‘In investing, what is comfortable is rarely profitable.’

—Robert Arnott

Have you thought about it?

Have you thought about locking your money up in the bank?

Have you thought about committing yourself to a 6% interest rate for 12 months?

If you have, rest assured, you’re not alone. Lots of people are thinking the same thing. There’s comfort in placing your money in the bank, isn’t it?

- It feels safe. It feels easy. It feels predictable.

- Your money just sits there. Dormant and passive. Pretty much shielded from the turbulence of the market.

- During times of anxiety, retreating to the perceived safety of term deposits appears to be the natural thing to do.

Source: Image generated by OpenAI’s DALL-E

Now, to be clear, I don’t blame you for considering this:

- In a world filled with angertainment, the news is no longer the news. Facts are no longer facts. It’s more about agitation, aggravation, and yes, anger. This has a profound impact on our state of mind.

- In my life, I’ve seen five major fear events unfold — the hole in the ozone layer, the Y2K bug, the War on Terror, the Global Financial Crisis, the Covid pandemic.

- Each time, the media said Western civilisation was going to collapse. And each time, the media was proven wrong.

- You would think a 100% failure rate would stop people from listening to the media — but apparently, the siren song of angertainment and conspiracy theories can be hard to beat.

So, understandably enough, during times of social upheaval, locking up your money in the bank feels like a credible option. It represents a longing for stability. A yearning for certainty:

- I call this process ‘turtling up’. Because what’s true in the human world is also true in the animal world.

- Just imagine a turtle that’s frightened. He’s reacting to perceived danger. So what does he do? Well, he immediately retracts his head and limbs. Keeps them snugly enclosed within a hard shell. Locked down tight.

- That’s the kind of primal response we can all relate to, can’t we?

Source: Image generated by OpenAI’s DALL-E

But watch out. What if turtling up and retreating into your shell is the wrong move? What if it’s just leading you to a quiet death of your earning potential?

- Yes, for a term deposit, you’re being paid a fixed interest of 6%. On the surface of it, this sounds nice. But, unfortunately, one vital ingredient is missing: you’re not receiving any capital growth on your term deposit.

- Capital growth is something the bank retains. Using your money to invest in its own corporate assets. Rewarding you *only* with a nominal sum for the privilege of doing so.

- What does this mean? Well, it means you may be missing out on at least half your future earning potential. Capital growth, while variable, is like nitro fuel. It can be a powerful accelerator. A real game changer.

- So ask yourself: theoretically speaking, what would another 6% in capital growth do for your long-term financial outlook? Here’s a spoiler: it’s pretty damn significant.

What’s the real price of turtling up?

Let’s consider the opportunity cost over 10 years. Here’s an imaginary scenario:

- If you place $100,000 into a term deposit, earning 6% interest annually, here’s what happens: you will get $179,084 in 10 years.

- Meanwhile, if you place $100,000 into the stock market, earning 12% annualised return (a combination of reinvested dividends and capital growth), here’s what happens: you will get $310,584 in 10 years.

- That’s a difference of over 73% — or $131,500 in extra money.

Now, let’s push the time horizon out a bit more. Let’s stretch it. Let’s consider the opportunity cost over 20 years:

- If you place $100,000 into a term deposit, earning 6% interest annually, here’s what happens: you will get $320,713 in 20 years.

- Meanwhile, if you place $100,000 into the stock market, earning 12% annualised return (a combination of reinvested dividends and capital growth) here’s what happens: you will get $964,629 in 20 years.

- That’s a difference of over 200% — or $643,916 in extra money.

Does this sound attractive? Why, yes, it does. However, here are some important things that you need to be aware of:

- Stocks are more volatile than term deposits. They can pose the risk of significant losses. This is especially true in a bear market.

- For example, between November 2021 and January 2023, Tesla [NASDAQ:TSLA] suffered a fall of over 70%. Ouch. Very painful. But, of course, Tesla has bounced back by over 100% since hitting that low point.

- So, generally speaking, the figures I’ve given for the stock market are annualised. Dividend income and capital growth are variable. They can change according to the economic outlook.

- On some years, a stock portfolio may outperform. On other years, it may underperform. Understandably, progress in the market doesn’t happen in a straight line. It’s the long-term annualised performance that we’re most interested in.

- However, past performance is never a guarantee of the future. So you do need to be an optimist to invest in stocks.

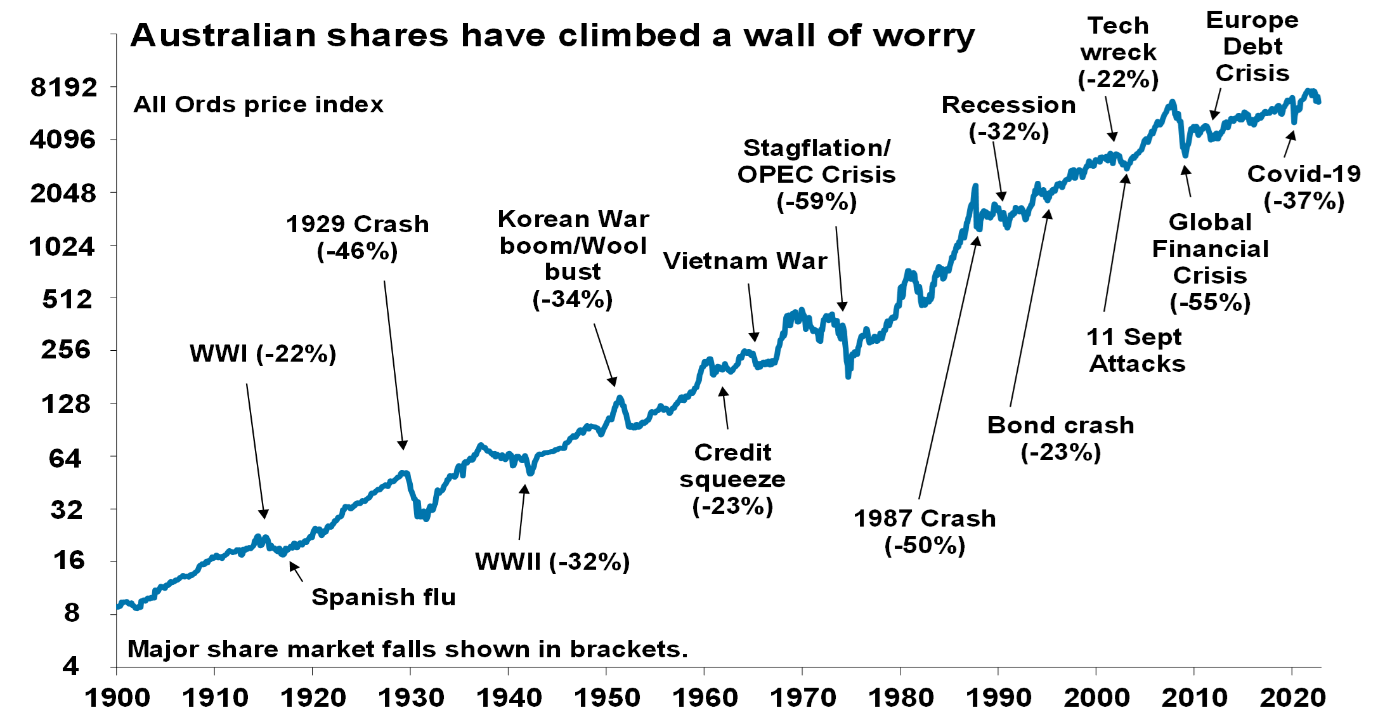

Source: AMP

Now, regarding interest rates, here are a few important things to be aware of:

- I’ve deliberately kept the financial model for my forecast simple. I’m following the principle of ceteris paribus — which is Latin for ‘all things being held equal’. However, real life is much more fluid and dynamic.

- For example, the interest-rate hikes that we’ve experienced lately are the sharpest in 35 years. We haven’t seen such an escalation since 1988. Therefore, people who save are being rewarded, while people who hold debt are being punished. Disproportionately.

- However, it feels like we may be coming to the end of this interest-rate cycle. Inflation in the United States has cooled from its peak of 9.1% in June 2022 to 3.2% in October 2023.

- So central banks will inevitably ease their foot off the pedal. Monetary tightening will be relaxed. This means that it’s highly unlikely that you will secure a 6% term-deposit rate for 10 years, let alone 20.

Retreat or courage?

So, here’s the trillion-dollar question:

- Will you choose the relative safety of the bank, where your money stays passive and static…

- …Or will you take a chance and dive into the living ecosystem of the stock market, where your money becomes fluid and dynamic?

Source: Image generated by OpenAI’s DALL-E

Ultimately, the question isn’t just about where to put your money. It’s about where your money can take you:

- While the safety of term deposits can’t be denied, the potential rewards of the stock market are too important to ignore.

- Just imagine yourself being a rugged adventurer. Seeking out a new uncharted land. Pushing ahead for a brighter horizon. Neither mosquitoes nor crocodiles will deter you. In this instance, risk and opportunity come hand-in-hand. Nothing ventured, nothing gained.

- When you invest in the stock market, you’re investing in the future. You’re investing in human courage and ingenuity. You’re investing in trends that will reshape our world.

- Yes, during this journey, financial heartbreak is a possibility — but so is financial joy. Both emotions are connected. They must be taken in stride. After all, in the words of hockey legend Wayne Gretzky: ‘You miss 100% of the shots you don’t take.’

At Wealth Morning, we run what may be the only active night-trading desk in New Zealand for our Eligible and Wholesale Clients:

- Every week, we aim to buy into exceptional companies in the Australia, the USA, the UK, and beyond.

- Our focus is on sectors that offer the perfect balance of growth and income.

- Our mission? To capture pockets of outstanding opportunity where we can.

- For us, it’s not about turtling up. It’s about venturing forth. Investing in the possibilities of the future.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.