Quantum Wealth Summary

- What you need to know: This consumer-staples brand is legendary. Its stock price is up over 5,000% since 1983.

- Why it matters: Warren Buffett has made this stock a cornerstone of his Berkshire Hathaway portfolio. It’s one of his largest holdings.

- Here’s the state of play: Surprisingly enough, this stock has a hidden, contrarian side. It has outperformed tech stocks like Facebook, Apple, Amazon, Netflix, and Google over the past five years. Should speculative investors take a closer look at this?

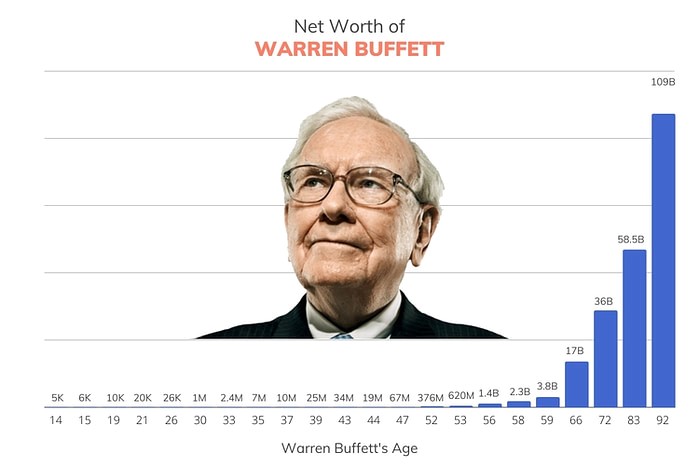

Warren Buffett is the sixth-richest man in the world.

Chances are, you already know this. It’s a pretty well-established fact.

But here’s something you may not know: Buffett is a late bloomer. In fact, he generated 90% of his wealth only after reaching the age of 65.

Don’t believe me? Well, take a look at his investment journey.

Source: FinMasters

What’s striking about Buffett’s investment journey is how he has paced himself:

- He doesn’t rush. He doesn’t sprint.

- He just runs a marathon. A steady, measured pace.

Clearly, Buffett is in it for the long haul:

- Why? Well, why not? Time spent in the market appears to beat trying to time the market.

- Buffett’s unique superpower is that he’s patient. Very patient. And he uses that ability to iron out any wrinkles he may encounter in the short-term.

Buffett says this:

‘We haven’t the faintest idea what the stock market is going to do when it opens on Monday. We’ve not been good at timing. We’ve been reasonably good at figuring out when we were getting enough for our money.’

Certainly, Buffett’s strategy of identifying value seems to have worked out pretty well for him:

- At the time of writing, Buffett has achieved an annualised return of around 20% a year. He’s done this since 1965. That’s almost 60 years. An outstanding track record.

- When you look into Buffett’s investment portfolio, you’ll see dominated entirely by stocks. That’s understandable. Over the long run, stocks have outperformed all other asset classes: bonds, real estate, commodities.

But having said that, not all stocks are created equal. Which is why Buffett is very fussy over the choices he does settle upon. Now, this brings us to a Company that he seems to favour greatly:

- It’s a consumer-staples brand that’s gone from strength to strength over the years. Since 1983, its stock price is up over 5,000%, thanks to some remarkable defensive qualities.

- Intriguingly enough, there’s more to this Company that meets the eye. It actually has a hidden, contrarian side. It has outperformed tech giants like Facebook, Apple, Amazon, Netflix, and Google over the past five years.

- The mainstream media has totally ignored this development and few people know about it. But should speculative investors with a higher appetite for risk take a closer look at this idea?

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

✅ EXCLUSIVE BONUS: You’ll also receive these additional eBook reports,

covering 13 NZX stocks, plus 2 global opportunities:

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.