‘I feel safer here than outside. Days go by. I have people to talk to and no decisions to make.’

—Bernie Madoff, 2011 (serving a 150-year prison sentence)

I was driving up to golf the other day.

My brother-in-law was telling me about a Netflix documentary he had seen — Madoff: The Monster of Wall Street.

Source: Wikipedia

My bother-in-law is not an active investor, as far as I’m aware. But this clearly fascinated him. ‘Why would he set up this Ponzi scheme when he knew he’d be caught someday?’

Having watched the show, I’d pondered this myself. And could see exactly how Bernie went down the track he did.

Some part of the blame must go to his clients.

You see, Bernie offered something that is impossible in financial markets. He had the cure to volatility. Oh yes. He offered consistency and reliability in a world where there is none.

Madoff’s fund offered consistent annual returns of around 10%. Nothing startling. Nothing exciting. Just a regular paycheque, giving you 10% on your money from a reputable Wall Street proprietor.

Of course, this was how whistleblower Harry Markopolos caught Madoff. He tried to replicate Madoff’s unusually consistent returns. And found they didn’t add up. Couldn’t add up.

Meanwhile, Madoff was likely waiting for some lucky break to make 30% or more and pay everyone off.

So, here is the lesson.

Clients want the higher returns that are possible from sharemarkets. They want their money to work hard. They want to make money.

But few are prepared to ride the inevitable peaks and troughs that actually go with a market where prices are published daily. Sentiment can rise or fall on any number of factors. From war, to interest rates, to the oil price, to Donald Trump’s prospects — share prices can jump around a lot.

This is also how wise investors make money.

They use the market dynamic to achieve long-run growth. As Warren Buffett says, it’s wise for investors ‘to be fearful when others are greedy and to be greedy only when others are fearful.’

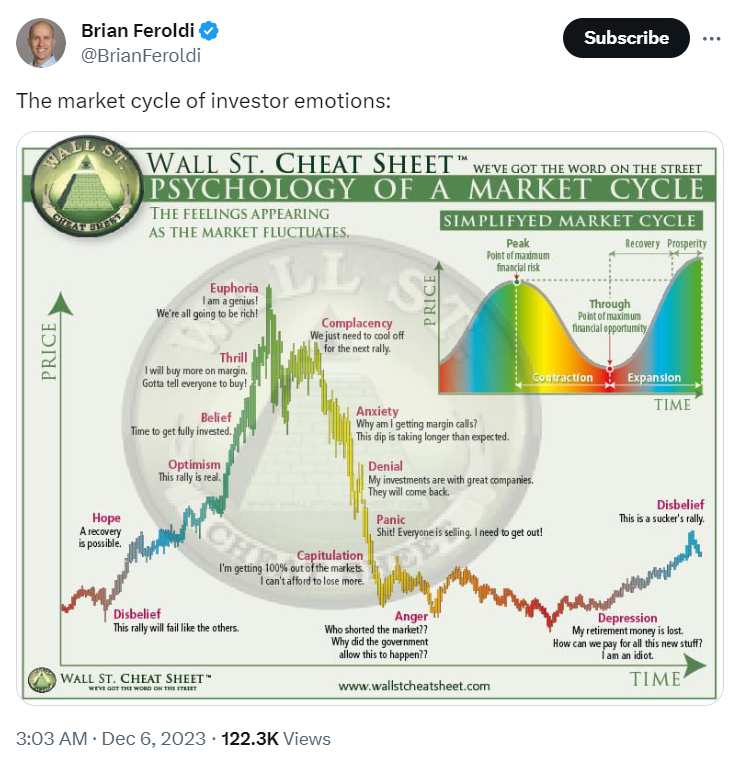

In the short-term, the market tends to run like this:

Source: Tweet by Brian Feroldi

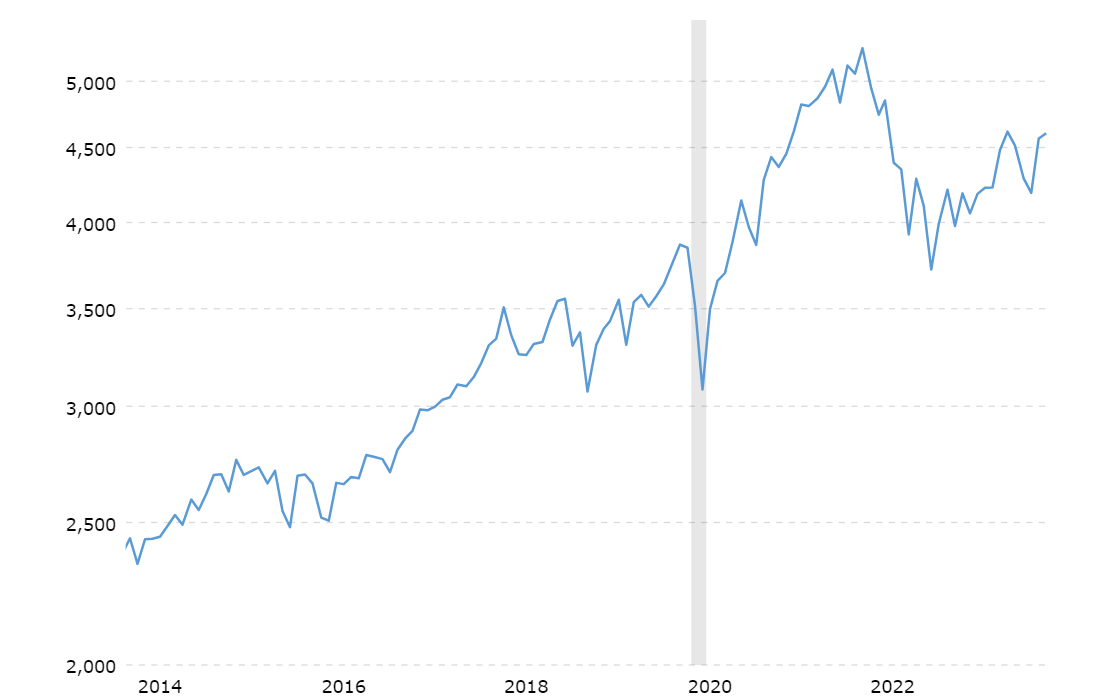

But over the longer term, these mini-spasms of volatility tend to iron themselves out:

Source: S&P 500 Index — 90 Year Historical Chart (Last 10 years shown here)

Think about it. If the market is down 35% (as it was immediately following the Covid-19 disaster and lockdowns), and it is then back up 70% a year later, it is possible to get a 70% return on whatever you buy at the bottom.

The trouble is that many people cannot handle seeing a 35% loss, even though that is only a temporary loss built on sentiment.

Some even get out of the market altogether and lock in their losses.

I remember 2020 very well. Even though I’ve been investing in shares since I was 17, this still scared me. Because I struggled to grasp how businesses could trade when they were forced to close.

Fortunately, I bought up during March 2020. My regret is that I was somewhat tentative and didn’t buy as much as I could have.

To be fair, I didn’t fully predict how much governments would step in to fund companies and their employees during the lockdowns.

While 2021 was a strong year of recovery and returns, 2022 was far more difficult.

We came to realise that much of the financial support to alleviate lockdowns had come via quantitative easing. The money supply had increased, in some cases, by more than a third.

Then we entered an inflationary spiral and more volatility!

As it turns out, the last quarter of 2022 was a great time to buy. As now the story is changing again with central banks appearing to take inflation back under control.

Yet being in the market over three relatively volatile years is just a snapshot in time.

Not a large-enough snapshot. By staying in the market over 10 years, these peaks and troughs iron out. Providing the economy keeps growing, good companies and their assets should also grow.

As Benjamin Graham put it: ‘In the short run, the market is a voting machine, but in the long run, it is a weighing machine.’

Bernie Madoff was a cheat who preyed on those seeking short-term security. He did enormous financial damage. Today he is no longer with us.

But the enduring lesson is not to expect consistency from financial markets.

If you want the good days of being up, you must be able to tolerate the bad days of being down.

I sleep well at night no matter what the market does. Of course, I feel happier when it is steadily rising and banking profits. But I have conviction in the quality of the companies I own. And that my portfolios are diversified across different sectors and parts of the world.

In the long run, value will deliver. And that is the truth of where the money lies.

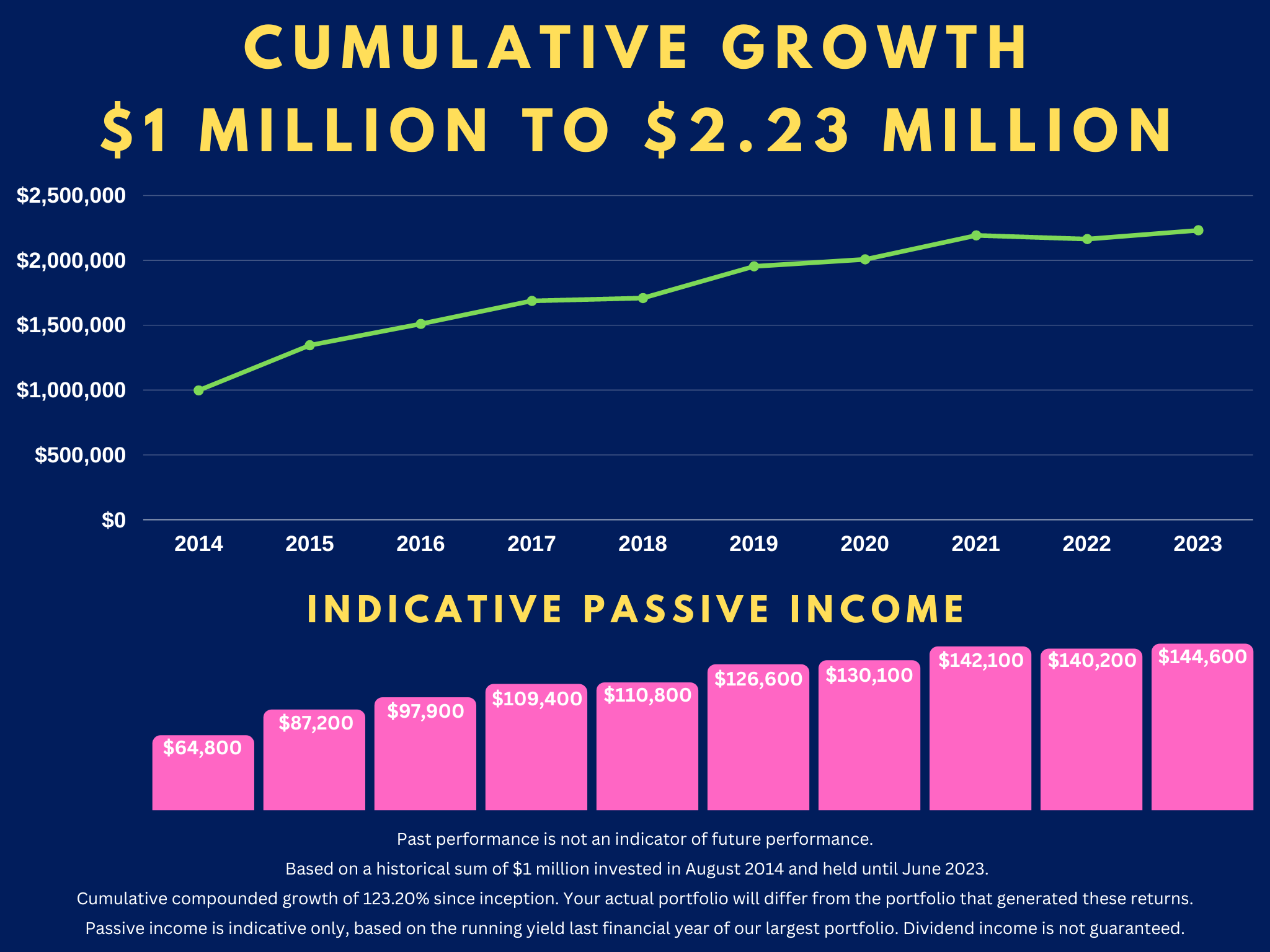

Our Quantum Income Strategy

So, what are smart investors looking for in 2024?

- Better prospects for capital growth.

- A stronger stream of passive income.

- Diversified wealth protection.

You could achieve all this when you choose to buy into global assets on the stock market:

- This is what we’re focused on with our Quantum Income Strategy.

- If you qualify as a Wholesale or Eligible Investor, we can help you set up and manage a global brokerage account.

- We have our eye on investment targets in Australasia, Europe, and North America. We are especially keen on resilient sectors like property, infrastructure, and energy.

For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions):

- Ask yourself: is this something you urgently need to act on?

- Come talk to us. We are already preparing our clients for the next quantum wave in 2024 and beyond.

Regards,

Simon Angelo

Editor, Wealth Morning

(Past performance is not an indicator of future performance. This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.