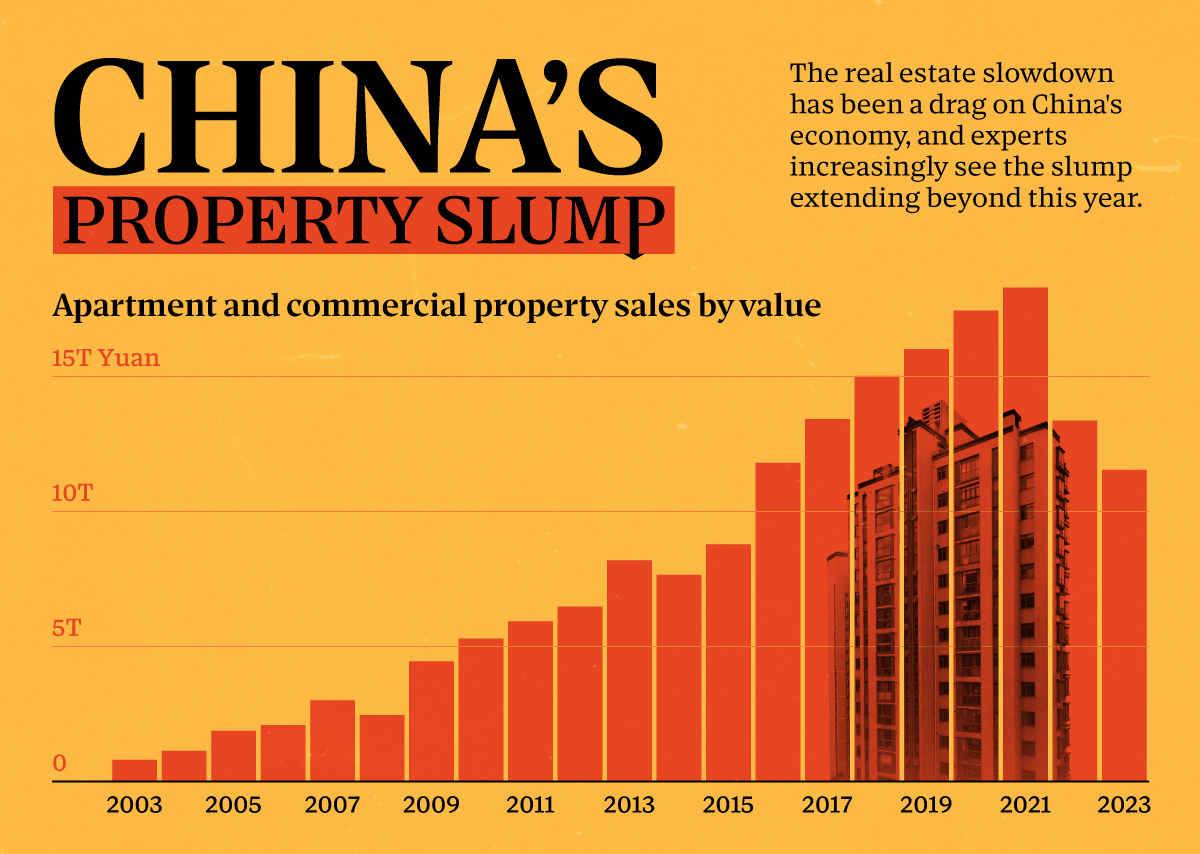

However, right now, the biggest headache for China has to be real estate. You’ve already seen the headlines:

- The property giant Evergrande — once considered the most valuable developer in the world — has been declared bankrupt. It has collapsed with a debt load of over USD $300 billion. This is larger than the GDP of New Zealand. It’s astonishing when you consider that this is just a single Chinese company.

- Is this the tip of the iceberg? Well, China is filled with ghost cities with barely any residents. This urban sprawl is vacant and overbuilt. In fact, some experts believe that China could have as many as 3 billion empty homes.

- It’s hard to really get an accurate picture of the scale of this property crisis. Especially given the level of repression and censorship in China.

- But one thing is clear: 70% of Chinese family assets are locked up in property. This means that the ordinary citizens have the most to lose from this meltdown. According to Bloomberg, every 5% decline in home prices will wipe out approximately USD $2.7 trillion in household wealth. It’s staggering.

- So, while the Western world worries about inflation, China has a far more catastrophic problem to worry about: deflation.

Chinese stocks on the CSI 300 Index are suffering from a debt-deflation spiral. Source: Google Finance

It’s now clear. China’s competitive advantage is shrinking. Its property sector is a time bomb. Collective anxiety is running high:

- In recent times, foreign investors have pulled out as much as 90% of their money from the Chinese stock market.

- This is creating extreme pain. Since February 2021, the CSI 300 Index — which covers the largest 300 Chinese companies — has slumped by over 40%.

- At the time of writing, the Chinese government has announced that they will increase stock buys to support their struggling market, while cracking down on short selling.

- Meanwhile, the People’s Bank of China has lowered interest rates and eased lending restrictions to inject liquidity. This is an attempt to turn around a deteriorating outlook.

But will it be enough to resuscitate the Chinese economy?

- Well, some analysts believe that the stock market has already capitulated and is showing signs of bottoming out. For the sake of ordinary citizens who have endured the worst economic challenge in a generation, let’s hope this is true.

- Still, it’s obvious that the myth of Chinese invincibility has been shattered. The nation’s prestige has taken a serious blow.

- Yes, China will continue to be a significant regional power. But, no, it won’t be the global hyperpower that some people have been predicting. Instead, China will get old before it can get rich.

Source: A Wealth of Common Sense

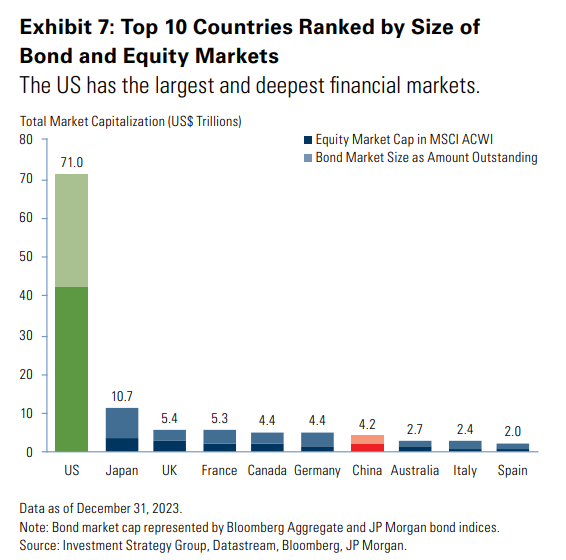

By comparison, America’s competitive advantage actually seems to be increasing:

- You already know this: America has the largest and deepest financial market in the world. It’s no secret why. In January 2023, employment data revealed that the American jobs market was the strongest that it has been since 1969. It’s a durable trend that continues to prevail, even one year on.

- What’s the source of this strength? Well, it’s about priorities. You see, while 70% of the Chinese economy is driven by property, 70% of the American economy is driven by consumer spending. This fundamental difference means that the American system is much more dynamic and perhaps more resilient.

- You shouldn’t forget that America has a healthier demographic trend as well. In fact, America has the largest immigrant population of any country on Earth. In fact, over two-thirds of the tech companies in Silicon Valley are founded by immigrants or children of immigrants. This may be a safety valve that allows American society to sidestep some of the ageing issues that are tormenting Chinese society.

Also, here’s another fascinating trend to observe:

- America may be getting closer to achieving energy independence. A shale boom means that America has officially become the world’s top liquefied natural gas exporter. It may very well be producing more oil than any other country in history.

- Ultimately, geography is destiny. In terms of energy supplies, America is relatively resource-rich, while China is relatively resource-poor. You shouldn’t underestimate the impact this will have in the years and decades to come.

Source: Image generated by OpenAI’s DALL-E

Finally, there’s also the tantalising possibility of science fiction becoming science fact:

- Over the past year, we’ve seen the American stock market boom. In 2023 alone, the Nasdaq Composite soared by over 43%.

- Companies are rising in prominence as they explore the potential of artificial intelligence, robotics, and automation. There’s a lot of debate about where this could lead — but for now, it does look like American tech is fashionable again.

- In the words of Madeleine Albright: ‘We are the indispensable nation. We stand tall and we see further than other countries into the future.’

- Who’s to say that this isn’t a sign of things to come? Could robots — built at scale, powered by AI, and supervised by skilled workers — one day bring cheaper manufacturing back to Western shores? Is the American disengagement from China an indication that the economic pendulum is already swinging?

We want to hear from you

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you. We’re eager for your feedback:

- If you have enjoyed this article, please consider leaving us a review.

- Let us know what you liked. Let us know what inspired you. Let us know if it’s made you a better investor.

Regards,

John Ling

Analyst, Quantum Wealth Report

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.