Quantum Wealth Summary

- Residential property markets are drowning. Values are sliding. Are they still investable?

- We report on one company investing in property at scale and currently delivering net income at over 9% p.a.

- We consider why the value of the shares in this company appears heavily discounted. And the opportunity it may present.

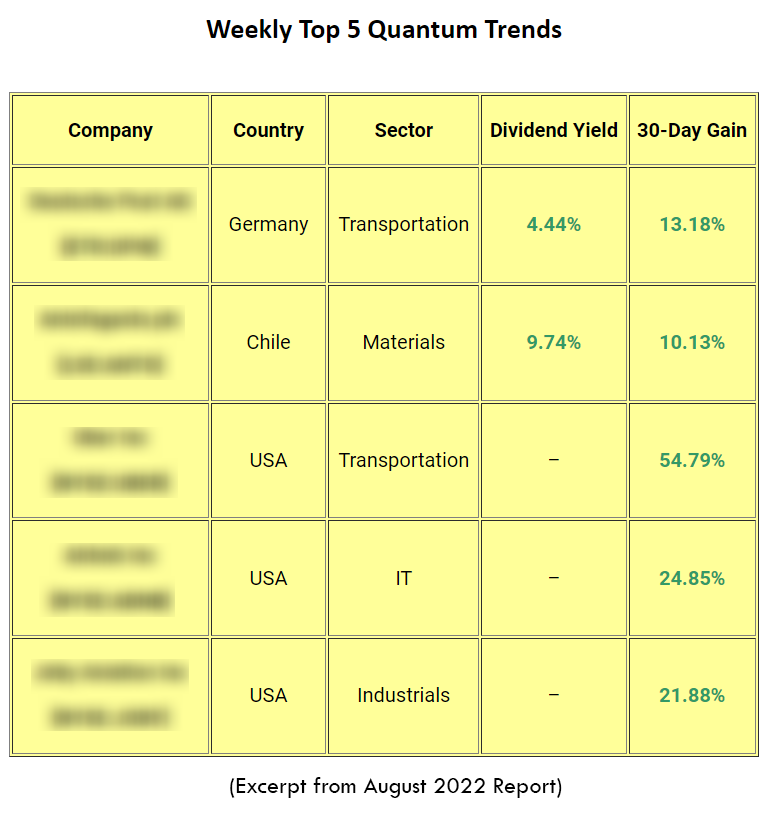

- As a bonus: we also reveal our Weekly Top 5 Quantum Trends. These are the most impactful global opportunities that we are currently watching this week.

One thing we were taught growing up was to think for yourself.

As my mother said; if others put their head in the oven, jumped from a cliff — [fill in a variety of other ridiculous situations] — would you follow them?

It’s not easy to think independently. To go against the tide. But it can be very satisfying, and in certain situations, lead to uncommon wealth.

When it comes to investing, many are inclined to follow the herd. Especially when the past performance of a certain asset class shows great results.

Yes, I’m still talking to people who ‘plan on buying an investment property for their retirement’.

The only way I can see this even remotely stacking up at the moment is if that property is a new build, ideally medium-density, or a strategic commercial property.

Yet many of the plans I’ve heard are simply to buy an existing property and rent it out. For these plans to have any real potential, there has to be a return to untaxed capital gain. Of 10% or more a year — to cover the costs or losses.

There are now at least 9 headwinds buffeting residential rental property:

1) Fastest rising interest rates in years. And still rising as the Reserve Bank struggles to get inflation under control.

2) No tax deductibility of those mortgage interest rates.

3) Large surge in homes coming to for-sale and rental markets as people struggle to sell at or near desired prices.

4) Low gross yields (around 3.5% in Auckland — before expenses). One study suggests after expenses (and when interest was deductible) — net yields were around 0.3%.

5) A raft of compliance regulation adding cost.

6) Projected house price declines of a further 15-20% to December 2023.

7) Provisional net migration loss to 30 June 2022 was –11,500, or –2.24 per 1,000 residents.

8) New dwellings consented to 30 June, 2022 were 9.9 per 1,000 residents.

9) New medium-density residential standards (MDRS) across cities means most full sites can now take three homes of up to three levels, paving the way for much greater supply.

The desire to buy residential property for purely investment purposes seems mad. A peculiarly Kiwi fetish or addiction?

Yet, in this post, we examine what could turn the tide back in favour for residential property investors.

Moreover, we look at what could be a smarter way to invest in property for retirement, capital growth, and passive income. And we report on the listed company involved…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.