Quantum Wealth Summary

- Pharmaceuticals is one of the world’s largest industries, with about 40% of it based in the USA.

- Development of new medicines improves life expectancy and grows the companies involved. Sometimes very rapidly.

- We look at the past success of certain key pharma companies.

- And we look to the future with one of the most promising treatment developments to come across our desk this year.

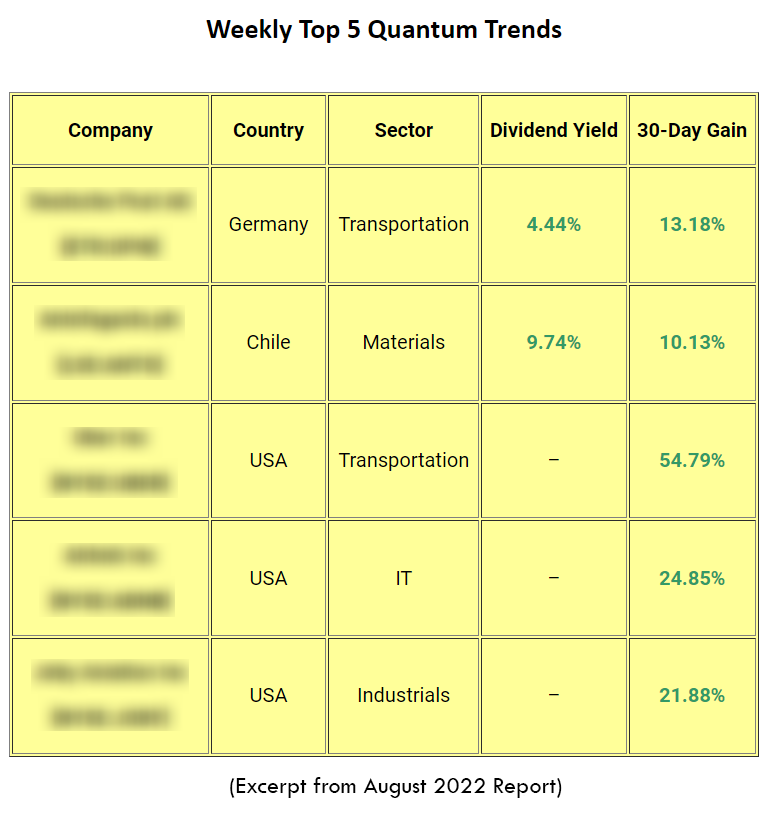

- Plus, our Top 5 Global Quantum Wealth Trends and where they’re going.

Before the advent of mass-scale, modern pharmaceuticals, we didn’t live very long.

It’s as simple as that.

I’m under no illusions that the industry is perfect. That profit is not the primary motive.

But, in most cases, the research and development of medicines lead to people living longer and less pain-ridden lives.

Adam Smith’s famous piece of logic applies to pharma companies just as much as it does to those addressed:

‘It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest.’

Pharma companies focus on delivering growth and income to their shareholders. To do that, particularly the growth component, they must come up with groundbreaking drugs that make our lives better. Much better.

As an investor, I’ve done quite well from spotting pharmaceutical companies ready to grow. They now form an important part of my portfolio — and those we run for our Wholesale Clients.

Here are two examples:

1) Horizon Therapeutics [NASDAQ:HZNP]

Horizon is a biopharma company focused on developing medicines for rare diseases. The founder, Tim Walbert, was himself diagnosed with a rare disease that inspired him starting the business in 2008.

The Company has had success, particularly with Tepezza — a treatment for Thyroid Eye Disease (TED) — and Krystexxa for gout therapy. These two drugs brought in third-quarter revenues of $490 million and $192 million, respectively.

We prepared a report on this business back in August for our premium subscribers. We noted its potential.

Subsequently, there have been news reports about some of the larger pharma companies interesting in buying Horizon.

Over the past month, the stock is up 26%.

2) AstraZeneca [LSE:AZN]

A much larger business, I first bought AstraZeneca about 5 years ago. I particularly liked its growth potential, regular dividends, and focus on key areas like oncology.

Over this time, it has provided steady and defensive growth to portfolios:

Source: Google Finance

Now, is there a pharma business ready for the next phase of defensive growth in medicine?

There certainly could be. Let’s take a look…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.