Quantum Wealth Summary

- 2022 has not been kind to tech companies. They have suffered disproportionately as a result of inflationary fear and rising interest rates.

- We take a look at one speculative company that has lost an astounding 97% of its stock value over the past year. It used to be hot, but now it’s not. This is an important cautionary tale for all investors.

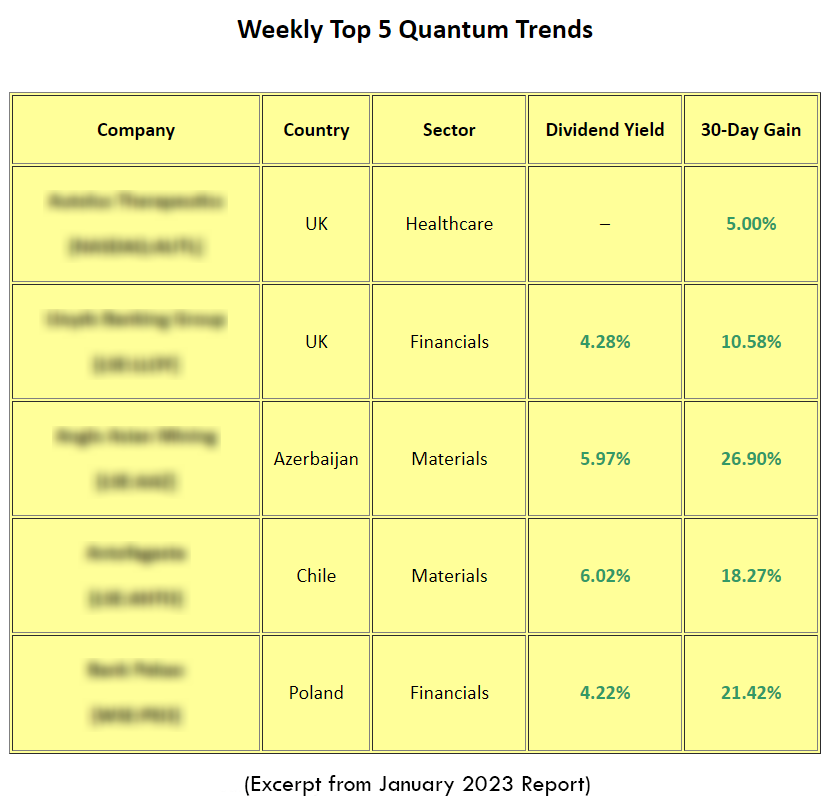

- But here’s some good news: the average bear market only lasts 388 days. We are now looking at several stocks that could prosper when the next bull run begins. You’ll find this covered in our Weekly Top 5 Quantum Trends.

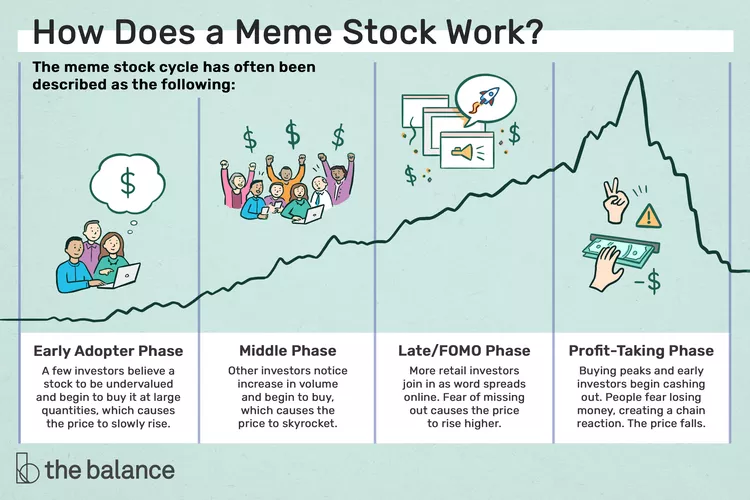

Quick question: have you ever invested in a meme stock?

Well, if you have, you might already be familiar with how the cycle goes.

Source: The Balance

Meme stocks are quite unique. When they surge in popularity, it’s not because of the usual fundamentals:

- Careful analysis of a company’s future earnings.

- Careful analysis of a company’s current assets.

- Careful analysis of a company’s dividend yield.

Frankly, none of that matters except for pure adrenaline. Pure euphoria:

- Retail investors, in particular, are drawn to meme stocks. And why not? It’s their chance to defy the system. Make a quick profit. Boast about it.

- In the eternal words of rapper 50 cent: ‘Get rich or die trying.’ This gambling attitude was especially evident in 2020 and 2021.

- That’s when record-low interest rates and the availability of easy money created an explosion of interest in meme stocks.

- FOMO — Fear of Missing Out — was a dizzying emotion. Few punters could resist it. But here’s the problem: you can’t defy gravity forever. Eventually, nature must take its course. And when it does, the downward spiral can be very destructive.

I have been watching, with morbid interest, the fate of one company that’s gone from hero to zero at warp speed. It has lost over 97% of its stock value over the past year:

- In August 2021, the founder of this Company had a net worth in excess of $11 billion. These days, he’s worth around $200 million.

- Make no mistake about it: this guy is still rich. But he’s lost more wealth in 2022 than most of us might see in a lifetime.

- Just in case you’re wondering, no, he’s not Sam Bankman-Fried. And what he has created has nothing to do with cryptocurrency. But you could argue that the end result is just as negative.

Here at Quantum Wealth Report, we constantly talk about the best ways to protect wealth. To grow wealth. To earn passive income.

So, for our Eligible and Wholesale Clients, we are focused on finding undervalued companies with great fundamentals. Companies that have the best chance of giving us stable, long-term opportunity.

But, having said that, it’s just as important for us to look at the other side of the spectrum. To explore the allure of get-rich-quick schemes. To examine why they often lead to crash-and-burn results.

Like crime-scene investigators doing a forensic analysis, we want to learn from other people’s mistakes. Because when it comes to investing, understanding what you shouldn’t do can actually be as critical as learning what you should do.

Remember: wealth creation is incremental, while wealth destruction can be shockingly quick.

This a cautionary tale — an urgent one — and I implore you not to skip this…

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.