It’s the leading source of household wealth.

It carries the retirement dreams of many New Zealanders.

A deep slide in prices in the real estate market has begun.

Is this the descent down a deeper cliff or a minor correction? Too early to tell. But this may be just the beginning. It takes time for interest rate hikes to play out in the market. And it takes even longer for sellers to adjust and stop overlooking the signs of shrinking demand.

I’ve been warning about this for a while. Last year, starkly comparing the situation with the Irish property crash. And when I spoke about it at an event some time earlier, the mood turned dark.

Sure, a broken clock is right at least twice a day. Some analyst or another will call a crunch. But this time, an alarm is sounding.

About 55% of Kiwi mortgages are either on a floating rate or on a fixed rate that needs to be renewed by July 2023.

Over this time, the housing market will be put to its greatest test.

High Kiwi property values have been supported by low interest rates.

Source: Global Finance

Property-invested analysts and economists promise a coming recovery. Yet there are more headwinds than tailwinds. And the winds are stronger this time:

- The market has already exhibited bubble characteristics for years. Median income-to-house-price ratios are badly out of whack. So too are net rental yields.

- Borders have been closed and migration has yet to recover. With key source countries like China and the UK facing a tepid economic soup, numbers are unlikely to do so.

- Auckland’s supply imbalance had largely been resolved. Now the existing pipeline and wide-ranging medium-density provisions will allow for many more homes.

- Rents across the country have already dropped, even as investors quit the market. It’s cheaper to rent a house this September than it was at the same time last year.

- The rent drawdown is likely because more and more sellers, unable to get the price they want, are putting their properties up for rent.

- Investors and landlords relying on a change in government to reverse tax and regulatory headwinds may be disappointed. Opposition leader Luxon has thus far failed to make headway in the crucial preferred prime minister stakes. Suggesting current tax settings are supported by many.

- At least one Auckland mayoral candidate has proposed a targeted rate on ‘ghost’ or empty homes. This idea is getting traction and could see a further 40,000 homes come onto the market.

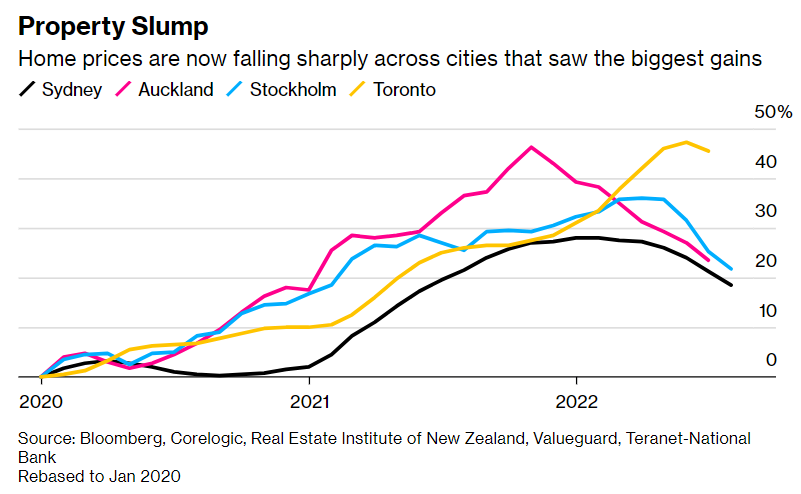

Of course, Auckland/New Zealand is not alone.

Other bubbly markets are seeing the later stage of this trend as the housing pendulum swings in the opposite direction:

The end of capital misallocation?

There’s an awkward problem here.

Lacking other worthwhile investment opportunities — and promoted to by vested advisers and property developers — many have invested in property as part of their retirement planning.

My colleague John Ling, who speaks with investors on a weekly basis, says the logic goes like this:

- ‘Housing is safe.’

- ‘Housing is a good earner.’

- ‘Why bother doing anything else?’

Years of taking this approach on a national scale has led to misallocation of capital.

The investment model is built on ever-increasing house prices. At some point — as we’re seeing now — these prices become unsustainable.

Unfortunately, much social and economic harm has already been done.

The flurry of investment dollars chasing houses has helped make them unaffordable for everyday Kiwis. It’s diverted resources from more productive pursuits. It’s pushed some into homelessness. And driven many overseas.

Tax consultant Terry Baucher ran the numbers on total net rental income over the total value of rental properties. His calculations show a return of around 0.3% p.a. Which suggests the entire investment for most depends on future capital gains.

New Zealand has lost productivity by incentivising investment capital into second-hand housing. The tide is now turning. A reckoning is due.

My love affair with housing

Confession: I’ve owned rental property in Auckland and did reasonably well from uplift in values. And in the old days, more positive rental yields.

Growing up, my parents were serial homebuilders and movers.

There is a degree of excitement and satisfaction that comes from owning a home. And moving into a new and better place that promises to put an end to old troubles.

My transition came when I moved to Europe and began working more seriously at a trading desk in international equities.

About that time, we bought an apartment in a beautiful old heritage building, looking over the English Channel. Turned out, the wider development was leaky. It needed some very costly repairs.

Sunset from our European apartment

While that was hard at the time — it pushed my focus in a different direction.

Assembling a portfolio of robust equities with good dividends proved to be a game changer.

No maintenance or repairs. No tenants. And while the initial yield on the purchase price may have been around 4% to 5% p.a., this soon grew rapidly as dividends increased.

The share portfolio provided financial independence. Choice in work. A greater degree of freedom.

I tried to concentrate the investing into the most productive, highest quality companies I could find. In developed markets around the world.

The downside? Well, even good stocks can be volatile. Even the best businesses are not immune to challenging times.

As the world went into lockdown in 2020, values came down by up to 35%.

I went from the building issues to the coronavirus market crash.

Of course, as any seasoned investor knows, when prices come not to reflect the true value or potential of the underlying business, this might be time to buy.

That analysis and action over time led to further gains.

Without having to replace a kitchen.

The one free lunch in finance

A key risk now, as property values fall, is that many investors have ‘all their eggs in one basket’.

Often their own home. And another home…or two…or three nearby. Sometimes a small retail or office commercial property in a nearby suburb or town.

Not only are they facing declines in equity, but compressed yields and more challenging tenant situations.

True diversification is the one free lunch in finance.

It protects you from the drawdown in one market by being allocated to entirely different markets.

For example, the daily loss of $753 on my Auckland home since January has no relation to my shares in a large UK power generator — SSE plc [LSE:SSE]. That company has seen approximately 10% capital growth over the year and a dividend of around 5%.

Assembling a robust share portfolio means investing in diverse companies. Across different sectors and in different countries.

It requires accepting market volatility and being up or down any given month.

It requires having the courage to invest more funds during market downturns to capture the likely upswing. And not to sell out at the first stage of fear, crystallising any losses.

It requires the patience to sometimes wait a few years for companies and situations to reach their potential, or recover from crises.

It requires a long-term view.

The ideal time frame for quality stocks with good dividend streams is 5 to 10 years. That’ll ride out bear markets. Ride in bull markets. And allow enduring value to rise.

Our opportunity for you

Prosperous clients usually have some track record with courage and decisiveness.

Often, in business or the markets, they’ve generated wealth beyond increases in the New Zealand housing market.

If you’re interested in building wealth and need a plan to optimise this, I’d like to offer you a free consultation.

Wealth Plan is an opportunity for Wholesale or Eligible investors. (With some previous experience in investing).

As a reader of Wealth Morning, you’ll likely be in this category.

We can help you identify opportunities to go further. Much further.

Take control of a courageous financial future today by requesting a free consultation.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Wealth Plan services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.