Monthly, we update our wholesale investors on what’s happening in the market. Running what’s probably the only late-night trading desk from New Zealand, we’re well-positioned to feel the pulse of the market’s direction.

Since the 2020 pandemic, these are some of the toughest times I’ve seen in the markets.

Covid-19 smashed up supply chains and shook geopolitics. ‘Responses’ in the form of lockdowns and compensatory money printing led to the worst inflation we’ve seen since the 1970s. The enema of stiff monetary policy was then applied.

But there are some areas of upside where we will prevail this year and next.

More about those in a moment…

The world has changed. So how do you grow and protect wealth in these strange days?

Make no mistake, the same rules apply. Buy certain quality at absolute value. Carry it for better times.

First, for those who invested in the darker months of 2022; 2023 has seen some recovery. That process is ongoing.

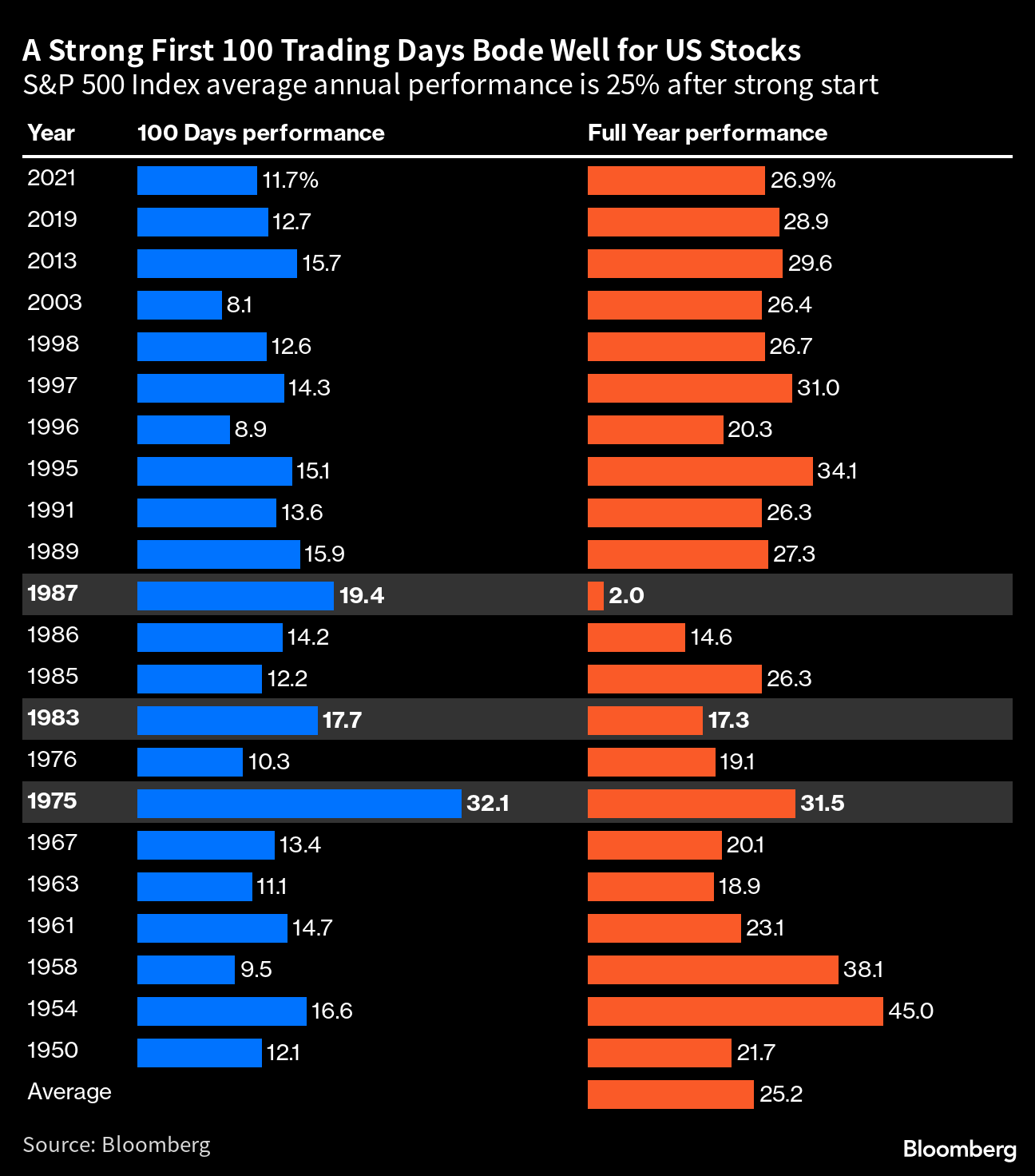

From January to April, we saw growth of 7.85% across all the wholesale portfolios we manage.

A strong first 100 days generally bodes well on many fronts:

But in this shaken world, the path is far from smooth.

May madness

We’re down in May, with the wider markets.

Only the Nasdaq was up in May (by about 7%). But this reflects the more rapid recovery of tech stocks. Some of which were pummelled by up to 70% last year.

What happened to disrupt the 100-day party?

- Uncertainty over the US debt ceiling deal weighed on buyers.

- Interest rate hikes continued to bite.

- The giant Chinese economy failed to live up to recovery hopes.

- Chinese manufacturing and import demand data was weak, weighing on commodities.

- Large commodity businesses have a large weighting on global indexes like the FTSE 100 and ASX 200.

Where could things go from here?

May has revealed some great value. And a chance again to buy it.

We see the following upside:

- Inflation is coming under control. German and French inflation fell to 5.7% and 5.1%, Spain at 3.2%. All below expectation.

- The oil price appears to have stabilised, only somewhat elevated to where it was before the pandemic:

Brent Crude Oil. Source: Yahoo Finance

Brent Crude Oil. Source: Yahoo Finance

- Central banks are hitting pause on raising interest rates. Some are forecasting a reversal in the cycle next year.

- Savvy investors are buying long-term bonds in the belief that interest rates will eventually revert back toward zero to combat sluggish global growth and population ageing.

- There are signs that ‘a floor’ is being reached in real-estate markets. Discounts are still available, but for how much longer? Especially within markets that can resolve labour shortages by immigration.

Our Quantum Income Strategy

To some extent, we’ve softened much of the calamity in the markets by our focus on income.

The running yield across larger portfolios is tracking above 6%. This suggests a yield on entry capital in some cases of over 10% — or over 7.5% excluding leverage.

When growth is uncertain, income can carry you through. And I’m proud of the fact that some of our clients now enjoy very meaningful levels of passive income.

Indeed, for our target client, we are focused on securing strong dividend income of $60,000 or more per year (depending on capital and market conditions).

Some say investing in a high inflation environment is a tightrope walk.

Well, there’s a pretty strong net underneath in the form of income and margin of safety in asset valuations.

Recently, we have been targeting discounted real estate. On a diversified basis across listed industrial, retail, residential, and less so, office.

The bond proxy effect

Large REITs (real estate investment trusts) operate like bond proxies. Their price functions like a medium to long-term bond.

As interest rates rise, they gasp for air. Values fall. Bargains become available.

Strong income helps you wait out the cycle until new oxygen arrives.

When inflation peaks — as it likely has — and the interest rate cycle reverses in time, the value of these positions can jump.

Now, a few other key mentions before we get to performance:

Broker interest

I want to remind clients that, at the moment, the broker is paying reasonable rates of interest on cash balances that are waiting to be deployed. These go up to around 4.6%.

Risk profiles

There’s a misconception in New Zealand that investing in global shares is much higher risk.

In my view, holding solely NZD assets is higher risk. It’s a small, distant trading economy. For now, it’s overly export-dependent on China. The current ‘Liebour’ government appears financially illiterate.

Mainly large managed global assets bought at value, with income and margin of safety, provide measured risk exposure to upside. And we target income levels seldom possible in this country alone.

Of course, the current weak NZD is a hurdle, as it, alongside AUD, correlates to the Chinese Yuan.

But we are still finding very meaningful targets in Australia and Europe.

Managed Account performance*

For the month of May 2023, we were down –1.11% across the composite portfolio (total aggregate return across all portfolios following the strategy).

Again, somewhat better than our MSCI EAFE benchmark, which was down –2.9%.

This brings our return for the year to date so far (1 January to 31 May, 2023) to 6.74%.

Our average annualised return since inception is 15.04% p.a.

Please see our performance chart for more details.

Mad May has been a great time to deploy capital at value.

We look forward to seeing what June may bring as the pandemic’s mess, slowly but surely, gets cleaned up.

Regards,

Simon Angelo

Editor, Wealth Morning

*Past performance is not an indicator for future performance. Your actual portfolio will differ from the composite portfolio mentioned. The information contained in this document does not constitute an offer to sell or a solicitation to buy an investment, nor should it be construed as investment advice. Wealth Morning Managed Accounts are available to Eligible Investors and Wholesale Investors (not to Retail Investors) as defined in the Financial Markets Conduct Act (2013).

🎯 Our Exclusive Managed Account Service

👉 Secure Your Place on Our Waiting List Today

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.