and how crisis paved the way for a golden investment opportunity.

The ‘70s and ‘80s were a great time to grow up.

Mine was a Kiwi childhood. Roaming farm paddocks, climbing trees, and hanging out for the next Star Wars instalment.

Financially, it was not so easy.

Mum and Dad were juggling very high mortgage rates. There wasn’t even any money left over for an ice cream on the weekend.

Inflation started galloping after I was born in the 1970s. The Yom Kippur War led to an oil embargo on nations supporting Israel. The price of oil rose 300%.

For a remote country like New Zealand, dependent on oil imports for primary production, the inflationary impact was exacerbated.

We had carless days. My father had a CNG tank added to our car. And, for a while, it became very hard to get ahead in New Zealand.

Simon Angelo, circa 1978. Rover 90 converted to CNG and ‘renewable’ mowing.

Muldoon’s 1982 wage and price freeze only further choked a gasping economy. Suppressing inflation before it ravaged again.

Source: RBNZ

Then there was the fixer

In 1984, Muldoon’s government was thrown out in the ‘schnapps [snap] election’. (Apparently, he was visibly drunk when announcing it live on television).

Roger Douglas became the finance minister. Rarer amongst recent politicians, I look back and see a focus on doing the right thing even when it was painful.

Sir Roger Douglas. Source: Celebrity Speakers

Advocating a neoclassical and monetarist approach, Douglas proceeded to reform the economy to dismantle bureaucratic privilege and allow markets to work.

He supported the groundbreaking Reserve Bank Act 1989. Telling Parliament in his 1988 Budget speech that it ‘would make certain that no future politician can interfere with the [Reserve] Bank’s primary objective of ensuring price stability, or manipulate its operations for their own purposes, without facing the full force of public scrutiny.’

Other central banks around the world followed New Zealand’s lead in targeting inflation. We’ve largely enjoyed the stability of a low inflation environment across the developed world. At least up until now.

Unfortunately, some politicians here could not leave the purity of the inflation target alone. From 2017, cross-purposes were added. With new directives for achieving ‘maximum sustainable employment’ and ‘supporting more sustainable house prices, including by dampening investor demand for existing housing stock to help improve affordability for first-home buyers.’ All rather like putting a pizza in a blender.

The New Zealand public called time for those politicians on Saturday.

According to Bloomberg, National would promptly return RBNZ’s mandate to a sole focus on inflation.

This would be more effective at tackling inflation.

Crucially, that could see interest rates drop.

Opportunity and upside

Your key economic building years are from the ages of 15 to 45.

Ideally, you’ll buy a home. Begin renovating and furnishing that place. Start a family. Then perhaps a larger home and an SUV.

I was very fortunate to come through these years during inflation’s atonement.

After the 1987 crash, I began learning about the sharemarket and buying shares. (A practice I’m still dedicated to today for our Wholesale Clients and my family portfolios).

Inflation’s aftermath provided fertile ground.

Through the 1990s and early 2000s, shares and property offered good value.

It was like picking up coins from the pavement. I regret being so debt shy and not stretching to pick up more. But when you grow up in the ‘80s, debt is danger.

Are we here again?

Ukraine and the recent Israeli conflict spur elevated oil prices. We’re facing persistent inflation and ‘higher for longer’ interest rates because too much money was ‘printed’.

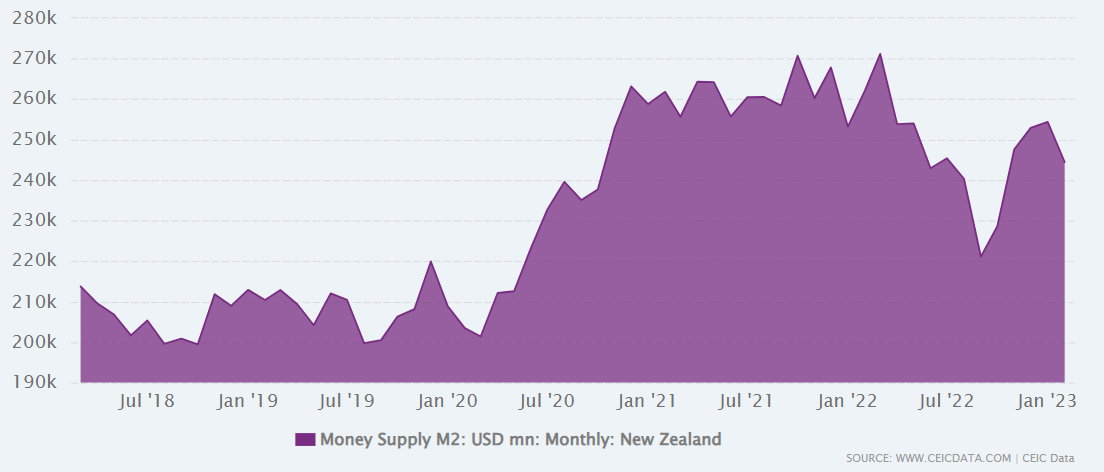

Here in New Zealand, the money supply increased ~35% since Covid!

Yet things move faster in the internet age. Markets turn on news by the minute.

Things feel like the last inflation hangover. Markets are volatile. Stock market investors are on edge over spiking bond yields.

Even fiercely fought urban property markets have been slammed.

I’m going in again.

We’re in that hard pain cycle of high rates. No let-up. Economic bloodshed as these conditions clobber businesses and households.

But we’re also seeing many listed companies hold their occupancy, lift their rents, and eke out earnings growth. I’m seeing a blazing rental market in Auckland.

This is why, over the long run, markets should still keep delivering income and growth. A burn-off straightens them out. It weeds out the sluggish players. And provides more fertile ground.

This takes time. Nobody knows where the bottom is or when things will turn.

Yet it still strikes me that now is a great time to take a little risk and get in position.

Just as it was all those years ago.

A new government brings new hope. Is a new golden age underway?

Reader opportunity: Eligible and Wholesale Investors

Have you been reading Wealth Morning for a while? Do you like what we have to say?

If so, you may be interested in our Wholesale Managed Accounts.

These are for investors with some experience who would like to have a robust portfolio built for them in their own brokerage account.

The focus is on income and growth. Globally diversified.

Income over this past year has been vital for investors riding out the inflation storm. While we position for growth when the cycle turns.

While a lot of focus has gone into fixed interest — bond yields, term deposits — the resurgence of dividends since the pandemic has been competitive across many positions.

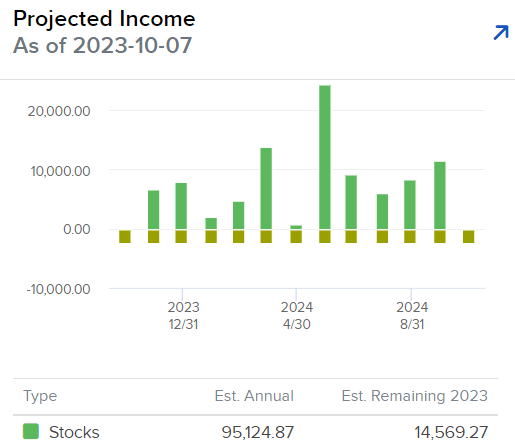

Here is a sample portfolio of around $1.45 million. It’s globally invested, with a defensive and property focus. It’s grown since the pandemic, with some drawdown on the interest rate story over the past few months.

The interesting thing is the resurgence in dividend yields. The portfolio is now projected to deliver a running yield of ~6.6% this year:

Now, past performance is no guarantee of the future. Dividends are not guaranteed either. They can be reduced or cut — as they were during Covid.

So continued success depends on company earnings growth feeding stock price growth. To some degree, this relies on a turnaround in the economy once inflation is atoned.

We are offering free consultations on our Managed Account solution to Eligible and Wholesale Investors until the 24th of October.

If you would like to take advantage of this to learn more and discuss your eligibility, please register here.

Regards,

Simon Angelo

Editor, Wealth Morning

This article is the author’s personal opinion and commentary. It is general in nature and should not be construed as any financial or investment advice. Wealth Morning Managed Accounts are only available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.