Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

Jerome Powell and Mark Carney take the pulse of economics in 2019 at Jackson Hole.

This year is very different and could move markets even more.

Source: The Hill/AP Photo/Amber Baesler

August has been the worst market month this year. It usually is. Northern Hemisphere traders bask in their scarce summer sun. Buying volumes are lower.

I remember the European holidays. When colleagues would go away for weeks on end, messages left unanswered or forgotten. Until they returned.

But this is not the only reason for this August drawdown.

Inflation is still proving stickier than expected. Long-run Treasury interest rates are higher again.

China’s economy has failed to bounce back from the pandemic. In fact, it’s now in freefall in some areas. Dragged down by overleveraged (and often unfinished) real estate.

So we pivot. Going through our targets line by line and switching some China market exposures to ‘wait and see’. Instead, ploughing into brighter spots: gradual recovery in the real estate sector, home building, new transport, and energy.

Here in Auckland, it has been one of the coldest Augusts on record. But there has been plenty to keep us occupied. In fact, we’ve been buying up bargains for all clients with available funds.

Now, as August has come to an end, there’s a turning point.

At the Jackson Hole meeting, Fed Chair Powell hinted that rates would likely be held ‘at a restrictive level’. But he’d only raise rates further ‘if appropriate’.

Perhaps spurred on by delectable catering at the event, he went on to add some lunchtime poetry:

‘To put it another way, I can prepare and intend to have a salad for dinner if appropriate for my waistline. But if I see fried chicken, my salad plans are too easily dashed.’

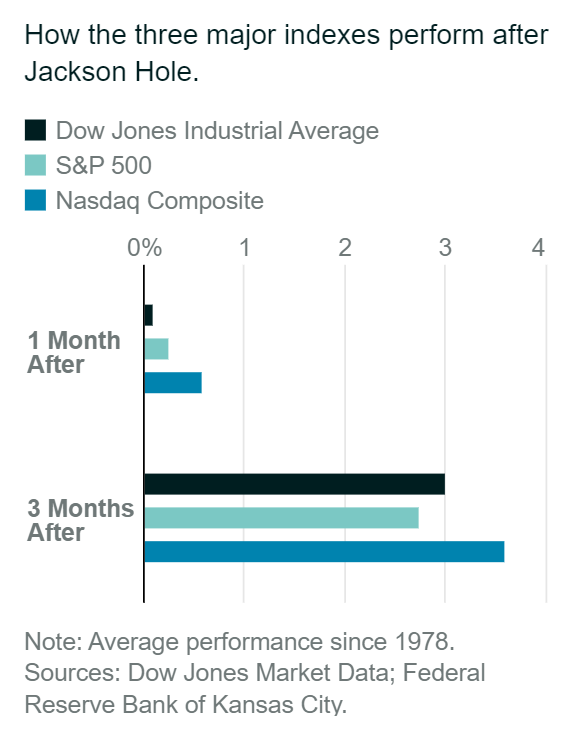

Moving into September, the market has some more appetising direction. This is typical after the Jackson Hole meeting, in fact:

With Eurozone inflation also slowly retreating, we could be at the cusp for another run in wisely-picked stocks.

For those looking to add funds to their account, now is a good time.

Managed Account performance*

For the month of August 2023, we were down 2.66% across the composite portfolio (total aggregate return across all portfolios following the strategy).

Our MSCI EAFE benchmark was down 3.56%.

This brings our return for the 8 months of this year to date (1 January to 31 August, 2023) to 12.00%.

Uncertain August has knocked out a near-15% return this year with some drawdown. But remember: drawdown is a great time to top-up and get some keener value again in buys.

Our average annualised return since inception is 15.22% p.a.

Please see our performance chart for more details.

Free consultations end today (1 September)

Finally, if you don’t already have a Wealth Morning Managed Account, we are offering a free consultation to discuss the option and provide information.

The registration period for this ends today.

Thereafter, we will be wait-listing new applications.

To request a consultation, please click here now.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Request Your Consultation Now

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.