Quantum Wealth Summary

- Gaining exposure to a key commodity experiencing growing demand can be a great investment strategy.

- Industry estimates suggest that demand for lithium by 2030 could be sixfold what it was in 2020. But could that change as new technologies evolve?

- The speed of EV sales (a big user of lithium-ion batteries) and the willingness of governments to back them has caught many by surprise.

- We consider alternative materials and technologies such as high-energy magnesium.

- We examine a high potential business in the lithium industry that is showing momentum, with large stakes held by insiders.

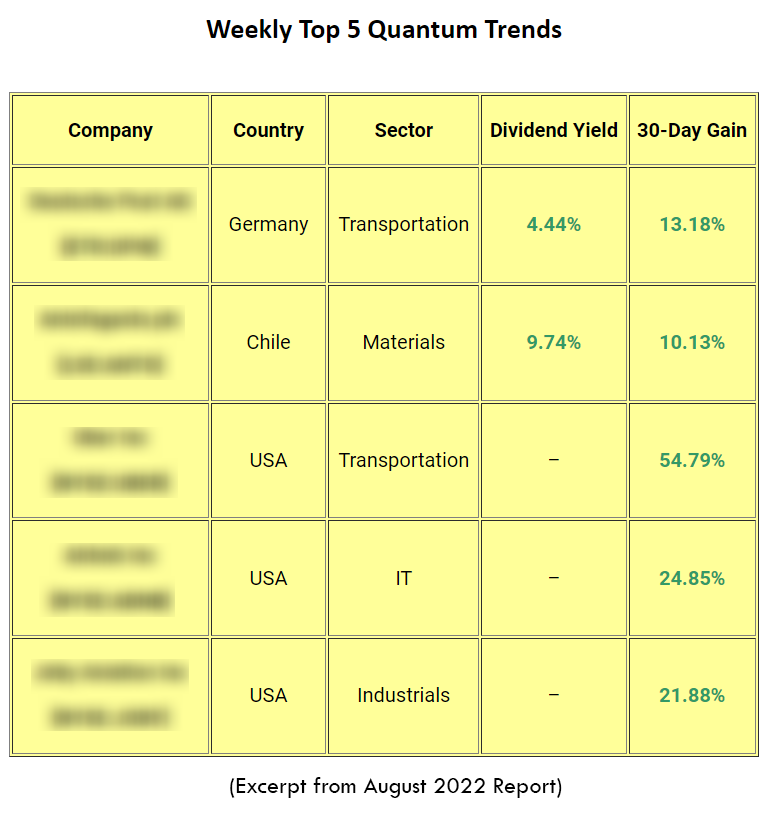

- And we review the Top 5 Quantum Trends we are seeing across global markets on our watch this week.

When it comes to investing, there’s no room for idealism.

I’ve learnt this over the years, having missed out on a few opportunities. Regret is the best teacher.

You may not believe in some trend. You may not wish to buy into it. You may think it’s not for you. But the lesson for investors is to put all that to one side. And concentrate on the numbers.

Numbers do not lie. But it’s very easy to fool yourself if you concentrate on sentiment.

I’m not a believer in EVs (electric vehicles). At least not at the current mix of high prices (even after government subsidies), limited range, long ‘refill’ times, and steady battery degradation.

Then there’s the environmental issue.

Much of the research I’ve done suggests that after you consider all the inputs — the mining, battery manufacture in China, the charging of the vehicle from a coal station in winter, unnecessary replacement of vehicles, and so on — there may not be much gain as to environmental outcomes.

Yet I’m also biased. I’m a long-distance driver who enjoys a good road trip in a large, powerful vehicle. The longest trip my wife and I have done was from the Lake District in England to Rome, Italy. Now try doing that in an EV.

While ICE (internal combustion engine) vehicles have become much more efficient, the news media and governments believe that they perpetuate demand for fossil fuels — which produce carbon.

Given that 22 trees absorb about 5,000 km of commuting each year, I suspect I may be ‘offset’ since there are at least that many on or next to my property.

This suggests planting trees may be a more worthwhile endeavour than all of the mining, manufacturing, and shipping that goes into the production of a single new EV.

But this analysis cannot ignore that demand for EVs is a key growth trend. That governments are incentivising their purchase. And so too is the news media, the peer pressure affect, and the fast-selling appeal of brands like Tesla.

Indeed, the UK plans to ban the sale of petrol and diesel vehicles by 2030. EVs will be the key option.

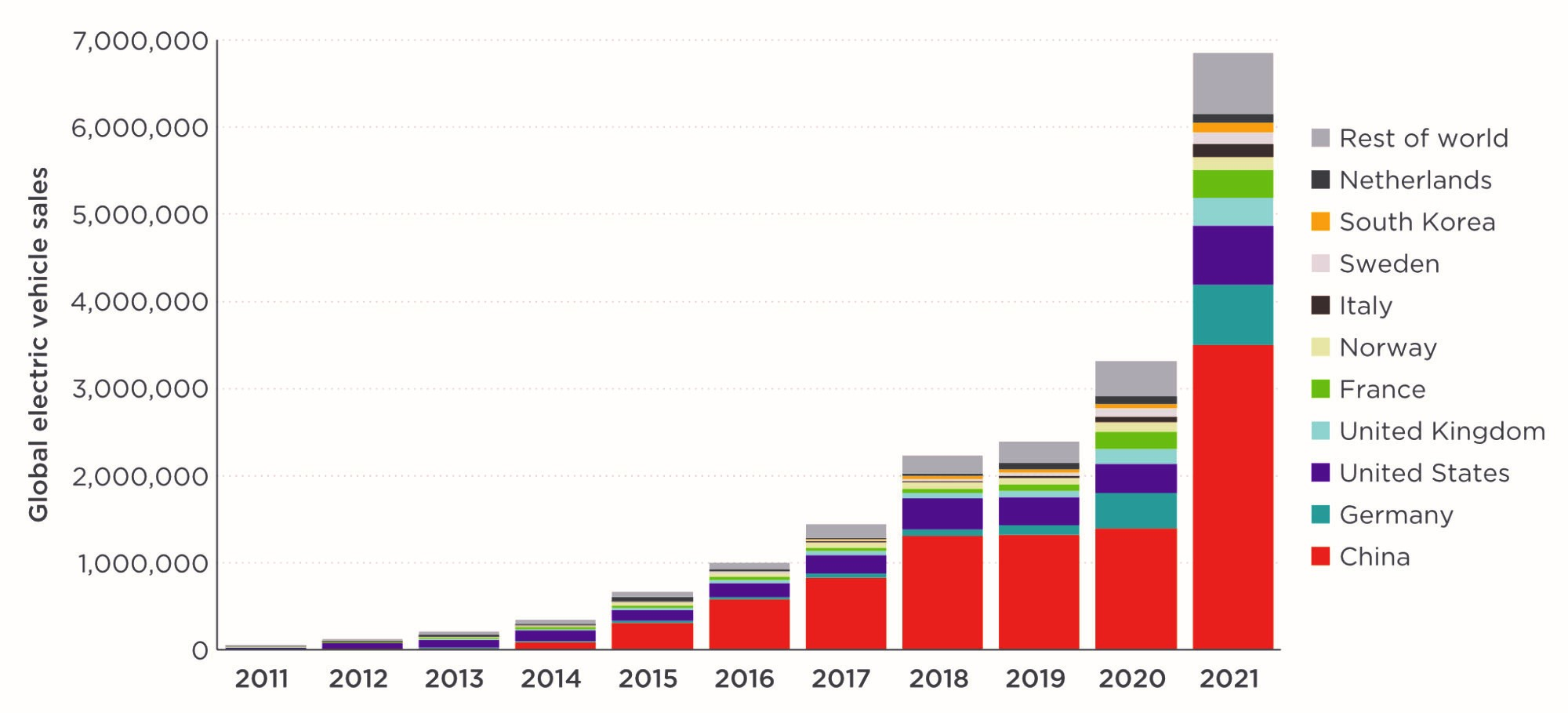

Take a look at the recent sales growth of EVs:

Source: ICCT

This is set to continue, with EVs ready to take 33% of global auto sales by 2028.

Clearly, most of the growth is happening in China. The country that has also cornered the battery market…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.