Quantum Wealth Summary

- In times of economic uncertainty, people will often choose to repair their cars instead of replace them. It’s the sensible choice for consumers trying to be frugal.

- One American business has a strong presence in automotive replacement parts. The Company’s stock price has rallied over 27% this past year, defying the volatility of the wider market. Is this a recession-proof opportunity? Could this be ideal for investors looking for a defensive play?

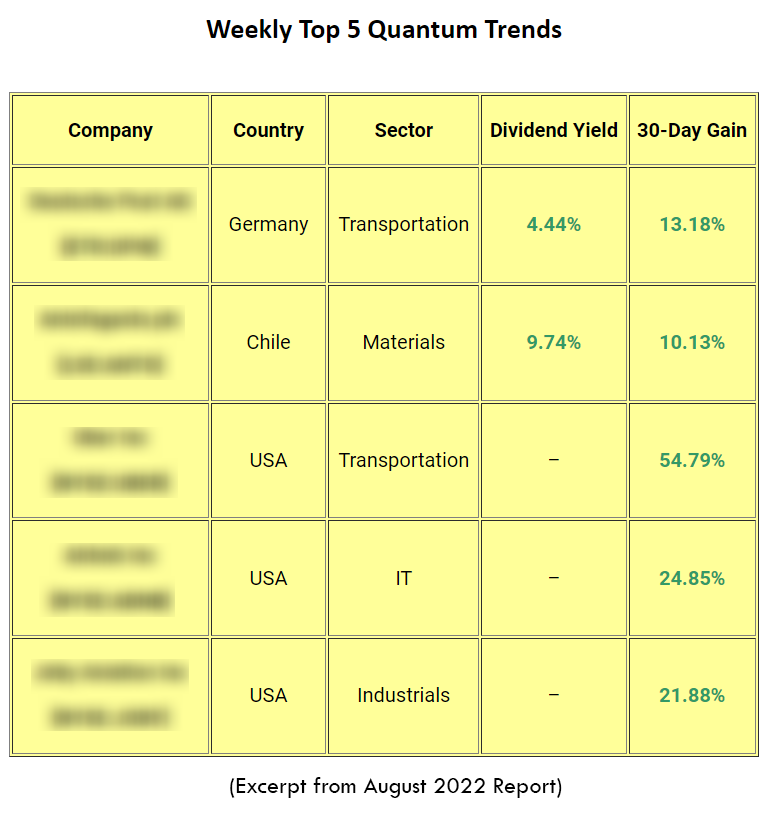

- We also explore our Weekly Top 5 Quantum Trends. These are critical and urgent global prospects that you can’t afford to miss.

Question: what do you do if you’re feeling glum about the state of the economy?

Answer: you immediately tighten your belt and cut down on discretionary spending.

Indeed, it’s no secret: whenever a recession hits, you’re less likely to buy a new car.

Well, what is true for you is true for everyone else.

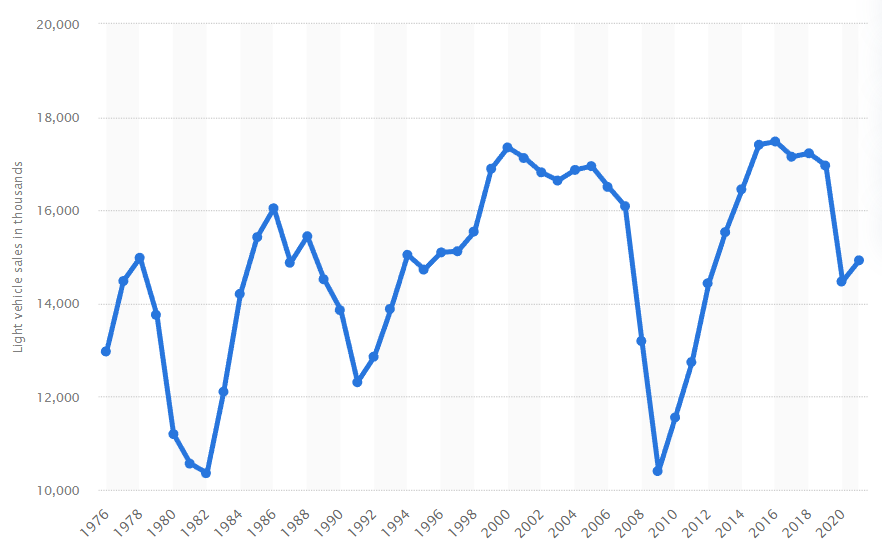

Just think back to 2008. The Great Recession was happening. In the United States, the sales of news cars fell by almost 40%. The worst-hit models? Well, those with heavy fuel consumption. The gas-guzzlers. The most expensive to maintain.

Americans were certainly cutting down on their discretionary spending.

It’s a historical pattern that always seems to repeat.

Just look at this chart, which tracks car sales between 1976 and 2021:

Source: Statista

The upswings and downswings are pretty clear, don’t you think?

It all comes down to human psychology. As people delay their spending on new cars, they will tend to go for something more immediate. They will choose to repair their existing vehicles. Keep them running for longer.

So, given this fact, companies that provide products and services in this space may survive and even thrive during a tougher economic climate.

This presents an interesting opening.

One American business has a strong presence in automotive replacement parts. The Company’s stock price has rallied over 27% this past year, defying the volatility of the wider market.

Yes, you could say that this is a classical business that has stood the test of time. The Company has been around for almost a century. It has over 50,000 employees, spread across 10,000 locations, in three continents.

Could this be a recession-proof opportunity? Is this ideal for investors looking for a defensive play? Let’s dig in and find out…

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.