Quantum Wealth Summary

- What you need to know: A new Cold War is brewing between America and China.

- Why it matters: Taiwan is at the centre of this conflict because it controls 60% of the world’s microchip manufacturing.

- Here’s the state of play: We take a look at 2 semiconductor companies with a Taiwanese connection. We explore if it’s worthwhile for investors to stake a claim here.

There’s no hiding it: Taiwan is a small country.

In fact, it’s so tiny that most Westerners would struggle to find it on the world map.

To put things into perspective, Taiwan is roughly the size of the American state of Maryland — and it’s about half the size of Scotland.

Which means Taiwan is easy enough to overlook.

Source: Center for Strategic and International Studies

But the country’s small footprint belies its huge strategic importance:

- The Taiwanese are a courageous people. Industrious. Innovative. And because of this, they have built this island-nation up into a formidable Asian Tiger, one of the richest in the region.

- They have achieved this through a combination of strong government vision, a pro-business environment, and a highly skilled workforce focused on specialisation.

- All this makes Taiwan a tech superpower — with the country controlling over 60% of global semiconductor manufacturing. What is especially striking is that when it comes to the most advanced chips, Taiwan controls roughly 90% of high-end production.

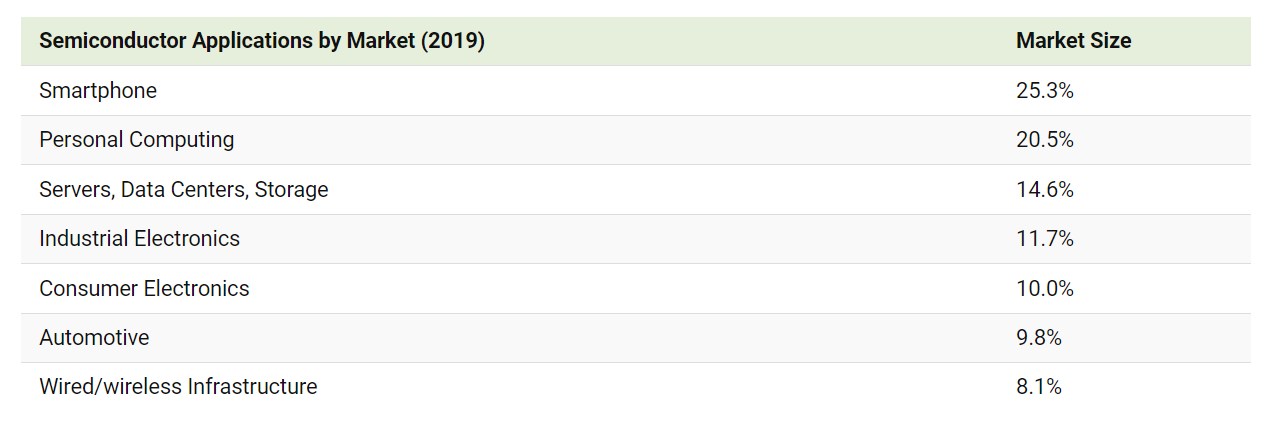

Ultimately, it’s all about supply chains. Semiconductors are the world’s fourth most-traded product. Which means that microchips are critical to our way of life in the 21st century:

Source: Visual Capitalist

It’s safe to say that without chips, modern life wouldn’t be modern at all. And as our world moves into a Fourth Industrial Revolution, we’re going to see semiconductors become even more important in these areas:

- 5G.

- Artificial Intelligence (AI).

- Internet of Things (IoT).

- Quantum Computing.

- Smart Factories.

So, this raises an essential question. With Taiwan being so vital to the global supply chain, what if its independence comes under threat? What if China decides to invade? What if the world order is thrown into chaos?

Well, hold on. Not so fast. This isn’t a Tom Clancy novel. This is real life. Here are some key points to think about:

- Russia, a country with extensive warfighting experience, has so far failed to subdue Ukraine, even though it shares a land border with its adversary.

- China, a country with limited warfighting experience, may face a more difficult challenge trying to cross a body of water in order to attack Taiwan.

In fact, invading Taiwan may be more difficult to pull off than D-Day during World War II. The Diplomat explains why:

Taiwan is a rugged, heavily urbanized nation of 23.6 million people. The country of Taiwan (also known as the Republic of China) is made up of over 100 islands, most too tiny to see on the map. Many of Taiwan’s outer islands bristle with missiles, rockets, and artillery guns. Their granite hills have been honeycombed with tunnels and bunker systems.

The main island of Taiwan is 394 kilometers long and 144 kilometers across at its widest point. It has 258 peaks over 3,000 meters in elevation. The tallest, Yushan, or “Jade Mountain,” is just under 4,000 meters high.

Unlike Normandy, the coastal terrain here is a defender’s dream come true. Taiwan has only 14 small invasion beaches, and they are bordered by cliffs and urban jungles. Linkou Beach near Taipei provides an illustrative example. Towering directly over the beach is Guanyin Mountain (615 meters). On its right flank is the Linkou Plateau (250 meters), and to its left is Yangming Mountain (1,094 meters). Structures made of steel-reinforced concrete blanket the surrounding valleys. Taiwan gets hits by typhoons and earthquakes all the time, so each building and bridge is designed to withstand severe buffeting.

This extreme geography is densely garrisoned by armed defenders. In wartime, Taiwan could mobilize a counter-invasion force of at least 450,000 troops, and probably far more.

Also, there are certain political and economic realities that can’t be ignored:

- If China destroys Taiwan’s infrastructure, this may defeat the whole purpose of an invasion in the first place. By doing so, China will only succeed in crippling its own economy, which is reliant on Taiwanese chips.

- Furthermore, China is facing a demographic crisis. A so-called ‘4-2-1 problem‘ is emerging, with many modern Chinese families now made up of 4 grandparents, 2 parents, and 1 child. This top-heavy structure is unsustainable. Chinese society may lose nearly 50% of its population by 2100. So, given this trend, can China really afford a war which kills its precious young people?

Finally, when it comes to leadership, you shouldn’t forget the role that personality might play:

- Vladimir Putin is a former KGB spymaster who’s driven by ultranationalism. As a product of the Cold War, he’s comfortable with using force to expand the Russian sphere of influence.

- By comparison, Xi Jinping is different. He’s the son of Xi Zhongxun, a Communist Party official with a reputation as a pacifist bureaucrat. This means that Xi Jinping may prefer to carve out Chinese power through central planning and propaganda, not brute force.

Source: Governing

So, an actual hot war over Taiwan isn’t realistic right now. But another kind of war — an economic war — is already underway:

- In August 2022, both Republicans and Democrats in the United States supported the passage of the CHIPS Act. This law aims ‘to develop onshore domestic manufacturing of semiconductors critical to U.S. competitiveness and national security.’

- In 2023, the European Union looks set to approve its own Chips Act. The goal to boost European semiconductor manufacturing over the next decade.

- Meanwhile, Western allies like Japan and South Korea may also be changing the way they do business. Increasingly, there is talk now of tightening the screw. Restricting the exports of advanced chip-making equipment to China.

This means that the ground is quickly shifting as we speak. America and its friends are trying to reset supply chains. They are trying to diversify. But one thing still remains true: our global dependency on Taiwanese chips won’t end anytime soon:

- With this in mind, we are taking a look at 2 semiconductor companies with a Taiwanese connection.

- We want to explore if it’s worthwhile for investors to take a punt on them for the sake of high-tech exposure.

- What are the risks? What are the opportunities? What does the future look like?

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.