Since the 2000s, New Zealand has become a two-step economy.

Those who keep prospering. Those who keep falling behind.

Worse, the gulf has become generational. You either have the Bank of Mum and Dad or some social capital behind you. Or you don’t.

Of concern for our democracy, the middle class is being squeezed out.

Some say it is this vacuum in the middle that destroys society. Without this vital buffer between rich and poor, cohesion falls apart.

That is what happened in Ancient Rome.

When inequality created a vacuum between the ruling class and ordinary citizens, the Roman Empire did not last much longer.

‘The Course of Empire: Destruction (1836)’ by Thomas Cole. Source: Aeon

Here in New Zealand, we are now officially in recession.

Bloomberg reports this might be a harbinger for the rest of the world.

Recessions hit people differently. They hurt the poor. Sometimes benefit the rich. And are largely overcome by a productive middle.

This recession isn’t about employment. There’s work available for you to work all the hours under the sun if you’re willing to adapt. Go pick fruit. Serve egg bennies to prosperous people. Drive a bus. Don’t be so damn picky.

But that is the problem. The highly available jobs tend to be lower pay. There appear less ‘middle class’ jobs in real wage terms. And as for jobs that have kept up with the cost of housing? We’ll get to that…

This recession is about interest costs doubling. And the price of eggs and many other essential items spiking.

Since your income has not doubled, if you have debt or a tight budget this recession will be painful.

You can see the pain is far more acute these days. I know of at least two home invasions in wealthy suburbs over the past few weeks. Supermarket staff say levels of crime and abuse toward them are the worse they’ve seen.

Now, you may struggle to understand this. But not if you’ve ever walked into a supermarket and found that the cost of the food you need to buy is beyond your reach.

Inflation is the most damaging and pernicious economic force

There are many examples through history when runaway inflation has led to the demise of societies and governments.

After recent events, I agree with Milton Friedman:

‘There is one and only one basic cause of inflation: too high a rate of growth in the quantity of money.’

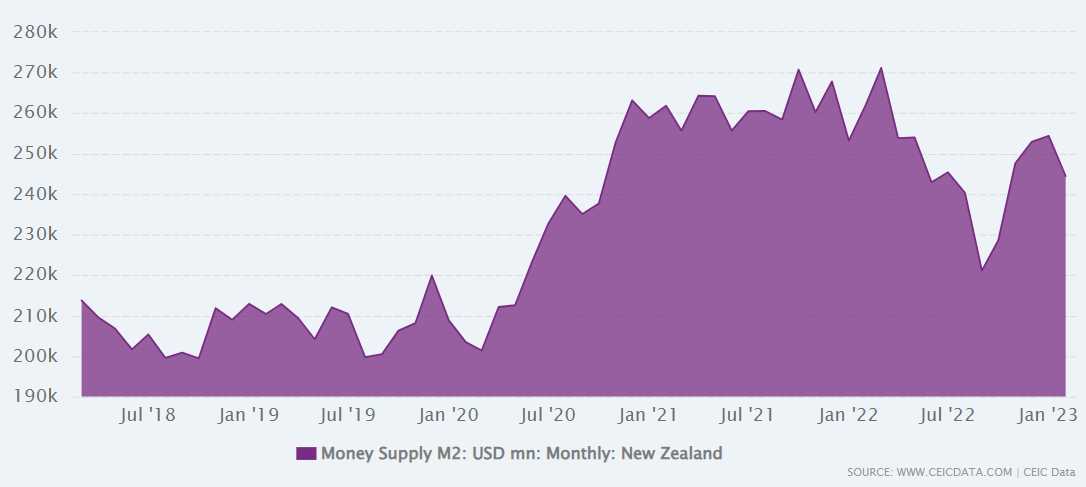

Let’s take a look at the M2 money supply in New Zealand.

M2 is basically cash + bank deposits:

Look at what happened to the quantity of money during and after Covid.

Rapid growth came from quantitative easing, lockdown subsidies, and expanded government.

While that was the tinder, the fuel was ultra-low interest rates courtesy of the Reserve Bank.

What did all that extra money chase? In a country fixated on housing, the property market became frenzied in 2021. And despite a media blitz on crumbling prices today, the reality has only been a correction back to around 2020 levels.

Minor additions to the inflation story came from international geopolitics. And local weather events. But the predominant driver was overegged monetary response to the pandemic.

So, when you pay your mortgage and buy eggs, you’re paying for how we dealt with a virus that emanated from China three years ago.

Beware of false prophets

One party to government tells us that the solution to right the ship is a wealth tax.

They correctly acknowledge that this recession does not affect everyone equally.

Their solution is more tax and spending to provide some guaranteed level of income to lift every family out of poverty.

Ultimately, this will mean more layers of government spending. More money in the system circling after goods and services. And it risks disincentivising those who work hard and actually create the means that reduce inflation.

Yes, productive businesses and productive people are by nature deflationary. Because the nature of business is a tireless endeavour to produce things better, faster, and cheaper.

If you truly want every single family to have the opportunity to be lifted out of poverty, you need more productive business to provide the jobs and lower the prices.

The hard truth is that the economy has been broken since the GFC

In the early 2000s, I was making a fairly average income as a recent finance and English graduate:

- I could buy a home in Auckland for around 4x my income and comfortably pay a mortgage at around 8%.

- I could take in flatmates, then tenants at reasonable rents and yields to pay that mortgage off.

- I could access stock market assets at quite reasonable multiples.

Then, in 2008, the financial plumbing seized up, and we had the Global Financial Crisis:

- This served to correct overstretched credit in housing, particularly in the US. It tested the monetary system.

- Rightly or wrongly the response to this test was to unleash more money into the system and let asset prices run again.

- A lack of productivity and fertility, especially here in New Zealand, was plugged by very high rates of net migration.

- Studies tend to show that population growth above 1% p.a. tends to reduce GDP per capita and lower living standards. So while we need some growth, there’s clearly, as in many things, a Goldilocks level.

But fast-forward to the 2020s.

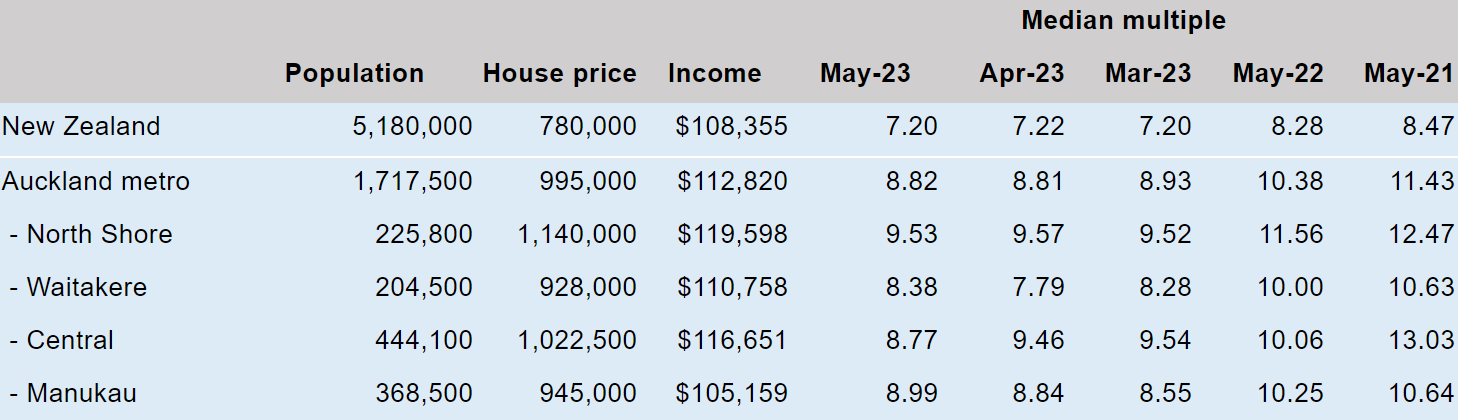

Home prices in Auckland are now around 9x median household income. That is down from around 11.5x after recent corrections:

Source: REINZ stats, Interest

Good housing affordability is generally accepted to be around 3x.

The net rental yields on that housing are now so low; investment value must primarily come from potential capital gains.

The dysfunctional and damaging nature of our housing market should not be underestimated.

Since around a third of households have a mortgage, and another third rent; the impact on disposable income across the economy from the inflationary-mortgage spike is significant.

How can you and your family thrive in a broken economy?

Warren Buffett once remarked that the best protection from inflationary forces is a good education. Skills are inflation-proof. As is the ability to stay atop in your chosen field.

The ability to increase your income during persistent inflation is the best antidote. Especially if you can increase your income and wealth ahead of the rate of inflation.

That requires an economy where businesses can innovate, grow, and create high-wage jobs. Or investment opportunities.

Running wholesale portfolios in global markets, we work with a group of highly prosperous New Zealanders.

Yes, they have some surplus. Usually built through hard work and the seeking of opportunity.

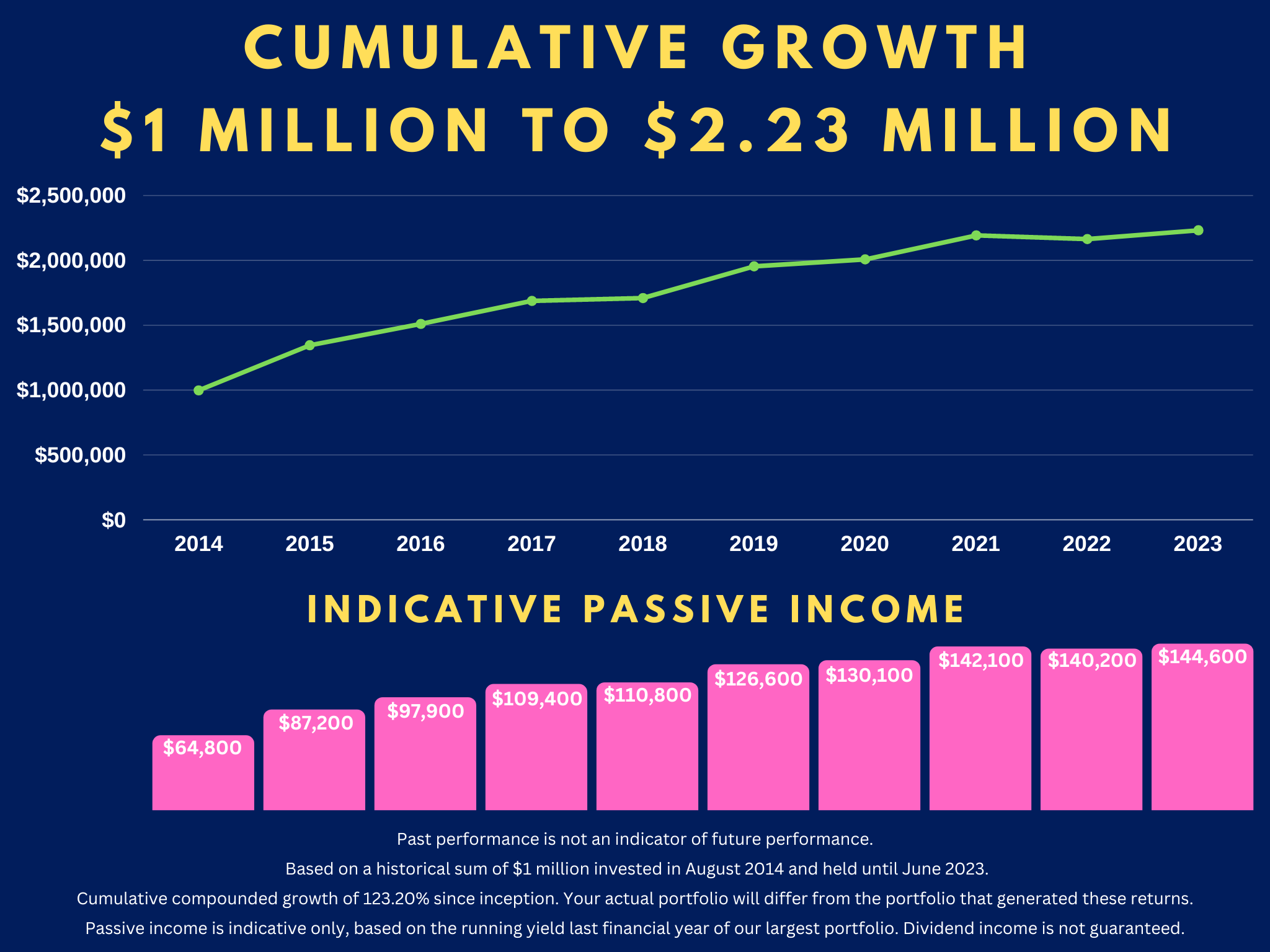

The primary opportunity we see to thrive in a broken economy is to build robust sources of passive income where the underlying asset can also grow.

Up to 70% of small businesses in New Zealand fail within two years.

Residential property investment has become so political, and so yield-constrained, it is very tough these days.

Good commercial property starts at a very high entry price and may still be subject to vacancy and relatively low yield.

Hence, for the investors we work with, we’re currently focused on quality global shares. Covering listed property and key growth industries around the world.

Since 2020, we’ve seen some portfolios grow to generate meaningful levels of passive income. This is income you do not have to work for. And gives you a buffer against escalating prices, feckless government, and the failure of real wages in many parts of the economy to keep up.

Anyone can do this. Try to set aside some surplus — as hard as that may be. Find reliable, productive, and income-generative assets in the markets. Build that with compounding.

Meanwhile, come October, I am hoping a new government, of whatever stripes, will fix housing and end monetary debasement once and for all.

The wrenching cost of shelter remains the main drag on this economy. A considerable cause of division, misdirected opportunity, and strangled productivity.

Each of us has only one vote in the political arena. Just a dollar amongst millions. That doesn’t count for much unless mobilised en masse.

But we do have a more meaningful vote with our finances and how we invest for the future.

Right now, our Wealth Morning Managed Accounts are designed for Eligible and Wholesale Investors who need a Quantum Income Strategy to protect and grow their wealth.

For our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions).

Ask yourself: is this something you urgently need to act on?

Come talk to us.

We are opening for limited consultations on our Managed Accounts Service. (Available until Tuesday, 20 June).

🎯 Apply for your consultation now.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is the editorial content of this periodical. It is the author’s personal opinion and commentary. It is general in nature and should not be construed as any promotion or as any financial or investment advice. Managed Account Services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.