Ambition. Greed. Savagery.

This is how Pablo Escobar became the richest drug lord in human history.

His rise to power is astonishing, especially when you consider his humble beginnings. He grew up living rough in Medellín, Colombia. His father was a peasant farmer. His mother was a schoolteacher.

Escobar learned to hustle at a young age. He used to steal headstones from local cemeteries, then sand the names off, before selling them on as new tombstones. He would also dabble in stealing cars, creating fake diplomas, and smuggling stereo equipment.

Escobar seemed destined for a life of crime — this much was certain — but few people could have predicted how wildly successful he would become once he ventured into the drug trade.

Source: Magical Quote

Pablo Escobar founded the Medellín Cartel in the mid-1970s. With entrepreneurial cunning, he set out to control the entire supply chain for cocaine: production, transportation, and sale.

Escobar expanded aggressively, running a multinational enterprise that trafficked drugs from South America into North America — then stretching beyond.

Escobar reached the height of his power by the late 1980s. He was worth an estimated $30 billion, and he controlled 80% of the global cocaine trade.

From that point on, Escobar seemed unstoppable. He became a narco-terrorist, waging war on the government in Colombia, killing thousands of police officers, judges, and politicians. He even blew up a passenger jet — murdering 100 civilians — in an attempt to eliminate César Gaviria, the presidential candidate who opposed him.

Such brutality was par for the course for Escobar. He had a trademark phrase. Plata o plomo. Silver or lead. You either showed loyalty to Escobar — or you received a bullet.

Clearly, Escobar had become public enemy number one.

So, the Bush administration in America was compelled to act, sending drug-enforcement agents to assist Colombian special forces to hunt Escobar down.

This covert operation took years. It was a cat-and-mouse game with false leads and near misses. But, eventually, they caught up to Escobar on a rooftop in his Medellín hometown. They killed him in a running gun battle.

It was December 2, 1993. Escobar was 44 years old. In an ironic twist, he had celebrated his birthday only one day prior.

An enduring mythology

Source: The Culture Trip

The legacy of Pablo Escobar is far-reaching.

Barrio Escobar is the neighbourhood in Medellín that bears his name. He’s a Robin Hood figure here. The residents think he’s a hero. And why not? He apparently did more for them in terms of infrastructure and welfare than the establishment ever did.

This is not the only evidence of Escobar’s wealth and influence.

In 2020, a plastic bag filled with $18 million in US currency was found hidden in the wall of an apartment in Medellín. And in 2015, a farmer digging in the countryside unearthed barrels of US cash worth over $400 million.

If the rumours are to believed, this is just a small taste of the vast amounts of money that Escobar reputedly stashed across Colombia. A secret treasure hoard. The scale of it beggars the imagination.

So, here’s the irony. America may have declared Pablo Escobar as an enemy — but in terms of ideology, Escobar was as pro-American as they come.

He fully believed in the American Dream:

- If you are ambitious enough and audacious enough, upward mobility is yours for the taking.

- Once you have claimed your prosperity, you can then count on America to act as the ultimate guarantor.

So, even for a renegade like Pablo Escobar, there are some rules in the global order that are sacred. Inviolable. Evergreen. And the US dollar happens to be one of them.

Our love affair with the US dollar

Source: FT

It doesn’t matter if you’re a drug lord. Or a soccer mom. Or a mechanic.

The US dollar stands for the same thing: safety.

It’s everyone’s hedge against an uncertain world.

The Financial Times sums it up like this:

In times of trouble, the dollar is the world’s refuge and strength. This is true even when the US is the source of the trouble.

This is why, even as we speak, the US dollar has hit its highest point in a generation.

In fact, the dollar has actually outperformed Bitcoin and gold this year.

Quartz explains:

Americans traveling outside the US will find that they are about 14% richer than they were at the beginning of the year.

That’s because the dollar has risen that much against some of the world’s most traded currencies.

In the face of tightening global financial conditions—led by the US Federal Reserve—most investors are pouring into short term Treasuries, pushing up the price of the dollar relative to other currencies. Raising rates also mean investors can get a higher return if they park their money in US assets. That has pushed the dollar up to a 20-year high.

Should we be surprised?

Well, maybe not.

Here’s a critical fact: the US dollar dominates almost 90% of the world’s forex transactions.

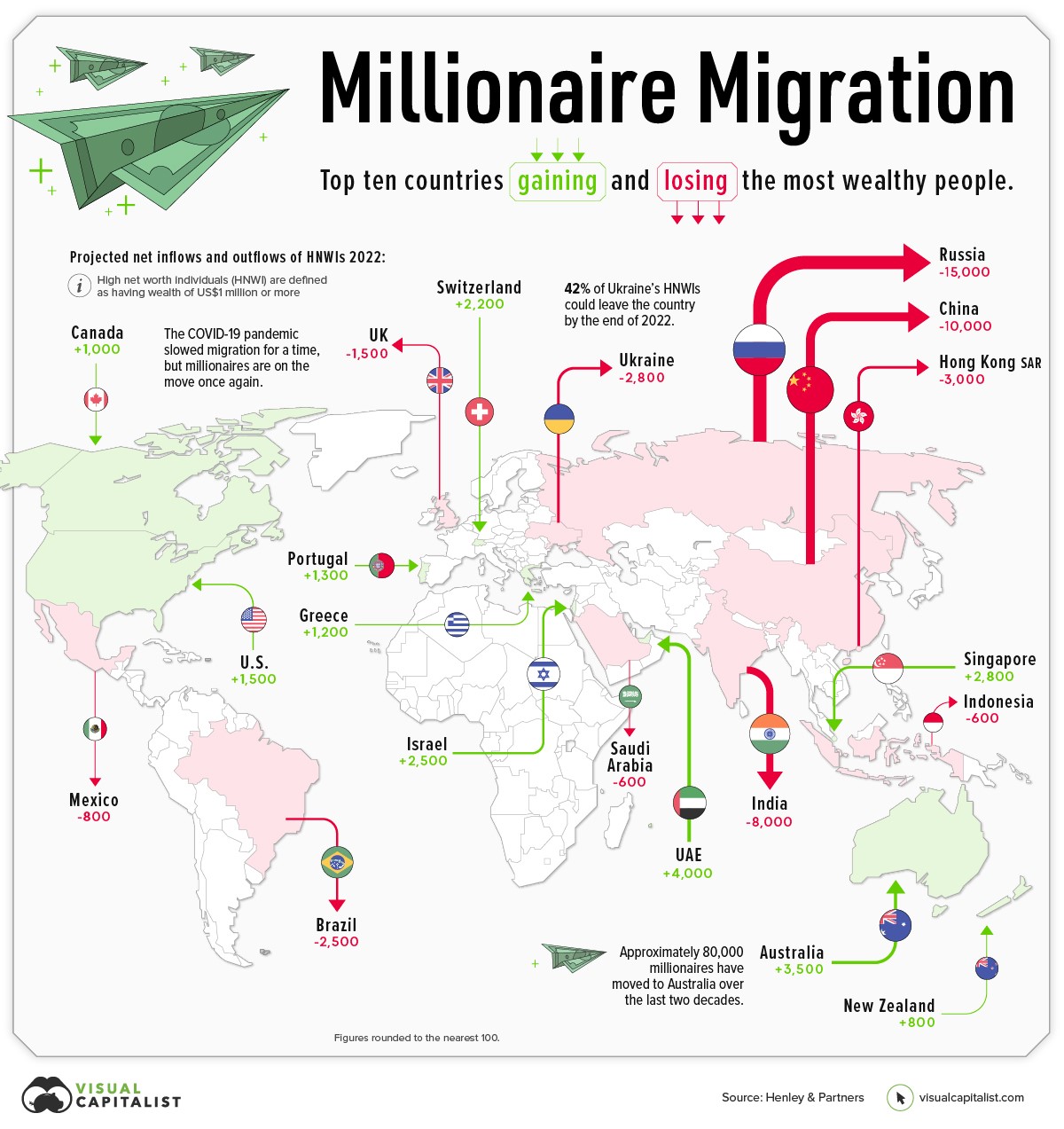

So, for all the talk about China and Russia ganging up to dethrone the US dollar, it’s just that: talk. When the rubber hits the road, it turns out that their own citizens still prefer the US dollar.

Here’s why:

Source: Visual Capitalist

It’s about choice. Mobility. Security.

As high net-worth individuals move across borders, the smart money moves with them.

The outliers of today are not necessarily renegades like Pablo Escobar, but ordinary millionaires wanting to opt out of repressive regimes. Because they, too, believe in the American Dream.

So watch what they do.

Watch closely.

Their actions will offer you a hint about why the US dollar still reigns supreme.

The bottom line

Which way is the wind blowing?

Well, at the moment, we’re in an inflationary environment — which represents both risk and opportunity. To navigate this ocean, you just need to find the right compass. And you need to be courageous if you wish to embrace the counter-cycle.

Here at Wealth Plan, we are helping our Eligible and Wholesale Clients regain control of their destiny by building a roadmap to financial freedom.

From farmers to small business owners to property investors, we understand their hopes and fears. And we’re showing them how to transform and optimise their money so they can reach their desired destination.

We are now offering guidance in the following areas:

- Diversifying Your Wealth Base and Navigating Global Markets

- Financial Independence and Retirement Planning

- Wholesale Managed Accounts

- Wholesale Investment Consultancy

- Trusts, Structuring, and Taxation Concerns

It’s about protecting wealth. Growing wealth. Gaining passive income.

So come talk to us. We’re now offering an initial free consult for Eligible and Wholesale Clients. We’d love to hear more about your financial goals and dreams.

🌎 Click here to register your interest today.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.