With the market heating up, we’re not the only ones wanting to exploit value while we still can.

But we began this process some years back. It takes time for value to realise.

As Warren Buffett once remarked: ‘You can’t produce a baby in one month by getting nine women pregnant.’

Some things just take time. Investing is one of those things.

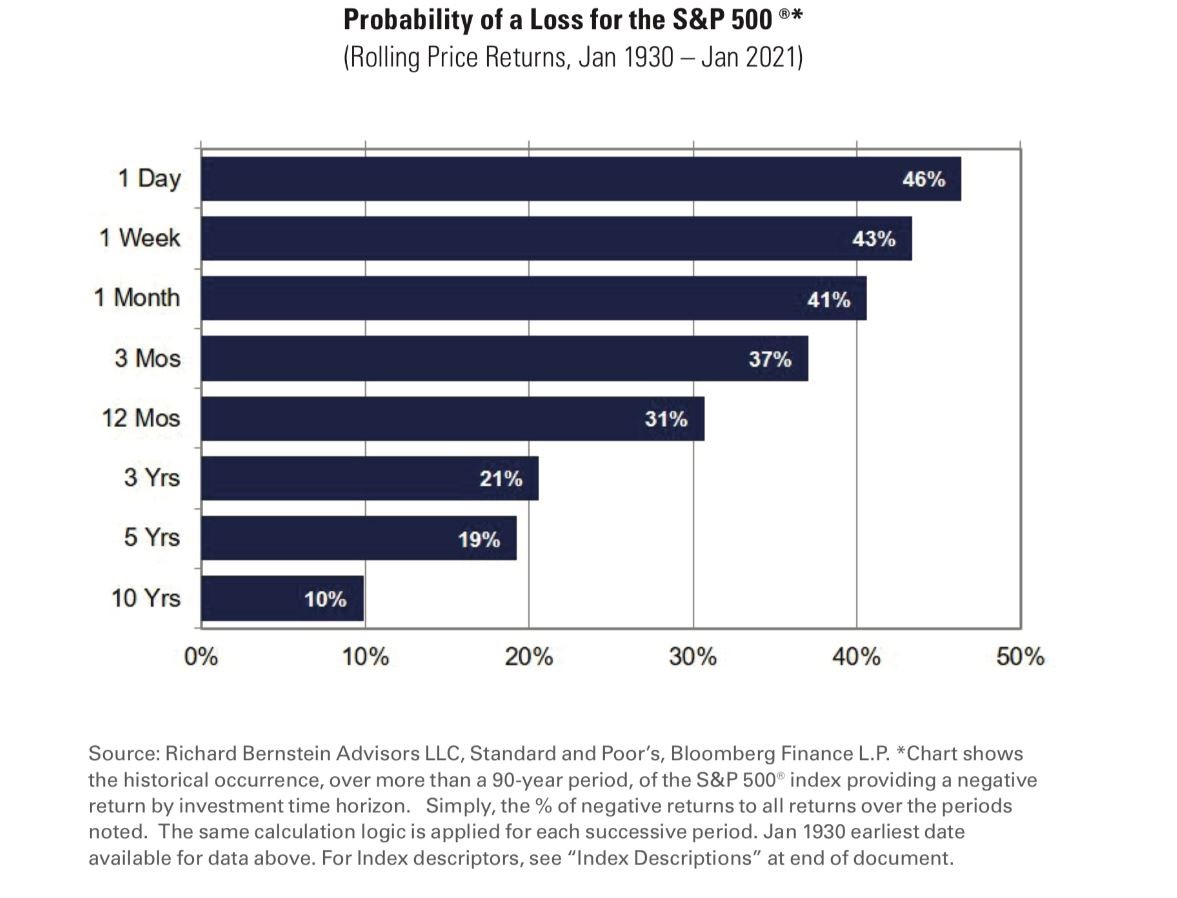

Time in the market — for example, on the S&P 500 — defines risk.

Richard Bernstein Advisors found a 10-year holding period reduced the risk of loss in stocks to only 10%.

When it comes to building portfolios for our Wholesale Investors, we’re professional scroungers. We’re not only looking to reduce risk over time, we’re looking to beat our index by finding opportune value.

Here’s why the takeover sharks are circling…

The other week, takeovers were announced for two holdings in our portfolios.

Other companies saw the value and potential we saw. I guess they wanted to make a move before the share prices rose further.

In this post, I want to look at why these companies presented value. First, back in 2022, when we spotted them. And now, in January 2024, when acquisition announcements were made.

I also want to look at the gaps they will leave in our portfolios. And how we plan to fill those gaps with the most promising sectors ready to drive growth in 2024 and beyond…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.