Quantum Wealth Summary

- We haven’t looked across the NZX for a while due to expensive companies and a paucity of opportunity.

- Recent market drawdown and the demise of the local property market have thrown up new prospects that could now offer value.

- We report on developments with 2 listed New Zealand companies. We consider the value and opportunity they may now present.

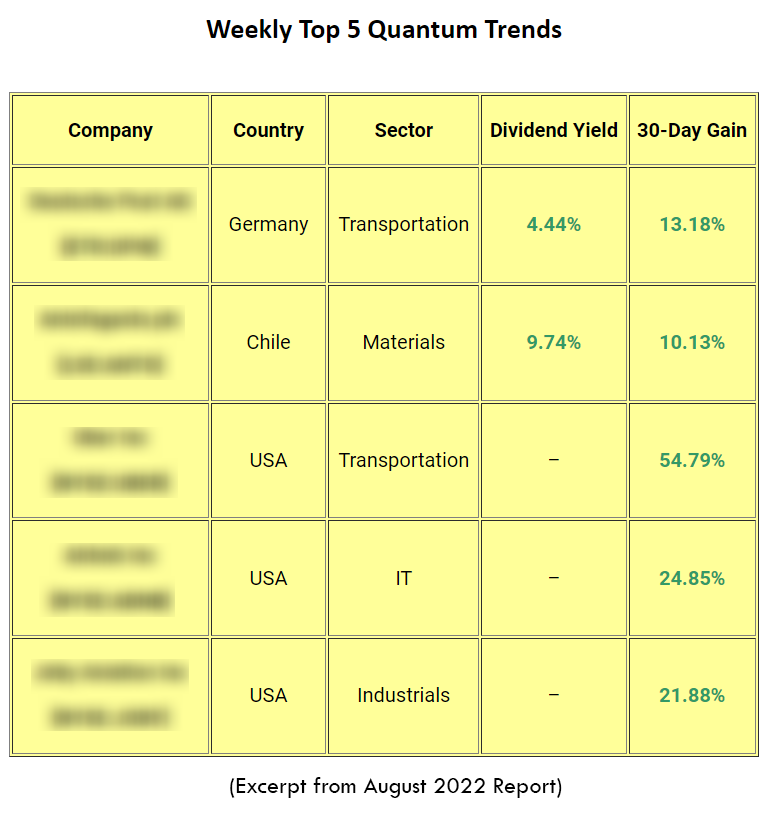

- As a bonus: we also reveal our Weekly Top 5 Quantum Trends. These are the most impactful global opportunities that we are currently watching this week.

Do you have $3 million in available funds?

If so, you could apply for your family to live, work, and study in New Zealand indefinitely.

Each year, there are about 400 places available for the Investor 2 Resident Visa.

This is pricier than some EU investment visas. For example, by investing €500,000 in shares in Italian businesses, you could gain access there. Or just €250,000 to €280,000 in property in Greece or Portugal.

But it is a demand vs supply issue. And since the early 2000s, large numbers of people from around the world have wanted to come to the safe haven of New Zealand.

This has become a self-fulfilling prophecy. The New Zealand economy has grown with immigration. We are all more prosperous for that. But, equally, housing and infrastructure issues have come to the fore.

Investing in NZ-listed companies

I’ve been investing on the NZX since I was 17.

Over the past few years, I’ve seen P/E ratios reach heady levels. Such that it often makes more sense to look offshore for cheaper stocks. In companies that offer size, scale, and sectors not readily available here.

Having worked offshore, the European markets present great comparative value to me.

Yet there is one area where many NZX companies do shine. And that is income. We have some strong dividend yields here.

So, when one of our Wholesale clients — on an NZ Investor 2 Visa — asked us to invest solely in New Zealand shares, this brought about a renewed focus on this market.

Both from the perspective of earning good income and achieving some growth over the longer term.

His timing was good. The rapid decline in the New Zealand property market — due mainly to higher interest rates — has also seen some listed property companies more keenly priced. With share prices either below their book value. Or offering a reduced premium with other growth prospects.

Today, I want to report on two companies that have caught my attention.

Now, they’re not the most red-hot exciting businesses. But they could deliver some long-run growth with good income along the way…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.