What if someone called you a moron?

Worse still, what if they did it in front of the TV cameras, before the eyes of the entire world?

How would you react?

Well, this is exactly what happened in 1997.

Source: Medium

Malaysia, known as a Tiger Cub Economy, was in trouble. Big trouble. Its neighbour to the north, Thailand, had just suffered a panic run on its currency. The baht was plunging, and it couldn’t maintain its value against the US dollar.

Soon enough, the toxic contagion spread — enveloping not just Malaysia, but Singapore, Indonesia, the Philippines, and South Korea.

The speed of it was frightening.

This event became known as the Asian financial crisis.

In the first six months, the Malaysian ringgit plummeted by almost 50%.

Wealth was destroyed. Millions of people lost their jobs. The stability of the region was pushed to the brink.

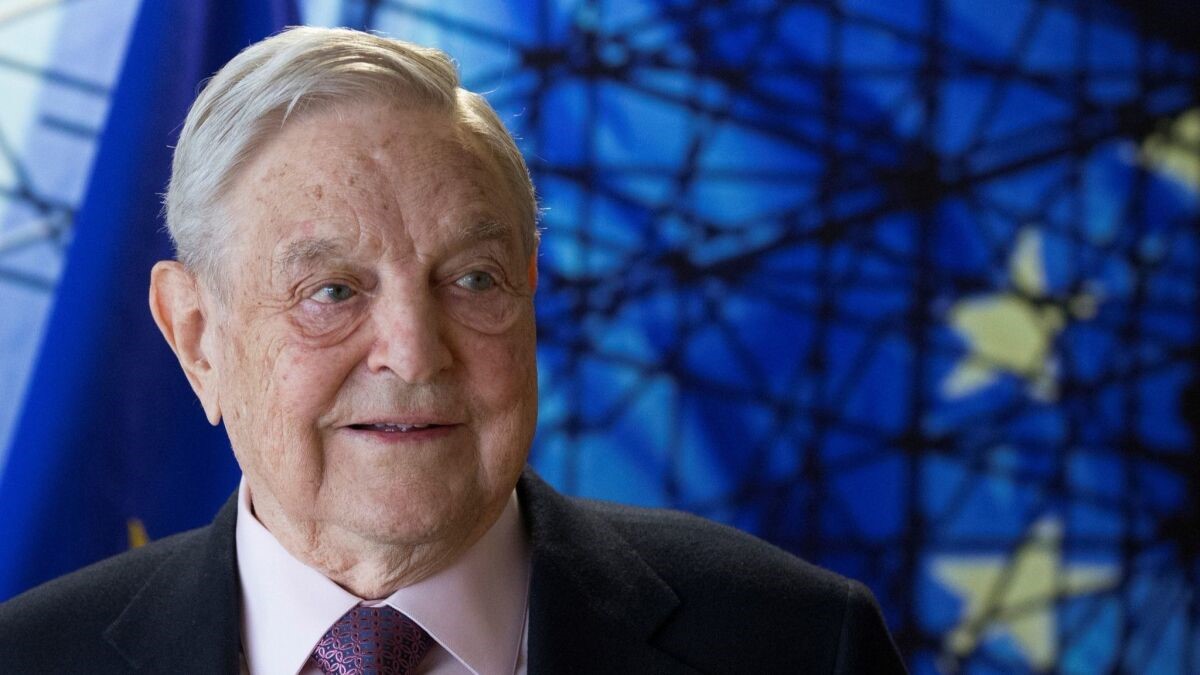

Dr Mahathir Mohamad, the prime minister of Malaysia, was a fiery man well-known for his anti-Western rhetoric. And he singled out George Soros as a ‘moron’, blaming Soros for the currency trading that had caused the economic meltdown.

Soros, in turn, hit back at Mahathir. Soros said it was crony politics, the centralisation of power, and runaway debt that had caused the mayhem.

This was a stunning duel between two formidable men. One was a right-wing ultranationalist. The other was a left-wing internationalist. And as their argument escalated, the spectre of anti-Semitism reared its ugly head.

In Mahathir’s mind, Soros represented an ecosystem run by the ‘hidden hand’ of elitist bankers and hedge-fund managers. An old boys’ club of Jewish imperialists, not too far removed from the European colonialists who used to control Southeast Asia.

Such stereotyping was shallow. Disgusting. Racist. But Mahathir saw no issue with milking it for all it was worth.

Source: BBC

Here’s a taste of Mahathir’s venom:

‘Currency trading is unnecessary, unproductive, and immoral. It should be stopped. It should be made illegal.

‘We may suspect that they have an agenda, but we do not want to accuse. And incidentally we are Muslims, and the Jews are not happy to see the Muslims progress. The Jews robbed the Palestinians of everything, but in Malaysia they could not do so, hence they do this, depress the ringgit.’

Source: The San Diego Union-Tribune

Soros refused to take any of this lying down.

He released statements of his own:

‘Prime Minister Mahathir is using me as a scapegoat to cover up his own failure. I want to express my sympathy for the poor Malaysians who were hit by this. But I don’t have sympathy for Mahathir because he’s responsible for it.

‘He is playing to a domestic audience and he couldn’t get away with it if he and his ideas were subject to the discipline of independent media inside Malaysia.

‘Dr Mahathir is a menace to his own country. Dr Mahathir’s suggestion yesterday to ban currency trading is so inappropriate that it does not deserve serious consideration.’

Now, I was just a youngster growing up in Malaysia at the time. Perhaps too young to fully understand the gravity of what was unfolding. But, still, the confrontation between Mahathir and Soros left quite an impression on me.

I found myself asking, ‘Well, who exactly is George Soros? And why are people so quick to throw accusations at him?’

Building a legend

George Soros, of course, is no stranger to anti-Jewish sentiment. His early life was defined by it:

- He was born in Budapest, Hungary in 1930. His father was a lawyer, and his mother was involved in the silk trade. His family was prosperous. Upper middle class.

- They sought to downplay their Jewishness. Their family name was originally Schwartz, but they changed it to Soros. It was their attempt to fit in better into Hungarian society.

- Unfortunately, trouble still arrived on their doorstep. In 1944, Nazi Germany invaded and occupied Hungary. During the Holocaust, over 500,000 Jews would be murdered.

- Soros’ family narrowly escaped certain death by splitting up and using false documents. They went into hiding, aided by Hungarian Christians sympathetic to their plight.

- In 1945, Soros paid witness to the Siege of Budapest — brutal door-to-door fighting between Soviet and German troops that left the city in ruins. This was a harrowing experience.

George Soros survived World War II, but the aftermath would provide no comfort. The communist takeover of Hungary convinced him that he would need to look elsewhere to build a better life:

- In 1947, at the age of 17, Soros emigrated to the UK. He worked as a railway porter and a nightclub waiter while enrolling himself in the London School of Economics. He studied under the famed philosopher Karl Popper.

- What came next was a restless period where he worked more odd jobs. But he soon found his life’s calling when he discovered the world of finance. In 1954, he joined the London merchant bank Singer & Friedlander. He started as a humble clerk before moving into arbitrage.

- In 1956, he emigrated to the United States. He joined arbitrage firm F. M. Mayer in New York City, where he started to make a name for himself as a pragmatic and sharp-eyed analyst of European equities.

- His timing was good. The European Economic Community — also known as the Common Market — was starting to take shape in 1957. American institutional investors were keen to capture this emerging opportunity. Soon enough, Soros became their go-to financier for this.

As George Soros’ reputation grew, so did his wealth. He became highly sought after as a hedge-fund manager for his ability to think outside the box.

He began to apply his old teacher Karl Popper’s theories to the world of finance. He popularised the concept of reflexivity in economics — the idea that markets are influenced by people who behave irrationally and emotionally, thereby reinforcing boom-and-bust cycles.

Soros believed that smart, clear-eyed investors would be able to position themselves to take advantage of either cycle:

- In 1970, at the age of 40, he used his wealth to establish Soros Fund Management — his very own hedge fund. His style was bold and unconventional. Embracing higher risk to give clients higher returns.

- In 1992, Soros scored perhaps the biggest achievement of his career. On 16th September, during what was known as Black Wednesday, the British pound crashed. It was unable to maintain its value in relation to the European Exchange Rate Mechanism.

- This crisis caught many people by surprise — but not Soros. He believed that the pound had been overvalued for a long time and a correction was due. In preparation for this, he had built up a short position of over £10 billion.

- When the dust cleared, Britain was forced to withdraw the pound from the European Exchange Rate Mechanism — and Soros cashed in, profiting to the tune of £1 billion.

- The mythology of George Soros as a rogue speculator was created during his time. The press called him the man who broke the Bank of England. This is perhaps an unfair label. He didn’t actually break the bank. He was just astute enough to see a bubble before it popped — then hedge his bets accordingly.

- Soros has said: ‘It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.’

However, making money is only ever a means to an end for George Soros. He is an internationalist — believing that education and opportunity can bring about a more open society across borders. He expresses this through his philanthropy:

- In 1979, he started supporting dissident movements in Poland, Czechoslovakia, and the Soviet Union, giving them financial support.

- In 1984, he created the Open Society Foundations. His first mission? To push for reform in his native Hungary by providing aid to schools and businesses.

- With the fall of the Berlin Wall in 1991, he accelerated his philanthropy across the world. Soros has given over $34 billion to Open Society Foundations to date.

- In the United States, he has donated to the Democratic Party almost exclusively, supporting causes like drug reform, same-sex marriage, and euthanasia.

- Internationally, he also supports organisations like Global Witness, the International Crisis Group, the European Council on Foreign Relations, and the Institute for New Economic Thinking.

A happy ending?

Refugee. Survivor.

Businessman. Speculator.

Philanthropist. Campaigner.

There’s no hiding it: George Soros is all of those things. But it’s arguably his liberal agenda that have given rise to the most controversy. It makes him public enemy number one for conservative ultras like Mahathir Mohamad.

But Soros’ experiences have obviously given him a thick skin, both in business and in life. And he has always been willing to reach across the aisle and engage with his opponents.

Source: New Mandala

In 2006, Soros visited Malaysia to meet with Mahathir. By all accounts, the encounter was cordial and relaxed.

In a rare show of contrition, Mahathir admitted that he was wrong about Soros’ role in the 1997 Asian financial crisis. This is remarkable because Mahathir had a reputation as an authoritarian leader who regularly locked up his political enemies.

This time, though, perhaps he’d met his match in George Soros?

Both men were of a similar age. And as youngsters, they had lived through the violence of World War II.

Soros had survived the occupation of Hungary by Nazi Germany, while Mahathir had survived the occupation of Malaya by the Empire of Japan.

The parallels were striking.

For this reason, both men appeared to find common ground in their dislike of the American invasion and occupation of Iraq. And they respectfully agreed to disagree regarding the merits of currency trading.

Indeed, what we witnessed with Soros and Mahathir’s meeting was a rare poetic moment. A liberal and a conservative engaging in respectful dialogue. Putting old grudges aside. Making peace.

This is a happy ending — which is incredibly meaningful, given how hard it is to achieve mutual understanding in today’s angry and polarised world.

Our opportunity for you

When faced with political turbulence, we’re mindful that it’s never been more important to seek out developed markets. Markets that offer stability. Markets that offer transparency.

This is why we believe that Singapore may offer a better alternative to Malaysia. We also have our eye on investment targets in Australia, Europe, and America.

So, right now, here’s what you need to think about:

- Are you risking your wealth by putting all your assets in just one country?

- Have you made an urgent effort to diversify your portfolio?

- Have you built a resilient stream of global income?

- Are you doing enough to protect yourself?

- Are you doing enough to protect your family?

These are big questions. Critical questions. And if they are important to you, you need to act now. Please accept my exclusive invitation. Come join our Quantum Wealth Report.

To date, we have investigated and exposed over 90 hidden ideas. From property to healthcare; from artificial intelligence to cryptocurrency; we are doing a deep dive into the latest quantum trends.

These are cutting-edge insights that could change your destiny — if you have the courage and conviction to follow through.

Ask yourself: are you concerned about your family’s well-being and happiness?

Well, if you are, this is the best time to act. And this is the best place to start…

💡 [LIMITED TIME OFFER] Get your first 4 weeks for only US$1 / NZ$1.50

Regards,

John Ling

Analyst, Wealth Morning

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.