Ralph Lifshitz had something different.

He was selling 4-inch ties when most men wore 3-inch.

And he insisted that the ties feature his new name and logo: Polo by Ralph Lauren.

The Bloomingdale’s buyer told him flat: ‘If you want to supply us, you’ll need to make your ties 3-inch. And they’ll need to have our logo on them, not yours.’

Ralph refused. It was not the first time he’d faced difficulty.

Ralph had legally changed his surname when he was 16, due to bullying at school. From Lifshitz — the name of his European Jewish immigrant parents — to Lauren.

Today, Ralph Lauren and Polo are known the world over. But it was no easy start.

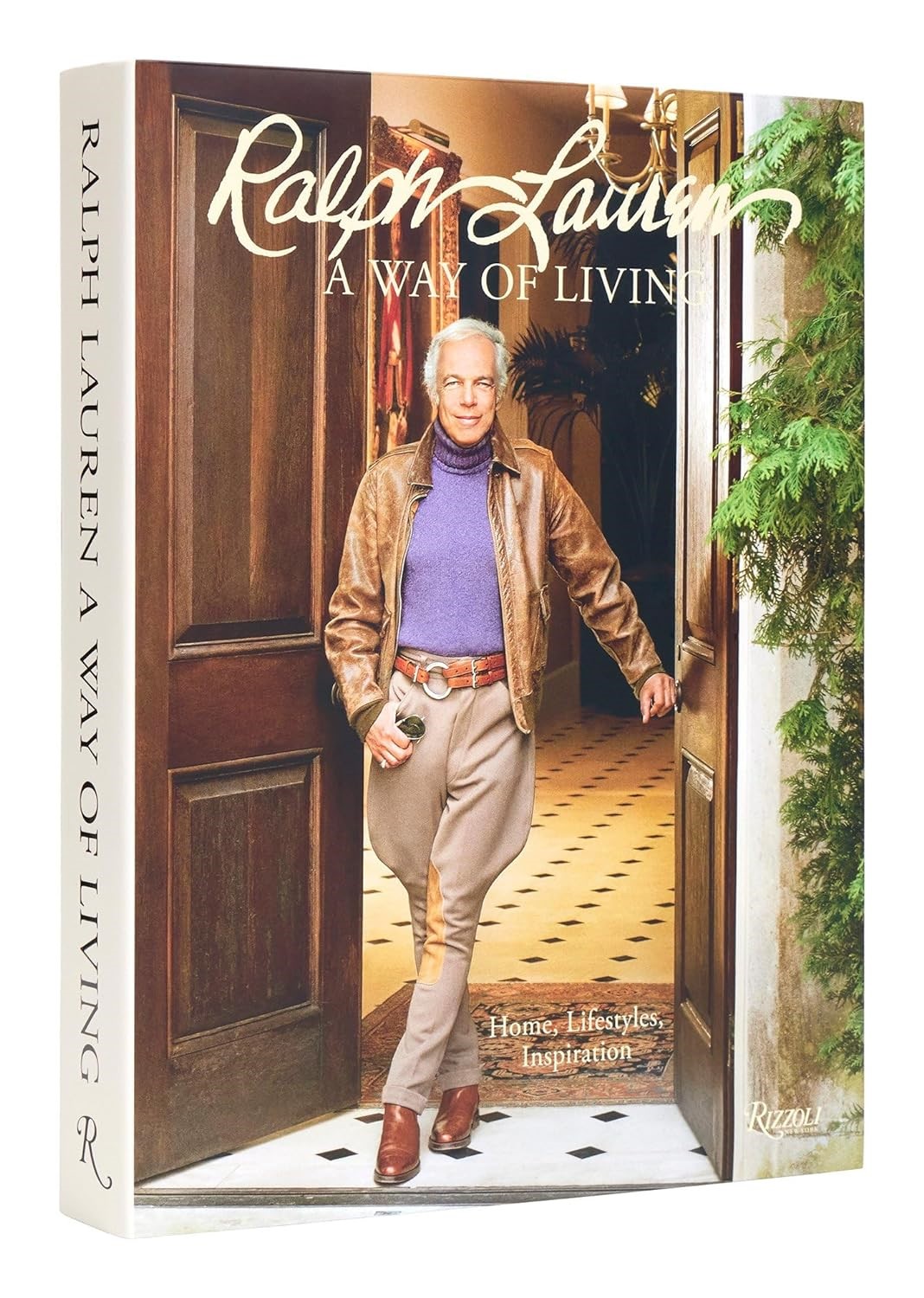

Source: Amazon Singapore

Source: Amazon Singapore

Eventually, Bloomingdale’s let him do things his way. And he became one of the first designers to break in with his own in-store boutique.

Ralph Lauren Corp [NYSE:RL] is a business that has stood the test of time.

Its style stands for the most beautiful aspects of the American dream. Family values. European heritage. Country life. The beach house. Freedom.

Despite a tough year just past for the global economy, Ralph Lauren’s stock rose 40%. It also pays a small dividend around the 2% mark.

This week in Singapore, I’ve noticed a lot of Polo

Ralph Lauren is a very popular brand here. For a small island, I found nine stores, including two for children.

Perhaps the aspirational nature of Ralph Lauren appeals to Singaporeans, because Singapore has its own Ralph Lauren story.

Singapore literally jumped from the Third World to the top of the income scales of the First World in just two generations.

My wife, who grew up on the island, remembers a much more basic place in the 1980s. It would routinely flood. From her apartment, she could see people’s furniture floating below.

Yet, during these days, the economy was growing fast. There was a real focus on quality development, from forward-thinking infrastructure to housing for all.

Today, there are roads that seldom jam — though few EVs. Some of the best shopping in the world — from bargain markets to luxury brands. All within an island the size of Lake Taupo that houses 5.5 million.

I did ask people about the paucity of EVs. ‘They don’t yet provide value for money’ was the reply I got. Climate seems less of a concern when infrastructure is resilient enough to mitigate for however it may change.

Many of the businesses here are built on strong foundations and values, having built up loyal customer bases in a very competitive market.

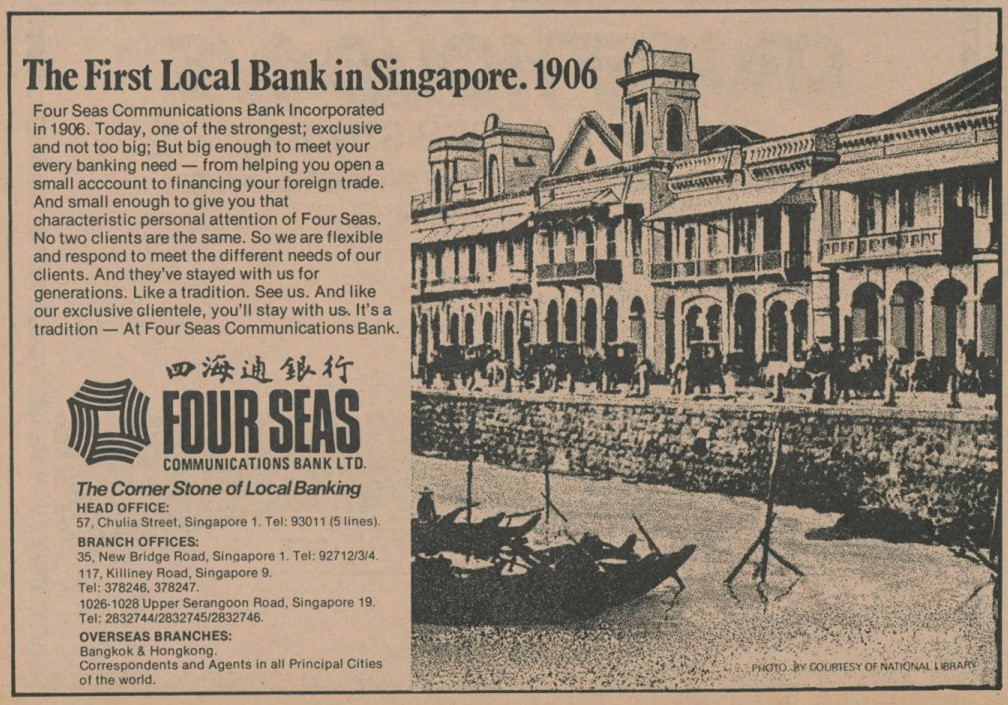

My wife’s great-grandfather and his business partners built one of the early banks: The Four Seas Communications Bank.

It was focused initially on the Teochew Chinese community, but went on to attract many loyal customers with its ‘cosy, homely atmosphere’ and focus on personal attention.

Early advertisement for the Four Seas Communications Bank. Source: Facebook

In 1972, Oversea-Chinese Banking Corporation (OCBC) acquired Four Seas. It was then the oldest surviving Chinese bank in Singapore. At this time, relatives of my wife received OCBC Bank shares. Some still enjoy the dividends to this day.

Like Ralph Lauren and Four Seas, OCBC [SGX: O39] is also a business that has stood the test of time.

It has been ranked amongst the ‘safest banks in the world’. Through the last few years of market volatility, the bank has traded across a narrow spread of around $2 — from ~$11.30 to $13.30. It has a projected dividend yield of over 6%.

RL and OCBC are the sort of businesses I like. Quality. Value. Stability.

And when you dig a little more; good returns on capital, low debt, strong margins — and for their respective sectors; reasonable valuations.

They provide beacons of certainty in an unstable world.

Unfortunately, some companies and sectors move in the opposite direction

These days, in contrast, I see many media companies going the other way.

Since the pandemic, a narrative began to emerge. If you’re not progressive or liberal Left, your ‘wrongthink’ must be denounced. And woe to you, if you’re in government against these views — even when elected by a majority of voters.

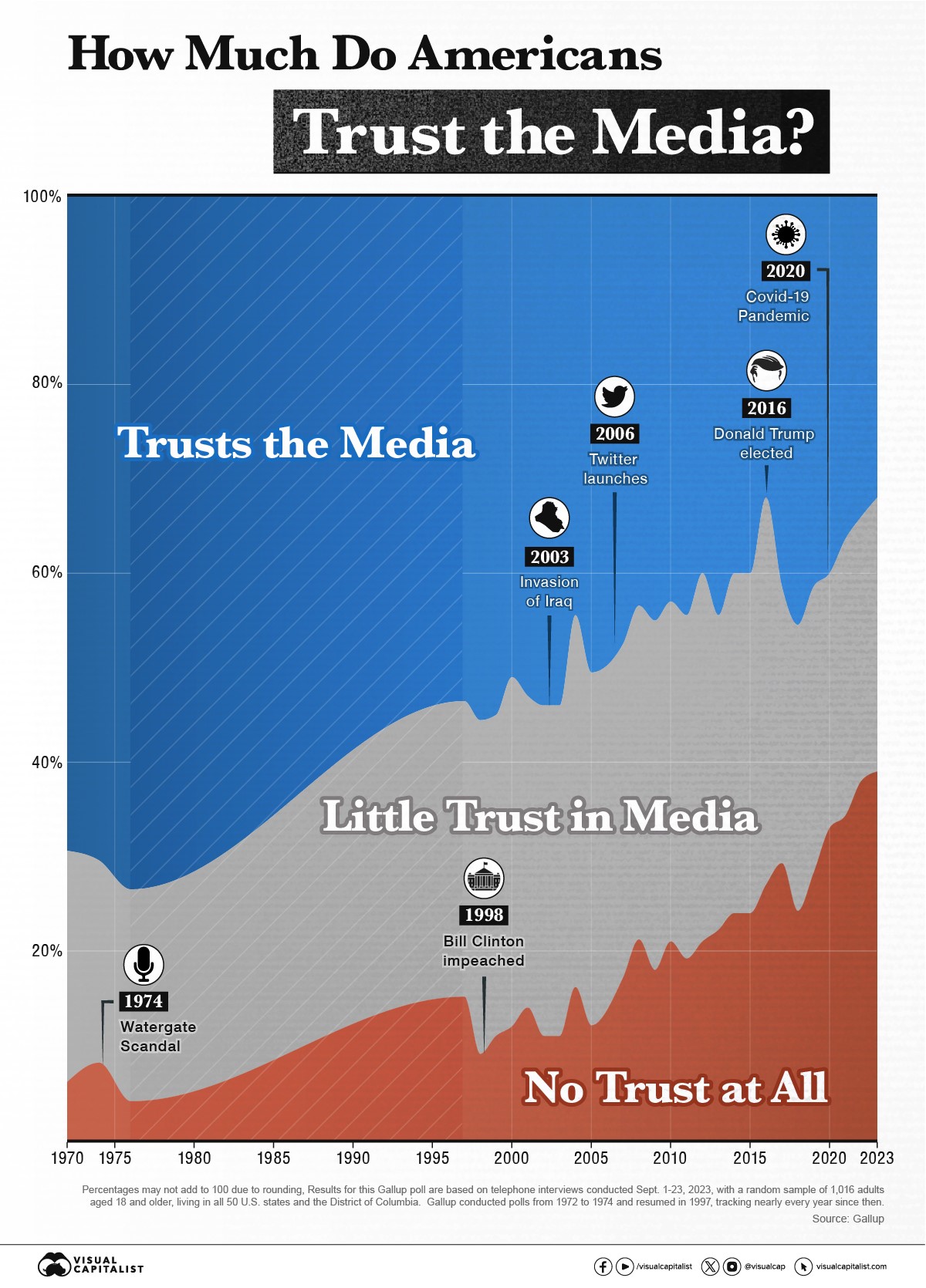

So we see declining levels of trust in mainstream media. Can you blame people?

Many journalists, at least to my reading view, appear to be gaslighting operatives for the woke Left.

They make the rules of thought. They define the values (or lack thereof). And they decide what is right and wrong thought when all you really want is objective news.

I see this in New Zealand. But this trend of declining trust since Covid has accelerated globally. Not so much here in Singapore (which has provided some respite), but especially in the US:

We need quality clothes. We need reliable banks. We need resilient infrastructure and strong economies designed for growth.

But we don’t need to read what mainstream news poseurs think about Christopher or Winston. Because Christopher and Winston tweet their news directly now.

So, in my investing, I’ll seek enduring quality and value. I’ll go to the source. I’ll look for the 4-inch tie over the 3-inch.

And frankly I’ll avoid or dump most else.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the author’s personal opinion and commentary. It is general information only and should not be construed as any financial or investment advice or any recommendation. Past performance does not indicate the future. You should consult a licensed Financial Advice Provider to discuss your own situation.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.