The juxtaposition couldn’t be starker. I didn’t realise that at the time.

I’m watching TVNZ’s Sunday while nosing into a real-estate listing on my phone.

On the big screen: a family crammed into an emergency-housing motel in Rotorua. The rooms look filthy. A rusted-out microwave is still in use. And boxes of household detritus occupy every space.

In my hand, on the small screen, the palatial rooms of the Parnell mansion formerly owned by Sir John Key. It’s beautiful. Though I wouldn’t want to pay $23 million given the swimming area seems overlooked.

Former prime minister’s mansion. Source: Trade Me

I look back at the TV.

A small overcrowded motel room. Allegations that vulnerable residents are prey to drug dealers and sexual predators.

Emergency-housing motel room. Source: TVNZ

Is this New Zealand?

It’s not the country I grew up in, that’s for sure.

Yes, there were plenty of state houses. But they usually had a yard. Some space. Some dignity.

There was wealth, yes. But not the startling inequalities we see today.

Those in Rotorua’s emergency housing are the ‘human shields’ of the housing crisis. A crisis that was years in the making as governments failed to manage market failure in housing.

Some got rich. Some slipped through the cracks and ended up on waiting lists and in motels.

Why was there market failure in housing?

It’s hard to build anything in New Zealand due to regulation. It’s expensive. Land around cities is tightly restricted. And for many years, the country ran net migration at very high levels. While offering unlimited right of return to permanent residents.

Addressing inequality and imbalances built up over years is now hard and painful.

New legislation promotes the densification of major cities. Such that, over time, they will become unrecognisable as New Zealand cities.

Landlords are the whipping boys. Facing aggressive regulation favouring tenants. And restrictions on deducting mortgage interest.

There was the Covid monetary policy overshoot. This, combined with the energy and food price shock following Ukraine, has created a perfect storm of rising interest rates.

The outlook for these now is only in one direction: up.

What is the outlook for investment property?

Every situation is different. Yet the overall New Zealand property market has exhibited characteristics of an asset bubble. It’s hard to justify values as a multiple of incomes, or even a yield on rents.

When you have rising asset prices based on the flow of cheap money — very low interest rates — you risk a bubble.

When those asset prices start falling and interest rates become much more expensive, there’s the risk of significant wealth being wiped out.

And when you have large numbers of people living in motels, there’s unlikely to be much sympathy or support for property owners as prices and rents plummet.

Every market is different. The problem with property markets is when prices do fall, those markets become more and more illiquid.

People can’t sell their homes at the price they want.

Some go on the rental market. Prices and rents fall. Supply continues to grow.

Eventually, a new equilibrium arrives. With hopefully many fewer having to live in dire motel rooms.

In the US, investors saw a much deeper house price correction during the GFC.

Investors there are warier that house prices can fall, and when they do, quite deeply.

New Zealand has yet to experience this, since the GFC only saw a drop of around 15% here.

Will 2022 or 2023 be New Zealand’s real GFC moment for housing?

Many of the warning signs are in place. Though renewed levels of high net migration could mitigate from the demand side.

Where smart money flows, assets grow…

Globally, our research into the wealthiest investors tracks the ‘smart money’. It suggests investors prefer more liquid and flexible investments these days.

Investing into shares across global markets appears to be where the smart money has been heading since the GFC.

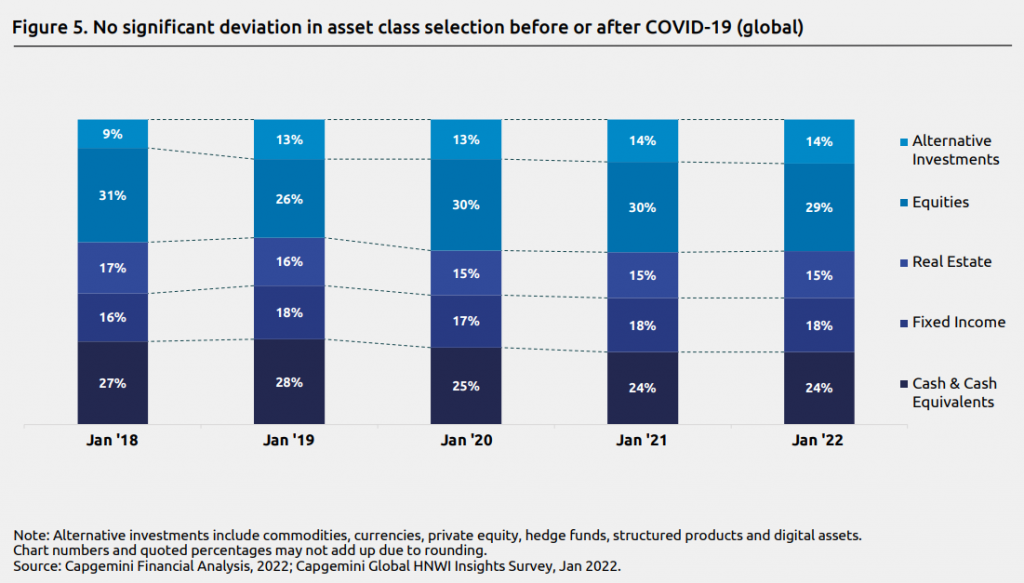

Here are the allocations of high net-worth investors globally — from 2018 through to the start of this year:

With allocations of only 15% to real estate, these global investors are not going to be heavily exposed to the housing downturn.

It’s a different picture in New Zealand.

80% of Kiwi household equity is now in housing. The ramifications of a severe real-estate downturn will have wider impact in this economy.

But that will have upside for some. Making the housing market more affordable, especially as supply increases. Potentially narrowing the chasm between mansion and motel room.

In my view, there’s no time like now to look at wider market investments offering potential growth and income.

While stock markets have been volatile since June, commodity stocks are surging on higher margins. There are other sectors flashing opportunity. And value is calling.

Wealth Morning opportunity: free consultation

If you’re interested in building wealth and income from a diversified portfolio, I’d like to offer you a free consultation. (Subject to availability).

Wealth Plan is an opportunity for Wholesale or Eligible investors. (With some previous experience in investing).

As a reader of Wealth Morning, you’ll likely be in this category.

We can help you identify wider opportunities with managed risks.

Learn more by requesting a free consultation today.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Wealth Plan services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility. This is available for a limited time only.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.