Let’s face it: the history of humanity is the history of Doomsday.

There has never been any shortage of people with a burning desire to predict the Apocalypse.

For example, many early Christians believed that they were living in the End Times. Therefore, they were convinced that Jesus would return in the year 500.

Source: Ascension Press

People waited. People prayed. People watched with earnest conviction.

Unfortunately, the Second Coming didn’t happen. It was a major disappointment.

Clearly, the Apocalypse needed a serious adjustment. So people decided that the year 1000 made more sense. After all, going from three digits to four digits was a major milestone, wasn’t it? Surely this had to be the End of Days?

Once more, they watched and waited with bated breath.

And…once more…nothing happened.

So, again, people needed to revise their expectations. They started looking at the year 2000. This marked the end of one millennium; the beginning of another. Surely this was it? The Big One? The End?

People followed the countdown, their anticipation feverish.

But…once more…there was no Second Coming. It was another huge disappointment.

Still, religious faith is not so easily dissuaded. And for believers, the signs of the End are ever-present.

Recently, with the Covid pandemic, inflationary crisis, and culture war, people are making predictions about the Apocalypse again. Indeed, it’s never been easier to make prophecies. Especially in this age of 24/7 broadcasting and social media.

But watch out. Conservative Christian organisation Focus on the Family has some words of wisdom here:

The Bible clearly instructs us to be vigilant. But it also teaches that no one can say for certain that we are living in the “end times.” This is at best a debatable proposition. Jesus Himself repeatedly said that no one knows or can know the day or hour of His return (Matthew 24:36; Mark 13:32; Acts 1:7). To be sure, we are surrounded by events and developments that could be interpreted as signs of the end. On every hand we see famines, earthquakes, disasters, troubles, persecutions, wars and rumors of wars (Mark 13:7-9). But has there ever been a period in the history of the world when this was not the case?

Can you imagine what it was like to be a believer in Rome under the emperor Caligula, or Nero, or Domitian? To face the arena, the stake, or the lion’s den for your faith? What do you suppose Christians were thinking when the legions captured Jerusalem and destroyed the Temple in A.D. 70? Or when Attila overran Europe in the 5th century, the Vikings in the 9th, Genghis Khan in the 13th, or the Muslim Turks in the 16th? Might anyone have concluded that the end was near when the Black Death decimated Christendom, wiping out entire towns and claiming more than 25 million lives between 1347 and 1352? How did the situation look to believers at the beginning of the last century, when the so-called Great War destroyed the flower of an entire generation (37 million casualties)? Or a few decades later, when the shadow of Hitler and the Third Reich was rising over Germany and Eastern Europe? Clearly, the early 21st century has no monopoly on death, disaster, devastation, and terror. You don’t need to know a great deal about history to realize this.

Source: Yahoo Sports

Yes, faith is a powerful and legitimate force. But so is state of mind:

- Psychologists have identified a condition known as ‘apophenia’. It’s about patternicity — our tendency to see shapes, patterns, and connections in random things.

- This is closely related to confirmation bias — which is our tendency to seek out information that confirms our existing beliefs, even while we ignore other rational explanations.

So, is it possible to predict the future of the stock market?

Source: A Wealth of Common Sense

Now, if you’ve been watching the market for any length of time, you will notice how much it seems to be driven by human emotion. What is the reason for this?

- Well, in 1936, John Maynard Keynes was the first economist to talk about ‘animal spirits’. This comes from the Latin word spiritus animalis — which means ‘the breath that awakens the human mind’.

- The two most commonly cited animal spirits are the bull and the bear. You hear about them all the time in the news. When people are feeling bullish, they will tend to buy. And when people are feeling bearish, they will tend to sell.

- This tug-of-war is about greed versus fear. This drives the market cycle.

Some financial personalities — like Robert Kiyosaki — seem to be always bearish and pessimistic:

- For years and years now, Kiyosaki has been talking about ‘the biggest crash in world history’.

- Of course, it hasn’t happened. But for Kiyosaki, it probably doesn’t matter. He must know that his controversial statements have shock value. They will get him attention and boost his profile.

- Remember: a negative headline gets 60% more clicks. And each additional scary word increases the click-through rate by 2.3%.

However, other personalities — like Warren Buffett — usually position themselves to be strategically bullish for the long-term. Here are two choice quotes from Buffett:

- ‘We haven’t the faintest idea what the stock market is going to do when it opens on Monday. We’ve not been good at timing. We’ve been reasonably good at figuring out when we were getting enough for our money.’

- ‘A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.’

Meanwhile, there are other bullish investors who believe that magic formulas do exist. Allowing you to predict the future. So you can have your cake and eat it too.

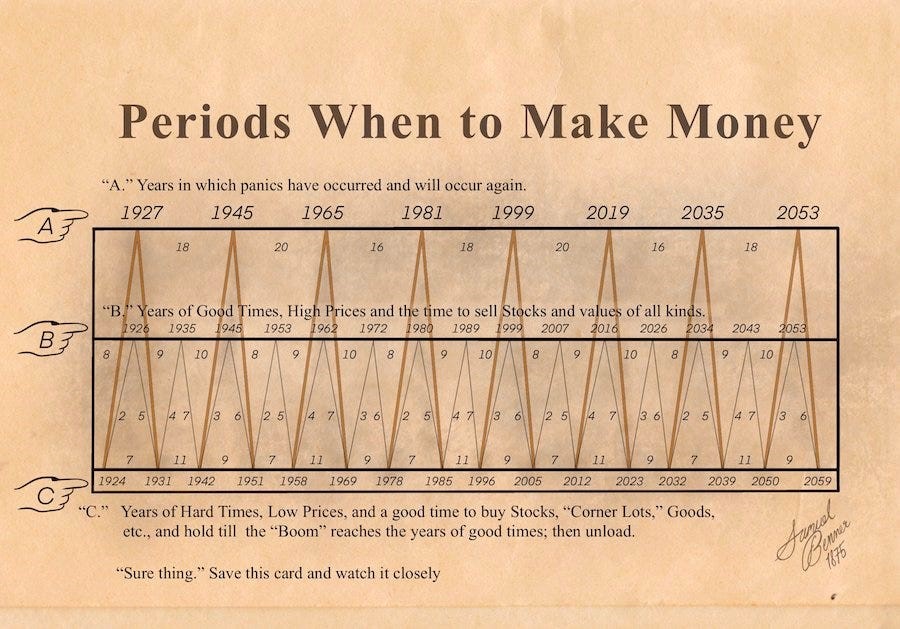

For example, just take a look at this fascinating idea here — Benner’s Prophecies of Future Ups and Downs in Prices:

Source: Asymmetric Finance

Now, if you follow the pointing hands on the chart, you will see three zones being highlighted. Here’s an explanation of what they mean:

- Zone A — This is where the market starts to panic, stocks plunge, and the bear takes over. This moment is apparently marked by severe corrections and crashes.

- Zone B — This is where the market enters an optimistic phase, stocks rise, and the bull is strong. This moment is apparently ideal for selling assets at a premium.

- Zone C — This is where the market starts to bottom out, stocks reach a trough, and the bear starts to transition into the bull. This time is apparently ideal for buying assets before the cycle turns.

At first glance, the chart feels spookily plausible, doesn’t it?

- All the major milestones do seem to line up quite closely — the Great Depression, World War II, the 1970s oil shock, the dot-com bubble, the Global Financial Crisis, and so on.

- Most notably, 2023 makes an appearance in Zone C.

- This, of course, raises the question. Is this an accurate crystal ball for the market? Or is this simply a clever historical hoax?

The Benner Cycle

Source: Amazon

Well, the actual origins of this economic model can be a bit murky. But so far as I can tell, here’s how the story unfolds:

- In 1873, the American economy suffered a financial crash. History tells us that this happened because of two main reasons: rising inflation in America, as well as rampant speculation in railroads.

- Believe it or not, the railroad boom was the tech bubble of its time. Too much greed; too much debt. And when the crash came, plenty of people were caught up in it.

- Among them was Samuel Benner, a pig farmer from Ohio. He experienced terrible losses, and they pushed him to the brink of ruin. Ouch. But Benner was a survivor. He quickly picked himself up, and he was determined to find a solution.

- Benner felt that he had been led astray by listening to rumour and hearsay for his investment decisions. He decided that he needed a better economic model for the future. So he began to create his own chart. Apparently, he had no formal training in finance. Instead, he relied upon his own seasonal observations of demand and supply; droughts and harvests; rain and shine.

- Benner wanted to forecast the rise and fall of commodity prices. Specifically, he was interested in the long-term performance of pig-iron, hogs, and corn. This made sense. After all, it was his livelihood.

- In 1875, Benner was confident enough to publish his economic model as Benner’s Prophecies of Future Ups and Downs in Prices. Not bad for a working-class man.

Now, intriguingly, the Benner Cycle uses this pattern:

- Economic booms that happen in a 16-18-20-year pattern.

- Low prices that happen in a 8-9-10-year pattern.

- Economic recessions that happen in a 5-6-7-year pattern.

But here’s where things get a little curious:

- Samuel Benner’s original chart was pretty limited. It only ran until 1891. It didn’t go further than that.

- However, another forecaster — George Tritch — apparently saw the value in using Benner’s model. So he adapted the chart, then extended it all the way out to 2059. Interestingly, Tritch would add more content in the form of buy/sell instructions, which were not present in the original chart.

- But watch out: there’s wild controversy here. Tritch appeared to believe that market cycles are linked to planetary orbits. In other words, the mood gets bullish or bearish depending to Earth’s position relative to other celestial bodies.

- Be warned: this financial astrology is a pseudoscience. It can’t be tested. It can’t be proven. It’s subject to a whole lot of randomness and subjectivity.

So, is the Benner Cycle legitimate at all?

Interestingly, the chart has been floating around social media for a while now. In regards to its actual authenticity, you will find both sceptics and believers:

- It’s important to remember that past performance is never any guarantee of the future.

- The Benner Cycle may be a fascinating historical document — but it is not widely accepted by most mainstream analysts.

- Critics argue that market cycles are influenced by a wide range of factors, including fiscal and monetary policies, global economic conditions, technological advancements, and geopolitical events. This makes it difficult to predict market behaviour based only on Samuel Benner’s model.

- Nonetheless, supporters say that the Benner Cycle’s simplicity is its greatest strength. While the years listed on the chart don’t line up 100% with actual historical events, it’s close enough. As the contrarian logic, investors may benefit when they buy during a famine and sell during a feast. This may provide a margin of safety, as well as maximise profits.

But, personally, I’m cautious about this chart. Investment decisions based on the esoteric and the occult can be questionable in the long-term:

- So, is the Benner Cycle simply another case of confirmation bias? Are people seeing a pattern in there when it’s actually gibberish? Or is the Benner Cycle the real deal? Does it truly predict the ebb and flow of animal spirits?

- I’m eager to hear your thoughts on the matter. Are you a sceptic? Or are you a believer? Please email me at [email protected] and let me know what you think.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.