Quantum Wealth Summary

- What you need to know: The luxury goods market appears to be surprisingly resilient, marching forward despite inflation fears.

- Why it matters: One European luxury brand has excelled since 1993, posting an astonishing return of over 33,000%.

- Here’s the state of play: We investigate whether it makes sense for value investors to take a closer look at this sector.

When I was a child, one of my favourite cartoon characters was Popeye the Sailor Man.

He was loyal. He was brave. He always ate his spinach.

His favourite quote was legendary: ‘I am what I am, and that’s all I am.’

Source: Know Your Meme

Indeed, Popeye was honest and true. He was a working-class man. Salt of the earth. Comfortable in his own skin:

- Popeye first appeared as an American comic-strip character in 1929. Back then, the majority of the world’s population still lived in rural areas. So naturally enough, Popeye reflected those pastoral sensibilities.

- If you were a sailor, everyone knew you were a sailor. If you were a farmer, everyone knew you were a farmer. If you were a teacher, everyone knew you were a teacher.

- There was no point in pretending to be something you weren’t. After all, in a close-knit rural community, everybody knew everybody. Your identity was clear-cut.

- Hence, Popeye’s trademark phrase: ‘I am what I am, and that’s all I am.’

Source: Thrillist

But now, in the 21st century, the situation has changed dramatically. People like Popeye are a dying breed. These days, more and more of the world’s population are living in cities:

- In 2007, urban folk outnumbered rural folk for the first time. Percentage-wise, the urban-rural split is now 55%-45%. This trend is set to accelerate in the years ahead.

- An urbanised phenomenon is now gaining prominence: the status symbol.

- It’s not hard to understand why. City life is crowded and anonymous. People change their jobs and addresses with alarming regularity. So they don’t really know each other that well anymore.

- Increasingly, people are depending on symbols to announce their status. Flashy cars. Flashy clothes. Flashy jewellery. It’s all about prestige; image; social net worth.

- You might be granted entry to an ‘in-group’ if you have the right status symbols. You might be exiled to an ‘out-group’ if you don’t.

The fluidity of social class means that people are now striving to reinvent themselves through consumerism. Aggressively. Obsessively.

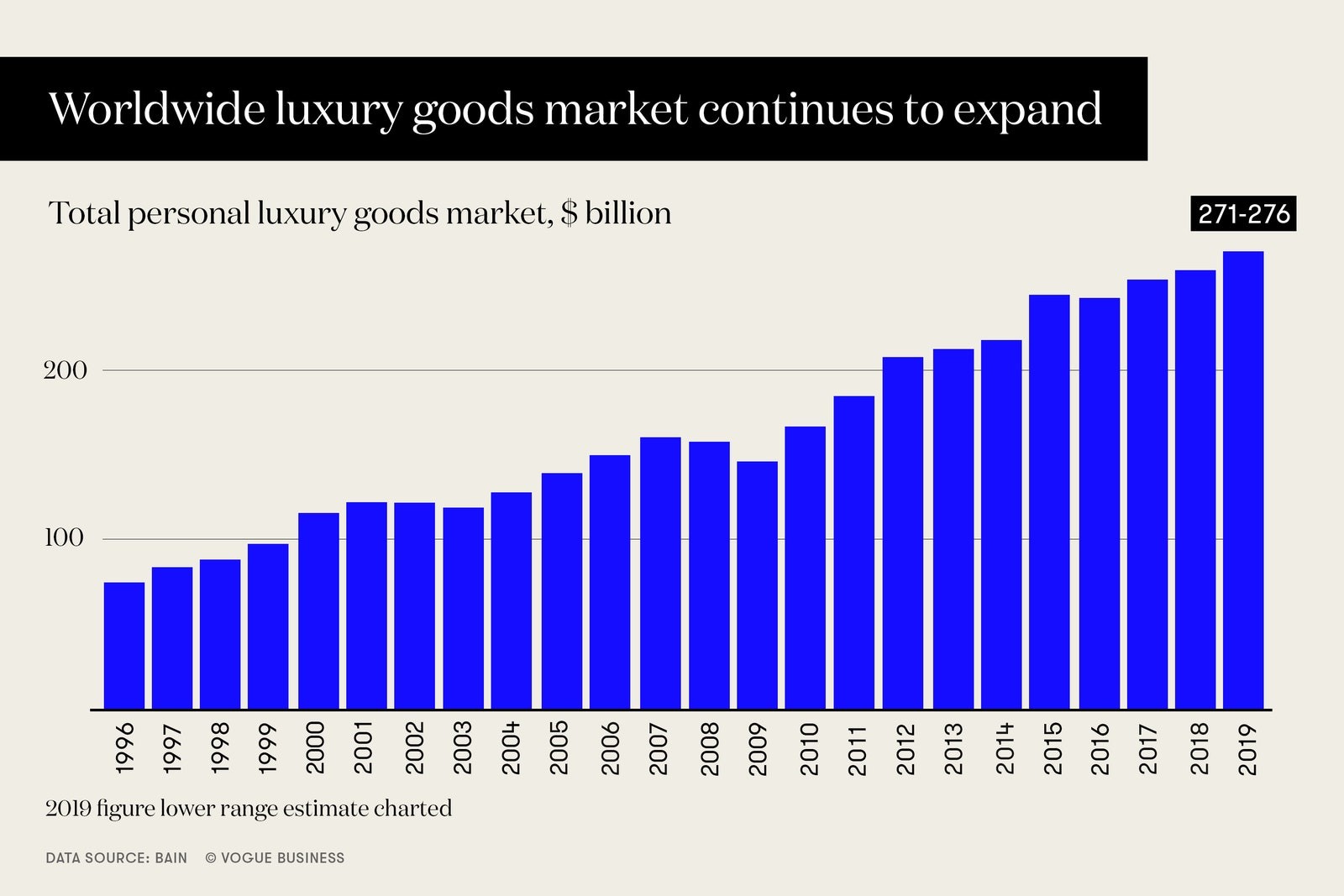

Their spending habits have acted as pure rocket fuel for the luxury goods market. Allowing it to scale ever greater heights. Defying recession after recession:

Source: Vogue

- In 2023, the revenue for the worldwide luxury goods market is estimated to be worth over $354 billion.

- Between 2023 and 2028, compounded annual growth rate is anticipated to be 3.38%. This is happening despite the fact that the world continues to struggle with post-Covid inflationary fear.

- Historically, one luxury European brand has experienced a growth trajectory of over 33,000% since 1993.

- I want to investigate whether it makes sense for value investors to take a closer look at this sector…

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.