When I was a kid and kept asking for things, my parents would say to me, ‘We’re not a bank’.

Then when I got a bit older and went to the bank for money and advice to buy a house, the bank said to me, ‘We’re not your parents.’

But, over the past decade, you could go to banks here in New Zealand, and they would lend you money like your crazy Aussie uncle.

Lots of people went out and bought property and did very well.

As a result, New Zealand property values have a ‘crazy Aussie uncle’ premium.

Now, when that uncle will only lend at much higher rates and not nearly as much, we could have a problem with that premium.

Are we ready for an ‘87 crash in housing?

So, if you’re an investor, you’re probably wondering how you can protect your wealth by targeting the right assets. How you can grow your wealth. And generate income from it so work is an option not a necessity.

That’s what we’re going to look at.

Asset premiums

Let me start with a view that was part of my life for a few years.

We lived on the north coast of Jersey.

On a clear day you could see the French coastline just 22km away. Beyond the Écréhous.

Source: Bam Perspectives

Now, here’s the pain point for most Jersey residents.

Property is more expensive than in London. Or even Auckland. You don’t get a lot of space for your money.

Yet, just across the channel in France, you can buy a large farmhouse on an acre of land for around NZD $470,000.

For some years, politicians in Jersey talked about a bridge linking the two countries.

Even in the heady days of growth in the finance sector, it was impossible to economically connect a population of 80,000 (now 100,000) to France via a road bridge.

A bridge of somewhat longer length connecting Hong Kong to Macau and China cost over €15 billion. Around three times the size of Jersey’s GDP.

What has this got to do with investing?

I see similarities between the housing market in Jersey and that of New Zealand.

Values are supported by forces that are transitory

With 100,000 people on an island 8km long and 14.5km wide, land is at a premium on Jersey.

Yet what supports very high housing prices is the wealth of the island. By GDP per capita, it has one of the highest income levels in the world, largely due to the success of the finance sector.

And that industry thrived due to favourable tax treatment — particularly no capital gains or inheritance tax. Along with the perception that the jurisdiction is a secure base for wealth.

Yet people in the industry talked of this changing. Of the carpet being pulled out from under them as EU transparency laws and the emergence of other havens changed the game.

Here in New Zealand, we have enough land. But when it comes to housing, that’s ring-fenced into cities. Further, it’s expensive and hard to build things.

The high property values we’ve seen come from abundant access to cheap finance via Australian banks. And rapid population growth, primarily through immigration.

As in Jersey, the New Zealand housing market — in fact, the wider property market is backward-looking.

Backward-looking investors say this: ‘Property in New Zealand has always gone up. Thus it will continue to go up.’

The problem with that is you end up with prices, yields, and income multiples all out of kilter.

Which is where we are today.

Globally, the GDP per capita ratio to house values is 3x. In New Zealand it’s over 10x.

Sure, New Zealand is an attractive place. It could command some premium. As Jersey does due to its status.

But whenever a premium develops on an asset, events can destroy that premium.

Remember: price is what you pay, value is what you get.

The problem with backward-looking investments is that nothing is forward-priced.

When you buy a property today, you’re paying what you think it is worth and what the seller is willing to let it go for.

One alternative is listed equities on the global markets

These are forward-looking investments. Funds and sophisticated investors — who buy the lion’s share of them — are pricing 12 months ahead.

This means that in the share prices you see today, a lot of the bad stuff is already priced in. And the main bad stuff is inflation. Because that pushes up interest rates and makes lower-risk investments like fixed interest more attractive.

Right now, it appears investors are pricing in Fed bank rates peaking at around 5% next year.

The Fed itself has signalled they may ease up on the pace of rate hikes — which currently sit at about 3.75%.

By definition, if we go over 5% next year, stocks will suffer. If, at any time between now and then, it doesn’t look like we will, they could jump.

When it comes to investing in financial markets — the key is to understand forward pricing.

And when that forward pricing could be wrong.

We saw a big jump in values recently for this very reason. Investors were forced to reassess their positions.

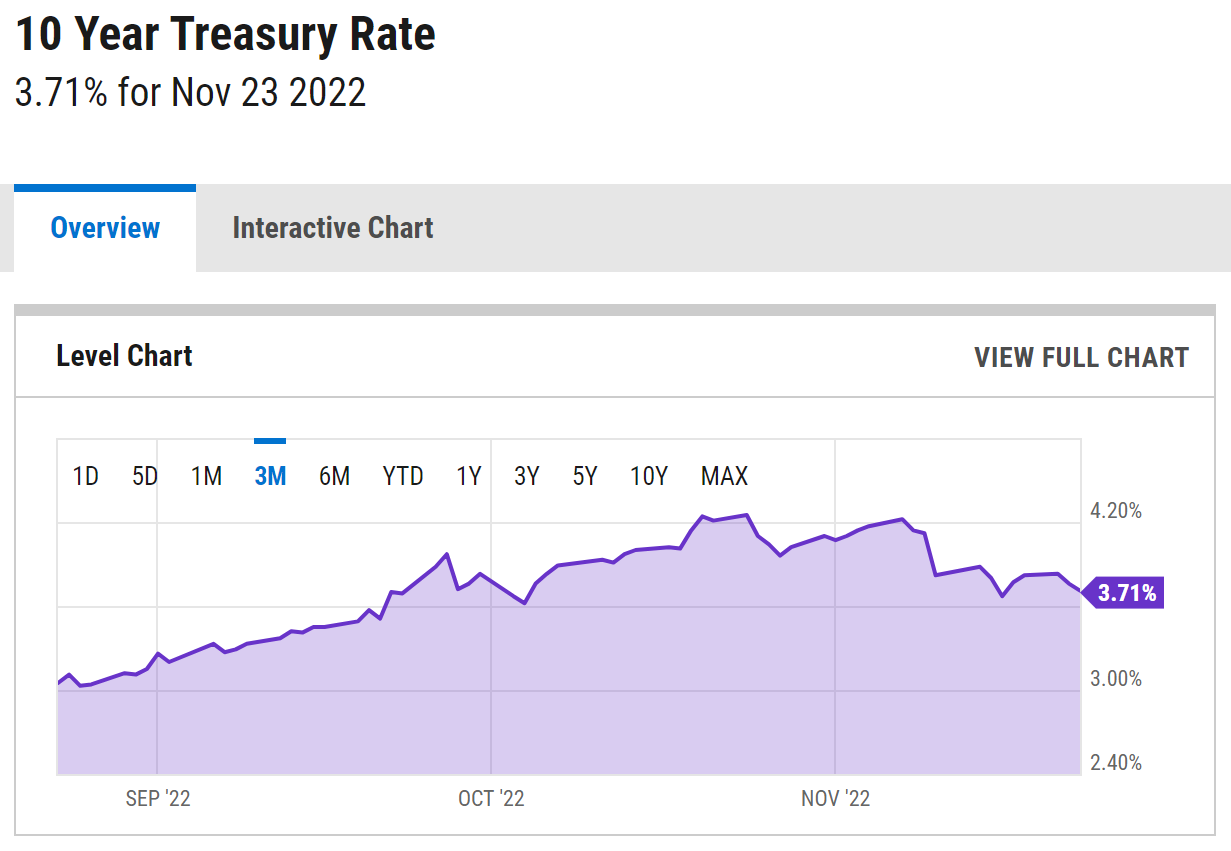

One thing we keep a close eye on is the US 10 Year Treasury Rate

Many use this as their risk-free rate.

We like to buy when that’s high and investors are dumping shares and giving us a discount.

We don’t want to buy when that’s low and investors are rushing into shares and making us pay a premium.

Here’s what the US 10-year rate has been doing:

Source: Y Charts

What happened in the last few months?

Stocks plummeted. A great time to buy. Discounts were evident.

What’s happening now? It’s easing off. From over 4.2% in mid-October to just 3.71% today.

Stocks are rising again.

The rate is elevated. We’re still seeing value — though not the same level of deep discount. Things could have entered a new phase.

Business investors

Here at Wealth Morning — and in the Wholesale Managed Portfolios we run at Vistafolio — we are business investors and value investors.

By that, I mean we are trying to find around 20 of the best-quality, highest-potential companies we can across developed markets. At great prices.

The future pricing of those assets that occurs, alongside the fear and greed we see across the markets every week, provides us opportunity.

And that opportunity is to buy good quality assets we understand, at value, when we see it.

We are not looking to pay a premium. We are looking for a discount and a margin of safety.

Right now, it is our view that many assets have been oversold. They’re underpriced. Because forward-looking investors are conservative, rate-shy, and have priced in excess risk.

Not as much as we saw in March 2020 or September 2022 — but there’s still value on the table.

We could be wrong. But we’re also perceptive of a price floor in many of our investments.

Let me give you an example:

Vonovia apartment complexes, Germany. Source: Vonovia

Vonovia [ETR:VNA] is a German housing REIT (real estate investment trust).

- The Company owns about 550,000 rental units across Germany, Austria, and Sweden.

- It pays a dividend — currently projected at around 6.7%.

- The units are valued at about €62 per share. (NTA — net tangible assets per share).

- But the share currently trades below €25.

Why is it down so much?

Investors fear Vonovia’s cost of debt jumping. The business does have long-term debt to equity of over 126%. Meaning it uses a bit more debt than shareholder capital to fund its apartments.

Yet, as of last annual report, the LTV (loan to value ratio) is only 43.7%, within the Company’s target range of 40-45%. And most of this debt is locked in at rates well below 2% for some years to come.

It appears to me there’s a floor on Vonovia’s share price.

For it to be accurate going forward, German housing markets would need to fall 40%+.

But German households tend to have less debt than in Anglo countries. Rental markets are tight. And the country’s industrial productivity perennially requires new workers.

This could be an oversold opportunity where there’s some intrinsic value that market gyrations have little to do with.

Of course, there is the nearby Ukraine war. And the energy price shock European tenants will face this winter.

But an armistice may eventuate at some point. Particularly if that is led by the Americans who are supplying a good deal of the military aid.

Beyond real estate opportunities, the world still needs commodities.

Electric-vehicle demand could see copper demand double over the next decade.

In our Vistafolio Managed Accounts, we’ve done well from Antofagasta [LSE:ANTO].

One of the world’s leading copper miners which caught our attention with reasonable metrics and an attractive dividend at the time of around 10%.

This business got caught up in market and economic fears. But the long-term outlook seems sound.

It has jumped over 30% since we bought it. Now we’re looking for new opportunities.

The market prices in many fears that simply aren’t accurate or won’t happen.

If you’ve done your homework on key businesses and know their worth, this can mean you can enter at sale price.

Further, we like to invest outside of New Zealand for our wholesale clients. It pays to diversify your wealth. And right now, democracy as we know it seems seriously under threat in this country.

Our opportunity for you

These days, the easiest thing is to do nothing and wait and see.

But that has an opportunity cost.

This market situation is rare. Many stocks sit below their intrinsic value. That may not last. Once interest rates pare back — as they will at some point — many of those shares will jump. And it will be too late. The lion’s share of the opportunity will have passed to other more courageous investors.

We’re investing now in the portfolios we manage for our Wholesale clients. And we’re investing in our own portfolios.

Wealth Plan is an opportunity for Wholesale or Eligible investors to discuss this further.

As a reader of Wealth Morning, you’ll likely be in this category.

If you’d like to discuss the economic outlook and the opportunities it could present for you, please get in touch by requesting a free consultation.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Vistafolio and Wealth Plan services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility).

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.