‘May the force be with you.’

—Obi-Wan Kenobi

As a kid, I was spellbound by Star Wars.

The George Lucas series that began in 1977.

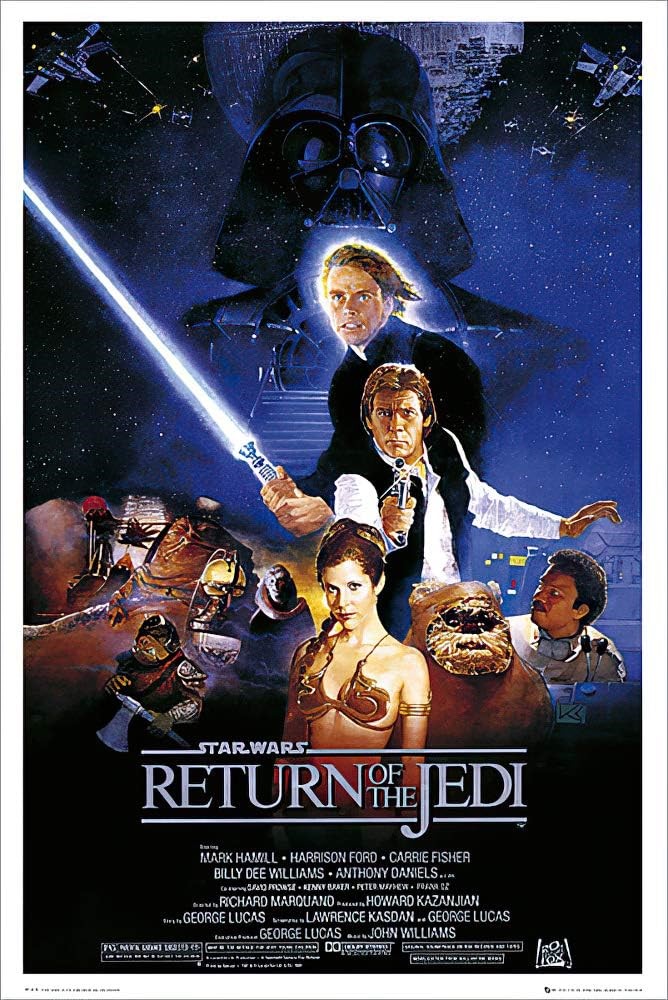

For me, it reached its zenith with Return of the Jedi in 1983.

Source: Amazon

To say I became obsessed with the galaxy far, far away is an understatement. I was absorbed then with all the information I could discover, as I am now on sharemarkets.

Star Wars bubble gum cards became the currency for school boys to trade at lunchtime. And I was constantly at my parents to drive to a new dairy which may hold the prospect of new packs and new characters.

To this day, I regret how we leaned on another boy, Krishnan, to get more packs for us. His parents owned the local dairy, you see.

Of course, when you bought a pack of gum, you couldn’t see the character card inside. So it was a constant game of chance. And endless chewing.

Then there was the crunch.

Source: Superpower Wiki

Boba Fett, as I recall, was the elusive character many sought but seldom found in Taranaki.

To have this card would give you trading value beyond all else. Boba was the crunch card. A less understood character and a contrarian pick.

Well, this idea of a crunch card today defines how we approach opportunity in the market.

As value investors, we are looking for the area that has been crunched but holds inevitable value.

In these turbulent markets, washed up with Covid’s fake money, we see several key crunch areas where value is evident. And one in particular, where takeover rumours have been circling around one company. Let’s take a look…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.