This is a true story.

Indeed, you know it’s a true story.

This is because you actually lived through the historical events that I’m about to describe to you.

Source: Computerworld

The year was 2020. It was the height of the Covid pandemic:

- Travel was suspended. Borders were locked down. Businesses were frozen.

- Life, as we know it, had taken a turn for the apocalyptic.

- Pundits and journalists were predicting the worst. They said that we were nosediving into an economic meltdown. It would be more horrific than the Global Financial Crisis and Great Depression combined.

Naturally enough, people from Cape Town to Jakarta to London were gripped by this existential terror. And here in New Zealand, the foul mood captured us as well:

- Among the Kiwis who found themselves caught up in the turmoil was a 67-year-old investor. He shall remain anonymous. But here’s the most important thing that you need to know about him: he was close to retirement, and he was debt-free.

- Logically speaking, he was on solid financial footing. He was in a better position than most of his fellow citizens. He could afford to wait this storm out.

- Unfortunately, the constant torrent of fearful headlines was impossible to ignore. His emotions eventually got the better of him. When he saw that his KiwiSaver balance had plummeted due to Covid, he panicked. And he made a rash decision.

- He liquidated his KiwiSaver account in a hurry. He cashed out, and he withdrew from the market. He locked himself into a term deposit with a 2.8% return for six months.

- He decided that he wanted to see things calm down before he did anything else.

Was this a wise move? Well, just consider how things played out globally:

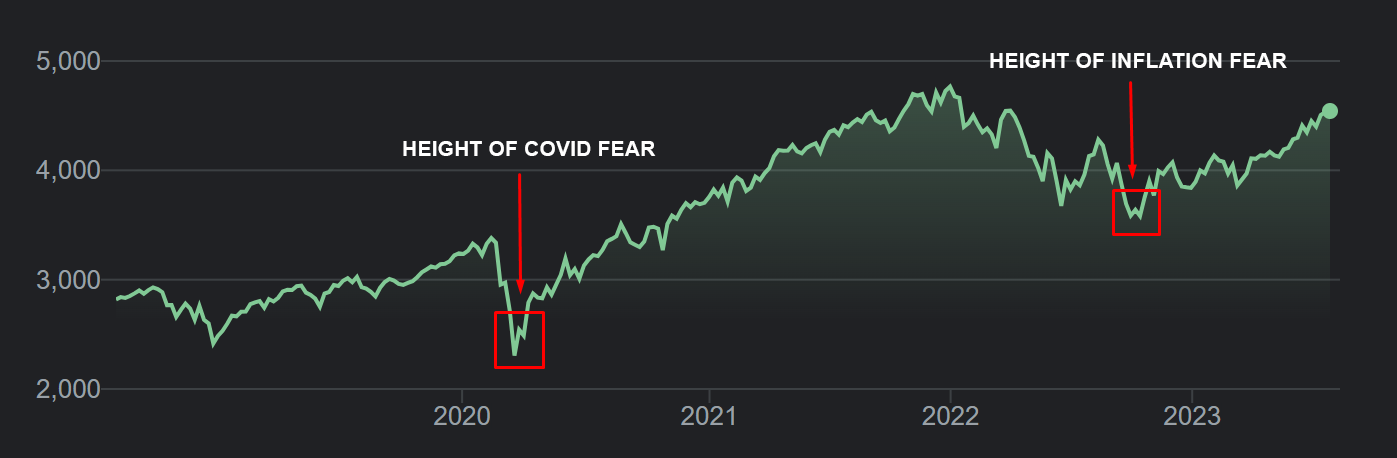

- From 14 February, 2020 to 20, March 2020, the S&P 500 index plunged over 30%. This felt terrifying at the time.

- But then, from 20 March, 2020 to 14 December, 2021, the S&P 500 rebounded. It quickly recovered its losses, climbing over 100%. It was breathtaking to see.

- This was the shortest bear market in history. It lasted just 33 days before the trend suddenly reversed, and we experienced a bull market.

Of course, in retrospect, this investor had made a tragic mistake:

- By impulsively exiting the market, he locked in his losses. Worse still, he missed out on the rally.

- He had committed his money into a term deposit at rock-bottom interest rates for six months. But six months might as well be an eternity.

- By the time he realised his error, it was already too late. Much of the gains in the market were already snapped up.

Well, hindsight is 20/20, isn’t it? What should he have done?

- Well, if this investor had additional money, he shouldn’t have retreated from the market. Instead, he should have invested as the market was going down. Even if he couldn’t quite pick the bottom, he could have at least benefited from dollar-cost averaging. He could have positioned himself handsomely for the upswing.

- However, even if he had no money to invest, he still would have benefited by staying put. Doing nothing. Allowing the cycle run its course. By doing so, he would have recovered his losses easily.

- It’s so obvious, isn’t it? Time spent in the market beats trying to time the market.

Source: Google Finance

Now, the events of 2020 can serve as a universal lesson for all investors:

- Contrarian thinking can be beneficial — especially when you’re faced with noisy headlines. Crisis and opportunity go hand-in-hand.

- Carlos Slim Helu, the richest man in Mexico, has a great perspective here: ‘Courage taught me no matter how bad a crisis gets, any sound investment will eventually pay off.’

Unfortunately, universal lessons are often the hardest to learn. This is because human beings have very short memories:

- Once again, I’m seeing investors make the same mistake as they did during the Covid drawdown of 2020.

- In 2022, when inflationary fears kicked in and interest rates went up, most people panicked. They began exiting the market. They reverted to using their primitive lizard brain instead of using their highly evolved mammal brain.

So, here’s how the volatility has played out:

- From 31 December, 2021 to 14 October, 2022, the S&P 500 index fell over 24%. This wasn’t quite as sharp and pronounced as the Covid scare, mind you, but it was still enough to ruffle feathers.

- Then from 14 October, 2022 to 25 July, 2023, the S&P 500 rebounded, rising over 27%.

- Like before, the bears didn’t stick around. With inflationary fears fading and rate hikes approaching the end of the cycle, the bulls have come stampeding back.

- This raises a curious question: how many people had the foresight to buy in when the market was bottoming out? And how many people actually missed out by staying on the sidelines?

- I’m willing to bet on the 80-20 rule here. What this means is that 20% of courageous investors probably captured most of the gains during this latest rally, while 80% of fearful investors lost out.

Our opportunity for you

John Maxwell once said: ‘A leader is one who sees more than others see, who sees farther than others see, and who sees before others see.’

Obviously, Maxwell was talking about leadership in general, but he might as well be talking about the psychology of investing.

So, what makes a good investor?

- It’s not someone who went to business school.

- It’s not someone with a higher-than-average IQ.

- It’s not even someone who grew up with wealth and privilege.

On the contrary, here’s the unspoken truth:

- A good investor is someone who has an even temperament. Someone who can stay calm even when the world gets noisy. Someone who can remain true to his life’s mission even despite the risk of disruption.

- Ultimately, here’s Napoleon Bonaparte’s definition of a genius: ‘The man who can do the average thing when all those around him are going crazy.’

Now, despite the recent bullish upswing, we are still seeing opportunities to buy into high-value assets at a sharp discount. It’s not too late to start investing for the next stage of the cycle.

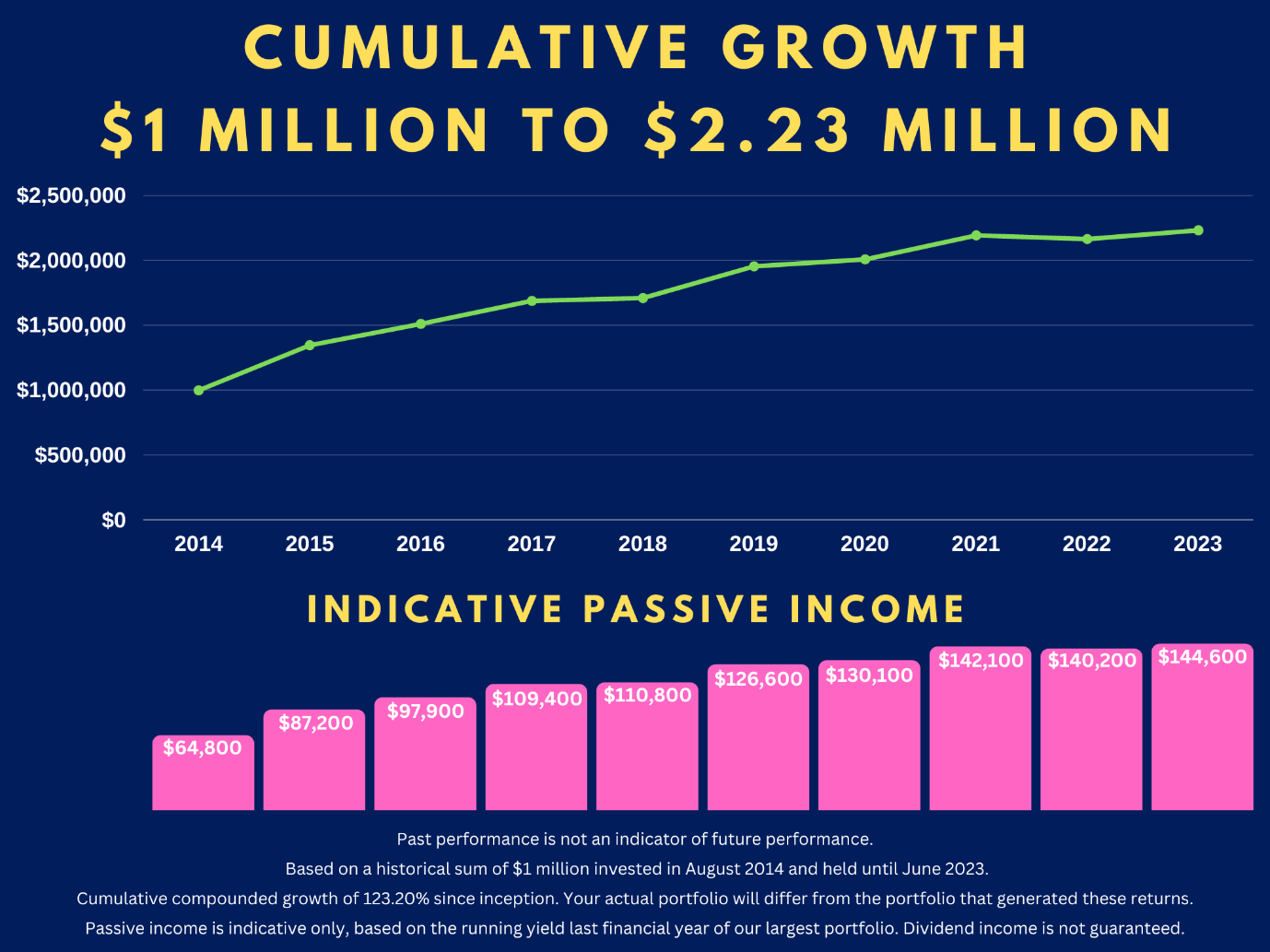

Right now, our Wealth Morning Managed Accounts are designed for Eligible and Wholesale Investors who need a Quantum Income Strategy to protect and grow their wealth.

For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions).

Ask yourself: is this something you urgently need to act on?

Come talk to us.

We are still available for limited consultations on our Managed Accounts Service. (Offer expires at 10:35pm tonight).

🎯 Apply for your consultation now.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.