I had cause recently to sit in a wine bar with a real estate agent. Not just any real estate agent. The owner of two branch offices, overseeing many agents.

He will remain nameless. But what he said, I found startling. Even though I’d been predicting pain for the property market over a year ago.

‘I don’t think the crash has come yet,’ he told me.

I sipped my pale ale and listened.

‘Home sales are stalled. Buyers can’t get the money anymore. Listings are piling up unsold.’

We learnt this week that New Zealand’s home prices have fallen 15% since their peak in November 2021.

This is not that interesting, since they’d enjoyed a greater run-up following the cheap money of Covid in 2021.

But I’ve learnt something. According to my real estate agent friend, interest rates and the availability of finance have the greatest bearing on prices. Far more than immigration, returning Kiwis, FOMO, or a supposed housing shortage.

A tale of two markets

Interest rates are set to drift higher as OCR lifts try to quell inflation.

There is some let-up in the inflation story — but not much:

- Supply chains have altered since Covid. A cloud of tension remains between the West and its all-time low-cost supplier: China.

- Wages are jumping everywhere as people panic over the climbing cost of living.

- Baby boomers, anecdotally, seem to be moving on in larger numbers. Selling their suburban dreams to downsize into townhomes, apartments, or retirement villages.

There doesn’t seem to be much shortage of sellers right now. But buyers are few and far between. They’re taking their time and exhibiting FOP (fear of overpaying).

After all, as they say in stock-speak, who wants to catch a falling dagger?

Ryman William Sanders retirement village, Devonport. Source: Ryman Healthcare

Ryman Healthcare [NZX:RYM], one Kiwi stock closely related to the housing market, is down around 50% over the past year. Investors fret over their debt. But perhaps even more the choking of the property market upon which they rely.

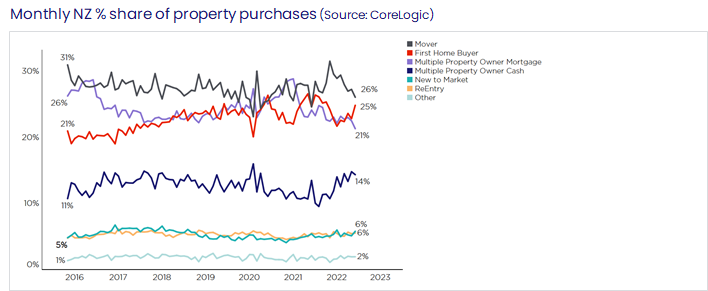

There are three main prongs supporting the New Zealand property market:

- Movers — who make up about 26%.

- First-home buyers — up to 25%.

- Multiple property owners / investors with a mortgage — about 21%.

Source: CoreLogic, September 2022

Note, these numbers were reported last year. Things are changing:

- With an ageing population, movers are more and more likely to be downsizers or buying retirement properties of various types.

- There is evidence that would-be first-home buyers are leaving New Zealand in larger numbers. Why juggle a high cost of living, still unaffordable homes, and wages up to 50% lower than Australia?

- Meanwhile, investors with mortgages are reeling from negative cash flow following yield compression.

- Then there’s the tax impact. Some tell me they’re now relying on National/ACT restoring interest deductibility to stay afloat.

- Over 70% of the housing market faces serious headwinds this year. It’s not hard to agree that far more of a crash is due than just the correction from 2021’s easy money.

- Meanwhile, equities — stocks and shares — are showing a very different path. In January 2023, they are commencing a swift rise. It feels like they are lifting up all the pain that took place in 2022.

We predicted this earlier in our research over the past year:

- New Zealand housing was ridiculous. Overpriced by any measure. From median-income multiple…to investment yield…to comparative value with other markets.

- Yet many equities showed value. By price to earnings. By book value. By future potential.

What is really investable?

Should houses be speculative investments?

They are ultimately social goods for people to live in, aren’t they?

But here in New Zealand, they became market instruments. To be leveraged. To deliver yield. And moreover capital growth.

The more investors chased them, the less attractive they became as net yields compressed due to rising prices:

- For first-home buyers, as houses became unaffordable, the government had to step in. To avoid a generational inequality crisis. To try and fix a property ladder with all the early rungs broken.

- They weighed in favour of tenants. They penalised landlords with mortgages. And they added, virtually, a capital-gains regime overnight called the 10-year bright line.

- No doubt, should housing become so unequal again — so distorted as a speculative instrument — parties on the left will succour younger votes with more extreme ideas. Like a land tax.

- Yet what we’re seeing now, when prices are so high, is that the Reserve Bank is in control of the scythe. Mortgages are harder to service. Banks are reluctant to lend as much. The wages that service borrowing are not keeping up with inflation, and a vicious spiral is underway.

As my friend in the wine bar pointed out, this cycle is probably only getting started.

A better path?

Australasian household debt, the lion’s share of which is mortgage debt, is among the highest in the world.

Simply, overpriced housing markets — especially in New Zealand where incomes are lower — mop economic strength.

A meaningful correction then poses serious risks:

- The New Zealand housing market is worth around $1.7 trillion. That’s almost 7x GDP.

- By comparison, US housing weighs in at around NZD $68 trillion — or just under 2x GDP.

Too much of the New Zealand economy involves selling one another homes.

But we knew this.

As investors, we can diversify into other industries, sectors, and countries via financial markets:

- There is some risk, particularly when adding leverage and foreign exchange. But my own experience, having sold rental property to make this pivot, is that returns can be better without the work or stress. The caveat being your stress tolerance to medium-term volatility.

- I’m quite comfortable dealing with drawdowns of 30% or more. Knowing that these are the times to invest and make money.

- Deployment during recent stock market routs in March 2020 and July 2021 have yielded profit as the market now forward prices recovery.

- Mostly, I like the liquidity of equities and — in comparison to property — the more rapid cycles in which to invest.

It may well be we are coming to the end of a 25-year supercycle in property gains.

As most Kiwi investors have been in the market for a long time, a majority should be safe. Although the future is not going to resemble this profitable past, unless a new government changes the rules.

My mortgage-broker contacts tell me inquiries are down 40%. The quality of leads is lower. And conversion is down 50%.

And then there’s that wine-bar chat.

So, would you bet on a wider Kiwi housing crash this year?

Regards,

Simon Angelo

Editor, Wealth Morning

PS: We handle individually managed accounts in global stocks for Wholesale and Eligible Clients. If you would like further info on this opportunity beyond the radar, please click here.

(This article is commentary and the author’s personal opinion only. It is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please consult a licensed Financial Advice Provider. Vistafolio services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.