‘Invest in preparedness, not in prediction.’

—Nassim Taleb

With markets improving, 2024 is a great time to open the door to prosperity.

So, how can you prepare yourself or your children to best prosper?

Look, there are three main ways that’s been achieved for most people over the past 30 years:

1) Buy well-located property.

2) Invest in good quality shares.

3) Own a successful business.

Yet a lot of investors are focused on trying to predict the future. They focus on the direst possible outcomes. I hear questions like this:

- ‘Will a 2024 Trump presidency rock geopolitical stability?’

- ‘Could high debt levels implode the financial system?’

- ‘Are we on the verge of World War III?’

Donald Trump just won the Iowa primary. Will he be president again?

Source: Wikimedia Commons

If you look back on the value of predictions, you’ll find something startling. Morgan Housel points this out in his excellent book, Same as Ever.

Most of the truly gravitational events — the events that made fortunes, brought disaster, created opportunity or crisis — were not predicted at all. By anyone.

Covid-19, the proceeding political power grab, and inflationary river of monetary easing were not predicted at all. Nor was the Great Depression of the 1930s. Nor the outbreak of World War II.

Understanding history has more value than foretelling the future. After all, when it comes to humankind, 14 times as many of us have already died or moved to the next life than those with us today. We can learn much from those who have lived through turmoil.

Housel also reminds us that much in this world ‘hangs by a thread’.

Random, seemingly miniscule events, can change the course of history. And they can change your life.

Historians point out that the worst devastation of last century may not have occurred at all, but for one man.

The Nazis only received 37% of the vote in the 1932 election.

Some 53% of Germans actually re-elected 84-year-old Paul von Hindenburg. He was supported by centre-right and centre-left parties into the presidency.

Hindenburg and Hitler, 1933.

Source: Wikimedia Commons

Although he disliked Hitler, Hindenburg struggled to form a coalition and was eventually convinced to appoint Hitler chancellor.

There was then a staged attack on the Reichstag. Hitler persuaded Hindenburg to dissolve it and allow Hitler to rule by decree.

The manipulations of one man and the wrangling of coalition government were the thin threads that changed the course of history.

Of course, anti-Semitism and conflict may still have exploded in Europe, though possibly with lesser destruction or genocide. But could Europe have ended up today less cynical, less war-weary, more Christian, more prosperous? As for its markets, more American?

History on a grand scale turns on these thin threads.

So do ordinary lives.

The excellent movie One Life brought this home for me the other week.

Source: One NZ

It tells the true story of stockbroker Nicholas Winton. His voluntary work in prewar Czechoslovakia saved the lives of 669 children from almost certain death at the hands of the Nazis.

Today, considering their offspring, it is thought one man is responsible for 6,000 lives.

For most people, there are often a few opportunities, decisions, or events that anchor success or disaster. This is pertinent when it comes to wealth.

If you bought a home in New Zealand in the past few decades (but not after 2021), you’ve likely enjoyed solid capital growth. Even startling growth if you bought in an ‘undiscovered’ area.

Even better, if you established a good quality share portfolio just after the 2008 Global Financial Crisis, you might be sitting on a fortune.

Perhaps if you’d started a new business, your fortunes may be less certain. About 70% of businesses capsize in New Zealand within their first five years. Still, those that make it through can do very well indeed.

This brings me to listed assets on the sharemarket.

Here, you will find business and property assets that have stood the test of some time. That have proven themselves through good times and bad. And that have been priced by the market according to a view on their future income and value.

These companies have also been tested by the customer markets they operate in.

Every day, millions of decisions are made by consumers and other businesses on what they need. Far better than any bureaucrat — who might be stuck with a single model — the market delivers the best options.

That’s why I like to invest in real-estate assets on the stock market. And in businesses like home builders helping resolve the housing shortages faced in many countries.

Unfortunately, in New Zealand, we have quite a small sharemarket. A lot of our investing activity has gone into houses. The growth in their values has slowed dramatically. Their yield (by net rent) can be paltry. There’s often a lot of work and management needed.

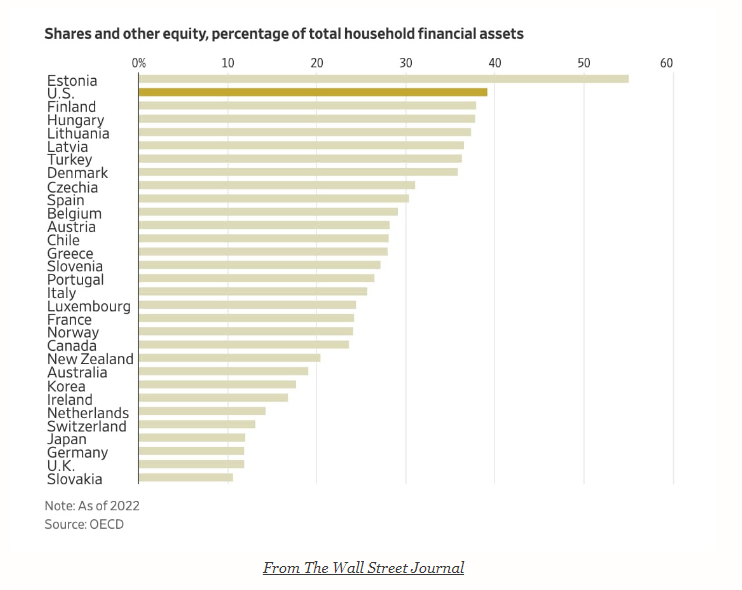

In 2022, just over 20% of household financial assets were in shares, compared to almost 40% in the United States.

Yet, if we consider being prepared for prosperity, we should look at the past.

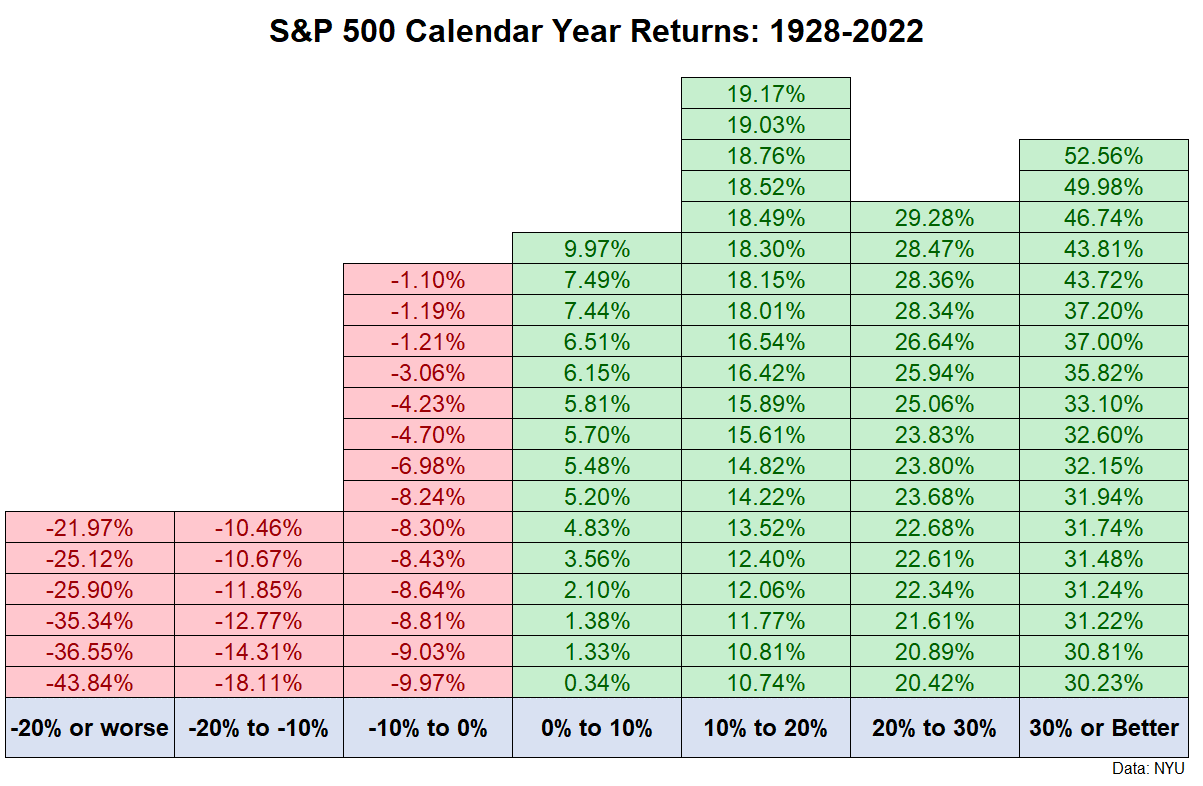

The S&P 500 has delivered very strong levels of performance for more years than it has not.

Source: A Wealth of Common Sense

Psychologically, you do need to be prepared for deep-down years and raging-up years.

Moreover, it can help if you do your homework and find the best quality companies to invest in.

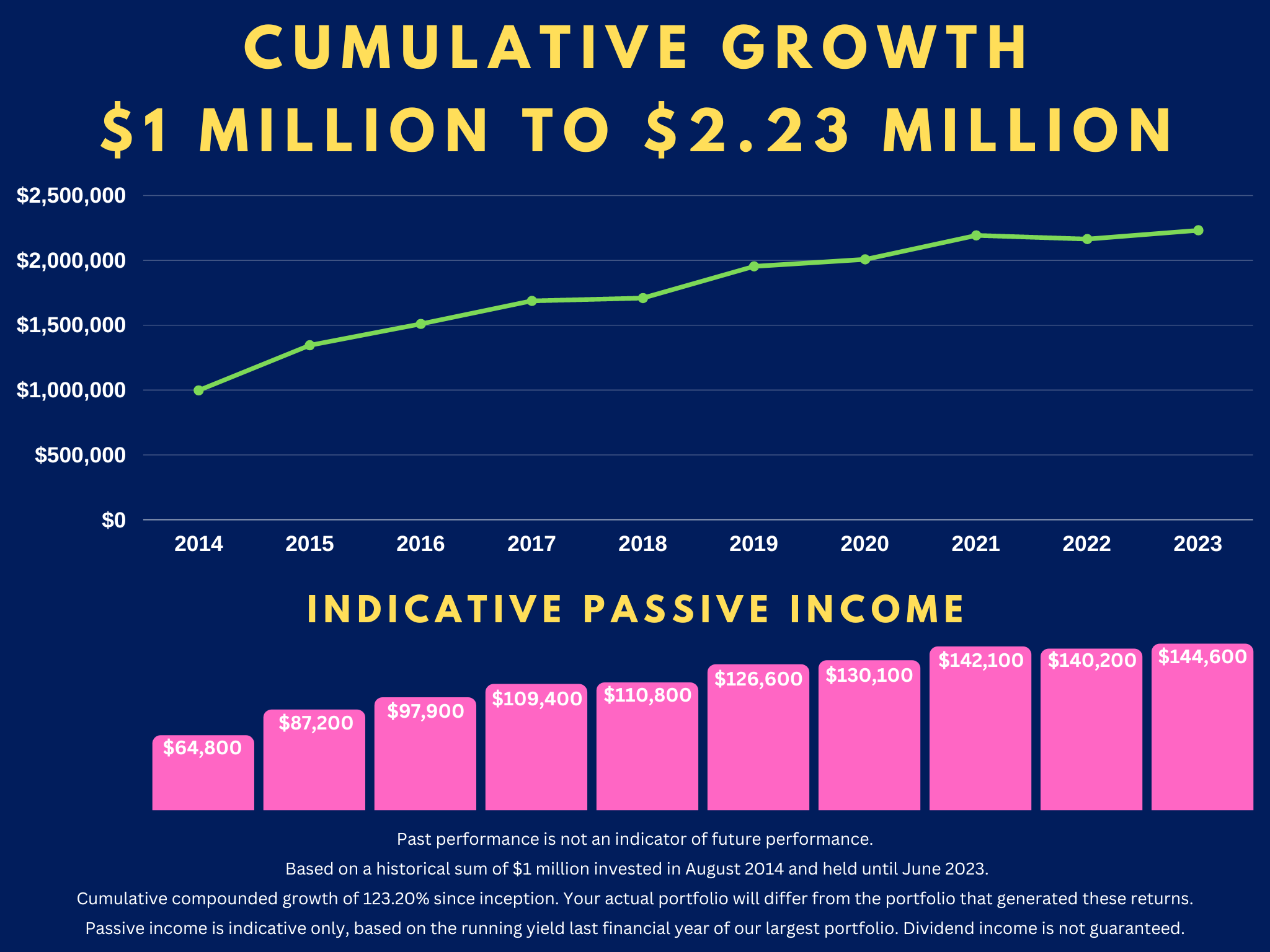

On that note, if you qualify as a Wholesale or Eligible Investor, you may be able to access our Wholesale Managed Accounts.

Here, we help you build you own portfolio of quality equities in your own brokerage account.

Our Quantum Income Strategy

For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions):

- Ask yourself: is this something you urgently need to act on?

- Come talk to us. We are already preparing our clients for the next quantum wave in 2024 and beyond.

Regards,

Simon Angelo

Editor, Wealth Morning

(Past performance is not an indicator of future performance. This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.