Some things never change.

Over coffee at Lake Hayes, I read that Queenstown’s housing crisis is ripping at the seams. This is July 2023.

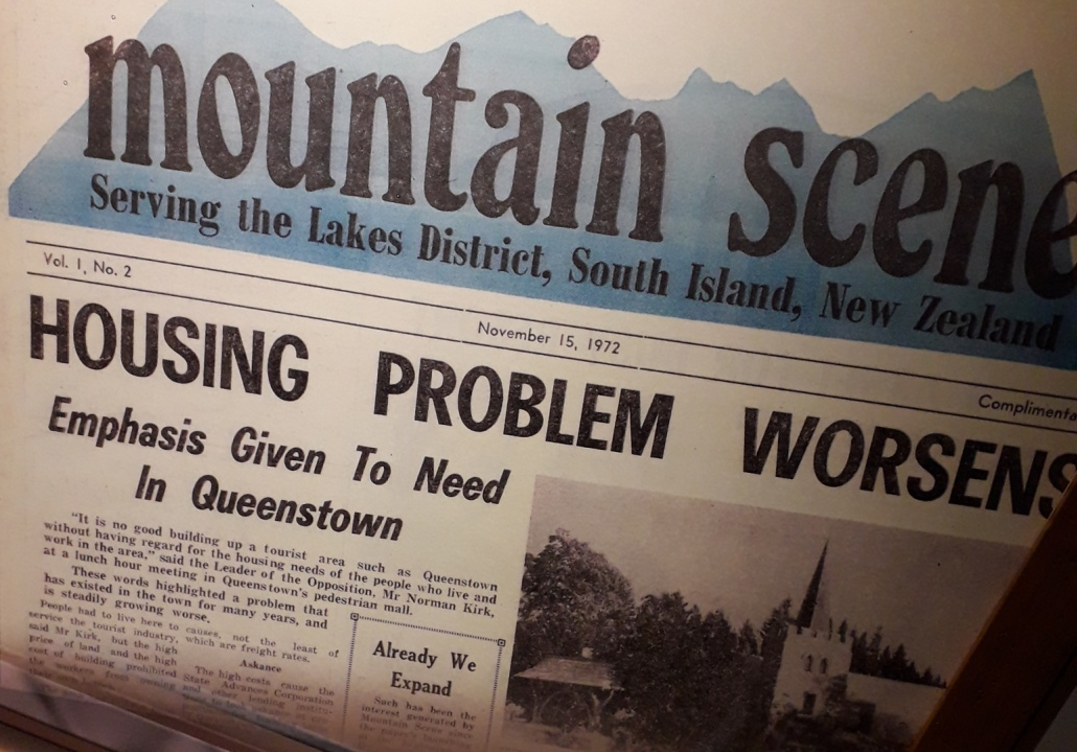

Only the other day, I saw a similar headline at the museum in nearby Arrowtown:

This one is November 1972.

Go back much earlier…

My great grandfather was a land agent in Queenstown in the 1940s. It was a time when the roads we see today were giving the town shape and opening it up for development.

This paved the way for the tourism boom of the 1950s and beyond.

Source: Wikimedia

More recently, there’s a street that bears our name in a new subdivision: Angelo Drive.

There aren’t a lot of stories that remain from Queenstown’s earlier days. Except the enduring sense that although life was hard, opportunity was available for the plucky.

Today’s housing crisis

There are similarities between the housing crises of 1972 and 2023. They were amplified in Queenstown but evident across New Zealand.

In the early 1970s, home prices increased 60%. The government responded by loosening planning in cities to allow for development and flats.

Then the oil shock hit. From 1974 to 1980, prices fell 40%.

The 2020s bear eerie similarities. A boom. A shock. A bust in housing that is not ultimately restoring affordability.

Inflation is the end product of the chaos.

Most incomes fail to keep pace with rents and prices. Interest rates rise swiftly. The real cost of housing remains unaffordable for many. A rising tax burden drains the economy. Society becomes more fractured and dangerous.

We have a friend who escaped Serbia during the unrest of the late 1990s. She says the country’s downfall was most evident in daily life when inflation became rampant.

Supermarket prices increased, stretching people to the limits. Then stocks on the shelves thinned out. And people had to become handy, making things themselves. That was the only way to get by.

Excessive government control was a feature of that crisis. Painful memories remain. But they also provide lessons.

Combating inflation

Free and competitive markets with a strong rule of law work.

Businesses operating in such markets, by their nature, are deflationary. Every day, those businesses work to provide goods and services cheaper, faster, and better.

Here in Queenstown and Arrowtown, there are lots of wonderful restaurants. There’s choice and competition. It’s a fantastic part of the world to get quality and value when dining out.

That’s not true in other parts of the country. After overbearing Covid lockdowns, I visited a town where only one restaurant was left standing. The food, service, and value were woeful.

Had there been choice, competition, and respite from control, things would likely have been different.

Swings and pain come around again.

But here in New Zealand, we seem to repeat the economic mistakes of the past. Like ordering a stiff drink after an AA meeting.

It’s very clear that governments work best in an economy when they act as the referee. Not an overweight player.

Deregulation opened up property in the 1970s after dire shortages. And it unleashed business opportunity in the 1980s when the country was in danger of going bust.

The few things that can make all the difference

At Wealth Morning, we run a night-trading desk investing in global markets for Wholesale Investors.

You learn from failure. And enjoy success when it comes.

Every day, you ask these questions:

- What key areas offer the most potential?

- What few things will make the most difference?

When it comes to company growth, we think some of those things may be:

- Biotechnology that can prevent and treat cancers.

- Transport mobility with autonomous driving improving road safety.

- Transport mobility in the form of electric urban aircraft.

- Cleaner, lower-cost energy production and distribution.

- Artificial intelligence, where it can be applied (for example, to self-drive cars and trucks).

- Real estate positioned for coming social change.

But what could make the difference to the business of a country like New Zealand?

The critical pain points are the cost of living crisis and the housing deadlock — where younger people can’t afford homes unless they have rich parents.

Both aspects are a disaster. Both lead to spiralling crime and despair. Both cause many to leave and require the harder measure of large-scale migration.

What would make all the difference?

- Removing all unnecessary, non-harmful burdens and controls on business and land development.

- Building roads to opportunity and affordable living.

- Incentivising those who take risk and generate wealth through the free market. So they can deliver more competitive firms. Like more supermarket options, for example.

We need to restore the Kiwi ‘no. 8 wire’ mentality.

Frankly, it’s in danger of rusting away right now. And that’s really sad.

Change is due. Freedom is around the corner.

The Golden Age is coming again.

For our Premium News Subscribers, we have more than 100 reports profiling the companies we believe could make all the difference.

Businesses at the forefront of new mobility, biotechnology, efficient energy, and real estate trends.

Come try our Quantum Wealth Report today.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the editorial content of this periodical. It is the author’s personal opinion and commentary. It is general in nature and should not be construed as any promotion or as any financial or investment advice).

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.