There’s an interesting story that’s been making the rounds lately.

Chances are, you might have already heard it.

Here’s how it goes.

Jeff Bezos is the founder of Amazon. He apparently had a heart-to-heart talk with legendary investor Warren Buffett:

- Bezos asked Buffett, ‘Your investment thesis is so simple. Why doesn’t everyone just copy you?’

- Buffett replied, ‘Because no one wants to get rich slow.’

- So direct. So profound. So true.

Just think about it. Without exception, every financial disaster that we have seen over the past five years has been caused by people refusing to follow Buffett’s philosophy. Let me give you some real-world examples here:

- Just think about the people who borrowed heavily to invest in property, only to suffer emotional distress when interest rates went up. Why did they do it? The short answer: they wanted to get rich quick.

- Just think about the people who poured their money into non-fungible tokens (NFTs), only to see 95% of them wiped out when the speculative bubble collapsed. Why did they do it? The short answer: they wanted to get rich quick.

- Just think about the people who signed up for multilevel marketing schemes (MLMs), only to find themselves taken for a ride by Ponzi scammers. Why did they do it? The short answer: they wanted to get rich quick.

Source: Chris Dunn, X

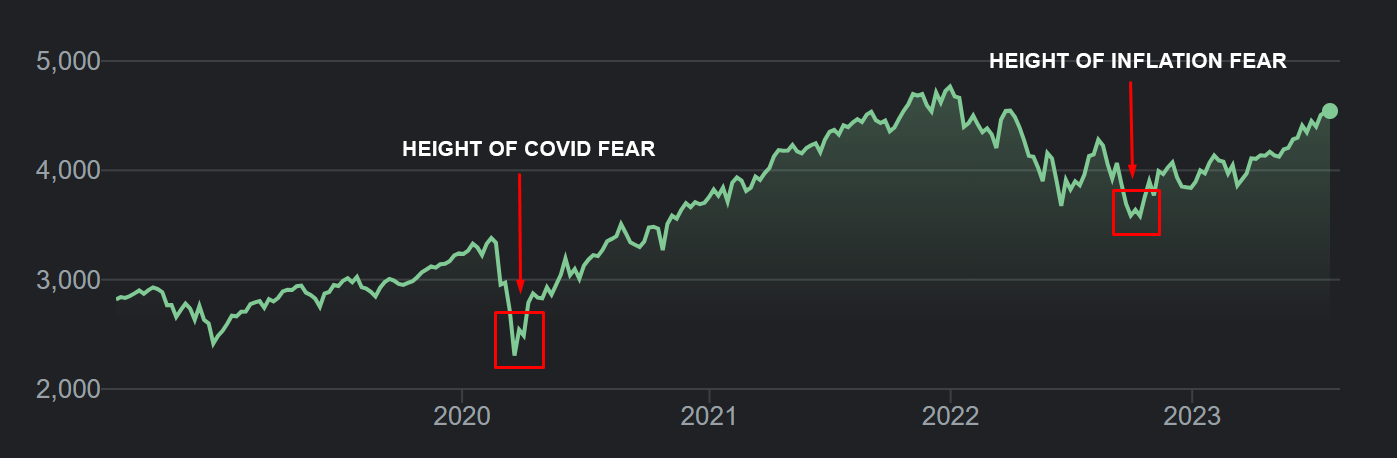

This brings us to the stock market. If you have been watching it for any length of time, you will notice this trend:

- When the market goes up, it likes to use the staircase.

- When the market goes down, it likes to use the elevator.

Why? Well, it’s really about human psychology:

- Wealth building is a slow and steady process.

- Wealth destruction is a quick and impulsive reaction.

Fortunately, if you are willing to extend your time horizon, you will find that there are more staircases than elevators:

Source: Google Finance

Source: Insider

The US Navy Seals have a saying: ‘Slow is smooth. Smooth is fast.’

- Indeed, building wealth isn’t about emotion or luck. It’s about judicious discipline. It’s about making small choreographed movements that add up to a big result over time.

- So, what does that look like? Well, if you invest $100,000 in the market and get a 15% annualised return, you’ll unlock something magical: the power of compounding. In five years, $100,000 will become $200,000. Then, give it another five years, $200,000 will become $400,000. Then, in five more years, $400,000 will become $800,000.

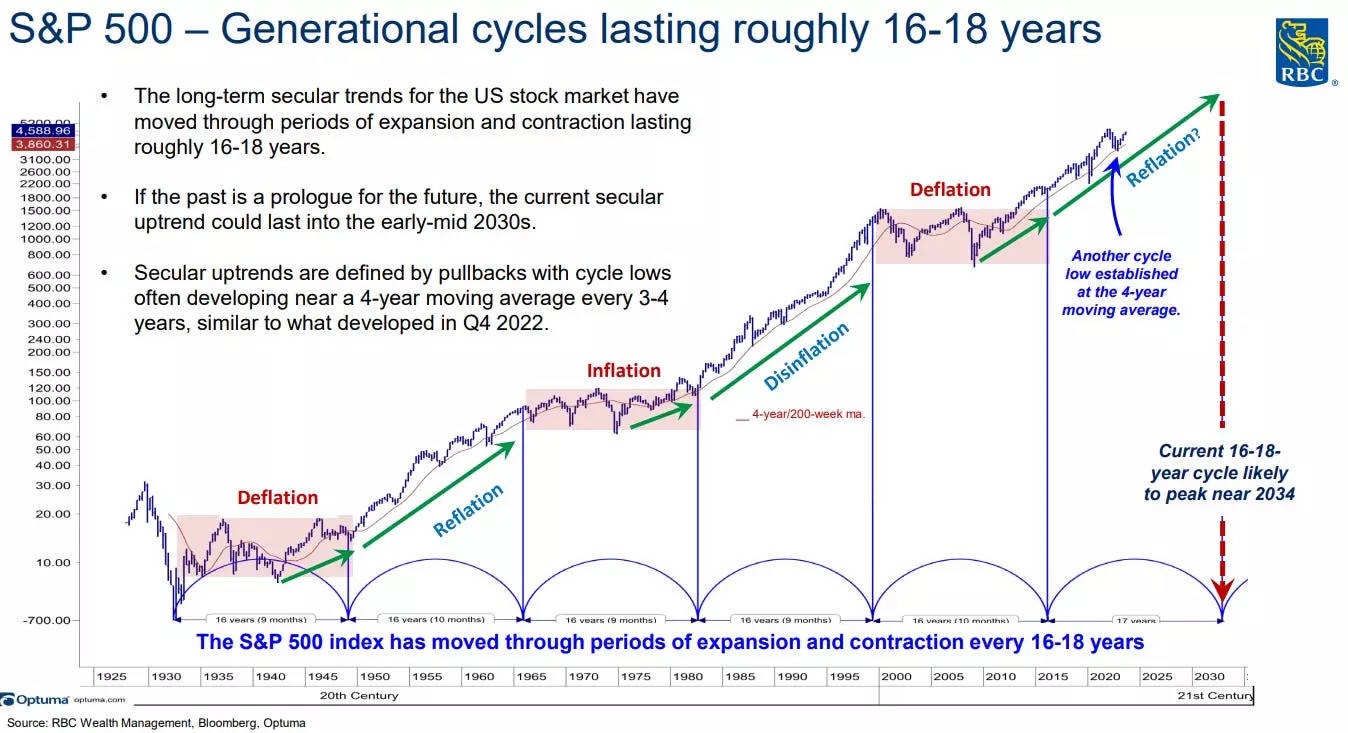

- So, this isn’t a sprint. This is a marathon. Good investing is about the long run.

Financial adviser Ben Carlson offers this simple insight:

‘I believe the timing of buy or sell decisions matters less than your holding period. Picking tops and bottoms is for the lucky and the liars. Patiently holding onto your investments is more important for most investors than timing.’

Of course, most people can’t stand to get rich slowly:

- They tend to overlook the staircase, even if one is readily available.

- Instead, they keep hunting for that elusive elevator that’s going up — only to keep stumbling into that disastrous elevator that’s going down.

- These people don’t lack actual intelligence. In fact, most of them are pretty smart — doctors, engineers, lawyers, you name it. But they keep making unforced errors. Because what they lack is emotional fortitude.

- However, here’s the good news: emotional fortitude can be learned. It can be nurtured. It can be harnessed.

- You can start climbing that staircase today. To protect wealth. To grow wealth. To generate income. This is the art of getting rich slowly.

We want to hear from you

Your prosperity is our focus — which is why we are always working hard to uncover new opportunities beyond the radar for you. We’re eager for your feedback:

- If you have enjoyed this article, please consider leaving us a review.

- Let us know what you liked. Let us know what inspired you. Let us know if it’s made you a better investor.

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.