I’ve been thinking a lot about balance lately.

About how important it is to have balance.

And yet…how often we tend to take it for granted.

You see, I suffered an ankle injury recently. It led to swelling. It led to pain. It led to imbalance. My foot had to be strapped up. Many activities had to be cancelled or deferred.

This was a lesson in humility.

A medical illustration of a human foot.

Source: Image generated by OpenAI’s DALL-E

Frankly, most of us don’t realise what an exquisite work of engineering the human foot is:

- It’s a complex network of joints, tendons, and ligaments. Look closely, and you’ll see that every foot has over 100 parts, with the ankle serving as a robust pillar.

- If you are a religious person, you may credit the genius of God.

- If you are not religious, you may credit the elegance of evolution.

- Still, regardless of what you believe, one thing is clear: the human foot needs to be perfectly balanced to work properly. Indeed, the whole is greater than the sum of its parts.

- I discovered this for myself when I suffered some strained ligaments. This created a chain reaction in my ankle and foot. It felt like the equivalent of a five-car pile-up on a busy highway. Everything came to a screeching halt. Ouch.

- Such is the importance of balance. Because when balance is disrupted, the consequences can be deeply profound.

Source: Leisure Capital Management

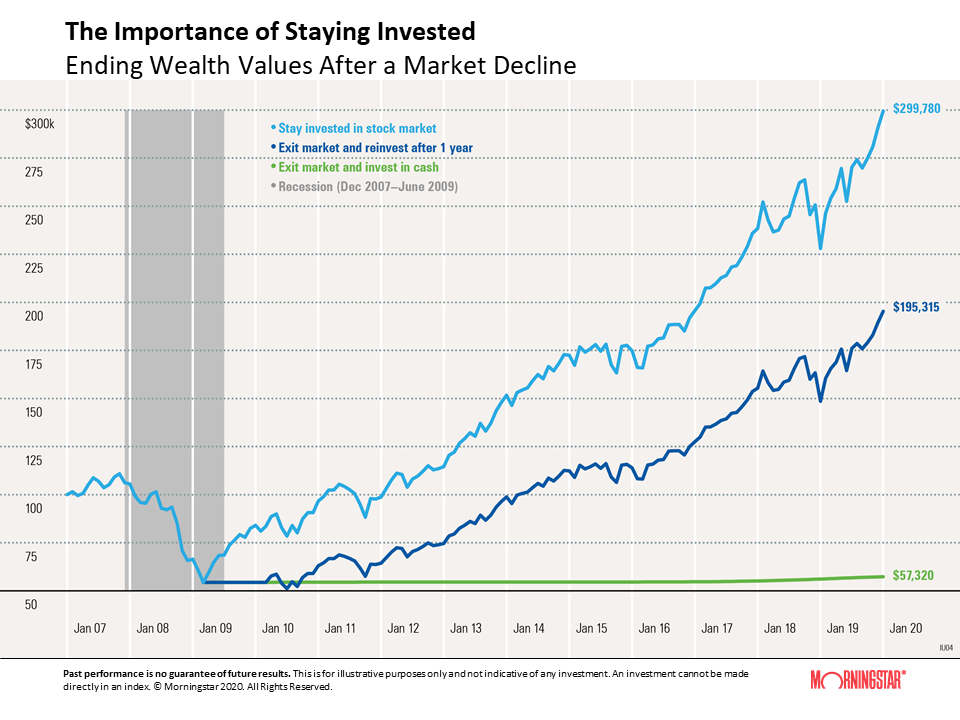

Of course, what’s true in human physiology is also true in the financial markets. Just take a look at this hypothetical American portfolio:

- It starts off in January 2007, with $100,000.

- Unfortunately, soon enough, the portfolio suffers one heck of a wallop, dropping by over 40%.

- This is the worst banking meltdown since the Great Depression. Millions of jobs are lost. Millions of homes are lost.

- The Global Financial Crisis runs from December 2007 to June 2009.

The market crashes and bottoms out. So, what happens next? Well, this is the story of three different investors and the aftermath of their decisions:

- The Green Line — This investor gets scared. So he pulls his money out of the market completely. He never re-enters the market. His account balance remains stuck at $57,320 by January 2020.

- The Dark Blue Line — This investor also gets scared. So he also pulls his money out. But here’s the twist: he only does so temporarily. After one year, he re-enters the market. His account balance surges, and he ends up with $195,315 by January 2020.

- The Light Blue Line — This investor doesn’t get scared at all. So he doesn’t pull his money out. Instead, he courageously stays put and rides out the storm. His account balance skyrockets, and he ends up with $299,780 by January 2020.

Now, the historical results are quite clear, aren’t they?

- The investor in the Light Blue Line has won the lottery. He almost triples his initial investment — and he does so just by sitting still.

- Now, to be fair, he would have needed tremendous discipline to achieve this. I’m talking about complete mastery of his emotions.

- After all, the Global Financial Crisis was terrifying, wasn’t it? The fear was absolute. The economy felt like it was collapsing. Everyone was rushing for the exits.

- And yet…the investor in the Light Blue Line didn’t run away. He was contrarian. He was counter-cyclical. He was able to look beyond the noise and remain calm. His courage paid off in the end.

- Napoleon Bonaparte’s definition of a genius is this: ‘The man who can do the average thing when all those around him are going crazy.’

This brings me back to my original statement:

- It’s all about balance. After all, there’s so much in life that we can’t control. But what we can control, as much as humanly possible, is our reaction to them.

- When I suffered my ankle injury, the best thing to do was to do nothing. I simply had to allow my foot to rest and recover. This network of joints, tendons, and ligaments is a work of art. It’s beautifully engineered to be resilient and sturdy. As it heals, it will find a natural equilibrium — if only I let it be.

- Likewise, the stock market is pretty much the same. It can be injured at times, which creates pain and distress. But you shouldn’t forget: the market is a highly evolved animal. It’s a force of nature. Given enough time, it can bounce back. This is its primal nature — if only we let it be.

- So, ultimately, it’s all about balance. Investors who understand this balance may be a better position to prosper over the long run than those who don’t.

- In the words of Shelby M.C. Davis: ‘History provides crucial insight regarding market crises: they are inevitable, painful and ultimately surmountable.’

We want to hear from you

I hope that you’ve enjoyed reading our articles as much as we’ve enjoyed writing them:

- Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you.

By the way, I have a small favour to ask:

- Would you like to write a review of our work here at Wealth Morning?

- Do you want to let us know if our stories have inspired you in a positive way?

- Do you want to let us know if our stories have helped you become a more successful investor?

We truly value your feedback It encourages us. It helps us to do better. It helps us to reach further:

- So, if you’d like to leave us a review, it’s quick and easy. It will only take two minutes of your time.

Regards,

John Ling

Analyst, Wealth Morning

(This article is commentary and the author’s personal opinion only. It is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please consult a licensed Financial Advice Provider.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.