‘Own at least two houses and your retirement is sorted.’

A property investor friend told me this some 20 years ago.

He meant that if you retired with at least two mortgage-free properties, you could live in one, enjoy rent from the other. And alongside national super, be comfortable.

It wasn’t stupid advice, the way things have gone. And it was probably the way a lot of people were thinking.

Up until recently, the IRD helped Kiwi investors with this strategy. The mortgage on your rental was tax-deductible. It was a tax-favoured investment.

This helped stoke a housing crisis:

- We couldn’t build homes fast enough or cheaply enough to cope with demand.

- Even if we could, tight regulations meant there wasn’t land or infrastructure available.

- Net migration of 50,000+ per year (before Covid) further fuelled demand.

- The Reserve Bank used low interest rates not only to control inflation, but to stimulate demand and job growth.

It isn’t hard to see why the bulk of New Zealand’s household wealth lies in housing. And there’s now a two-tier economy. Those who own property. And those who don’t.

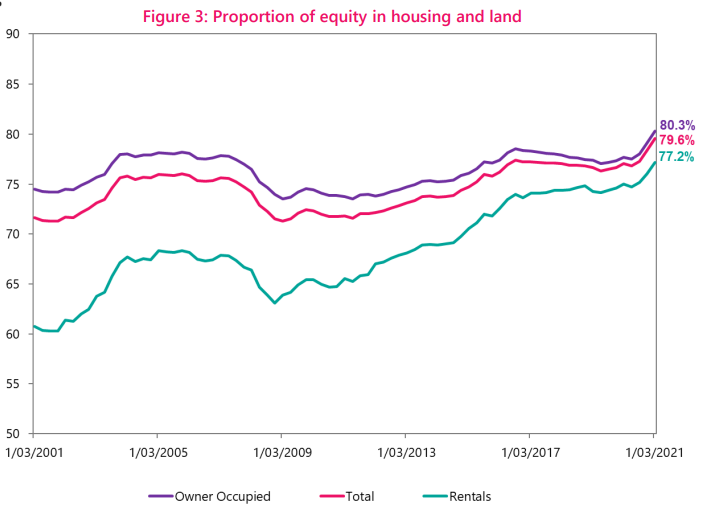

As of March 2021, around 80% of household equity in New Zealand was in housing:

Source: RBNZ

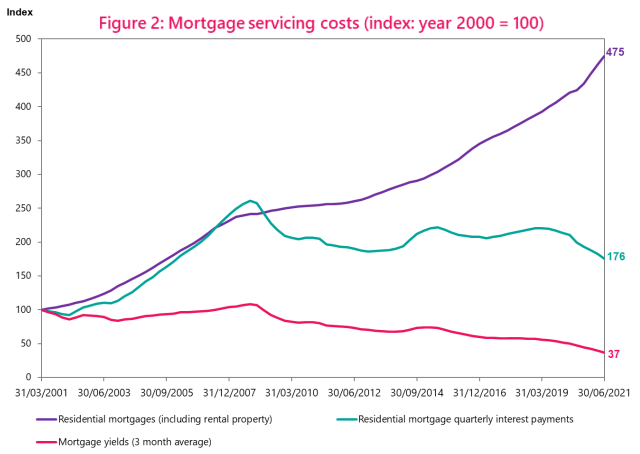

Meanwhile, while mortgage lending had increased 475%, the cost of mortgages had actually come down:

Source: RBNZ

The trouble with this analysis is that it is past-looking.

Mortgage rates will now increase until inflation has been brought under control.

Yields on rentals have been smashed by the market and lack of interest deductibility.

By way of example, a townhouse in Albany touted as a ‘rental’ provides a yield of negative 3.39%:

| Purchase: | 900,000 |

| Deposit: | 360,000 |

| Mortgage (60%): | 540,000 |

| Expected rent (annual): | 36,400 |

| Interest @ 6.35% (annual): | 34,290 |

| Rates and body corporate: | 5,735 |

| Company tax @ 28% (owner): | 8,586 |

| Loss: | –12,211 |

| Yield on 360k capital: | –3.39% |

By way of comparison, 360k invested in a share portfolio with a running (dividend) yield of 5% would generate +$18,000. And could still provide capital growth. Though, of course, dividends are not guaranteed and share prices can rise or fall.

The only way the property equation above works is if the capital value of the home increases ahead of inflation and the yield loss.

Because 80% of New Zealand wealth is in housing, this means governments face a deal with the devil:

- Option 1: Allow housing valuations to correct downward — and you wipe out national wealth on a historic scale.

- Option 2: Allow them to continue to increase by restoring interest deductibility and net migration levels — and the situation seems more digestible.

Unfortunately, KiwiSaver and the NZ Super Fund do not fill in the gaps for the coming retirement cliff:

- As of December 2021, the average KiwiSaver balance is just $29,022.

- The NZ Super Fund is currently worth around $58 billion. Only around $11,600 per New Zealander.

- There is too much retirement wealth in housing. Not enough in other investments.

Paid to leverage?

The National party wants to restore interest deductibility for rental properties.

But this creates an unfair playing field. Rental properties have a tax advantage.

If you want fairness…

- Either you make the mortgage deduction available to all home owners (as I saw when I lived in Europe);

- Or mortgages on the scarce second-hand housing market are not deductible at all.

Yes, I can hear the outcry already.

Rental properties are ‘businesses’. Mortgages on these properties are thus a legitimate business expense. And the end result of not allowing the deduction is an increase in rents.

Actually, this has not been the case.

Fewer investors willing to enter or remain in the market has helped lower house prices.

Indications suggest those unwilling to sell their homes at lower prices have turned to the rental market. Increasing rental supply.

Further, if an investor wants to increase rent to cover the lack of deduction, there are constraints. Tenants have limited budgets. And any increase would trigger taxation of that increase at the investor’s marginal rate.

The resounding issue, though, is fairness. Housing is a social good:

- If I buy a house for my family to live in, I don’t get a mortgage deduction.

- If I buy a house to rent out to a family that does not have a house, then I do get a deduction?

By definition, wealthier people will end up owning the bulk of housing — which they’ll rent to mainly poorer people.

Competition for housing will continue to force prices and rents upward.

When poorer people do try to buy a house, they’ll be competing with wealthier people bidding to buy that house for a rental.

We saw this before in Auckland.

First-home buyers complained of being outbid on properties. Only to find them listed shortly after for rent by the winning buyer.

Housing density could be a game changer

Of course, something that would change the playing field would be a mass increase in housing supply.

The bipartisan-enabling housing supply legislation promotes this in major cities.

By right, you can build 3 storeys and 3 units on most urban sites, unless there’s some specific qualifying matter like heritage.

Yet this intensification still does not resolve the key problems:

- There are not enough homes or sites for sale to intensify.

- In many areas, infrastructure cannot handle intensification.

- The construction industry faces labour shortages.

- It is still very expensive to build any home in New Zealand.

- Meaning, even if density does increase, most new housing still won’t be affordable.

Thus, we face a reckoning.

Either we allow home prices to continue falling, based on increasing interest rates, no deductibility of that interest, and lower levels of net migration…

…or we refuel them by restoring that deductibility and ramping up net migration to 50,000+ again.

The bottom line

Housing has become a fraught investment in New Zealand. Far too much of our household equity and retirement saving is tied up in housing and the mortgages that support it.

Meanwhile interest rates are increasing to fight inflation. We don’t yet know if the last round of rate increases will bring it under control, or whether they will need to go much higher as they did in the 1970s and 80s.

As interest rates increase to fight inflation, many homeowners face the Sword of Damocles. It’s good to own a home, but at what cost?

There are serious equity issues in affordability.

For investors, the numbers don’t appear to work unless historic rates of capital growth can be assured for the future.

Are we seeing the release of a bubble?

The market still seems tight.

The rates of price decline suggest a meaningful correction rather than a crash. Though that would speed up if interest rates have to go much further.

For investors, the more compelling lesson may be this…

How the wealthiest investors allocate

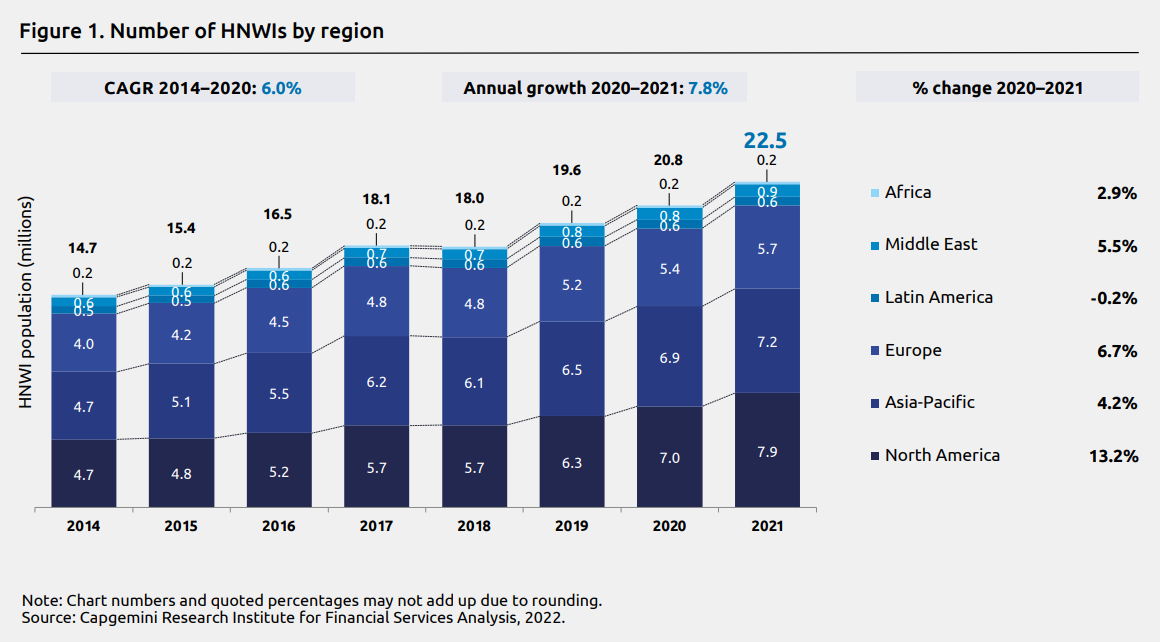

Worldwide, there are a growing number of HNWI (high net worth investors with investable assets > USD $1 million):

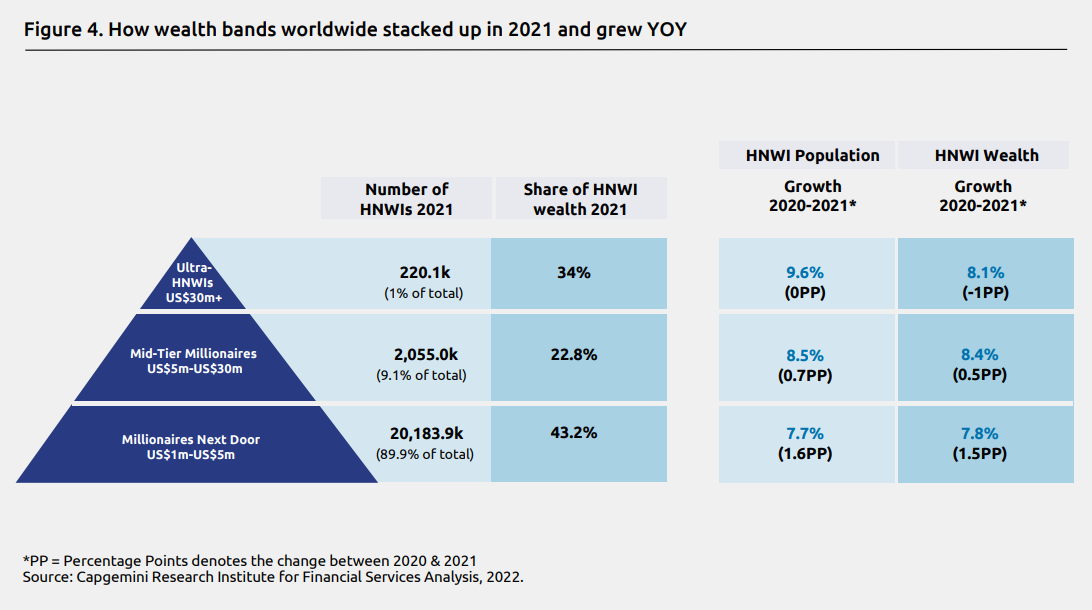

The vast majority of these are ‘millionaires next door’ or mum-and-dad investors:

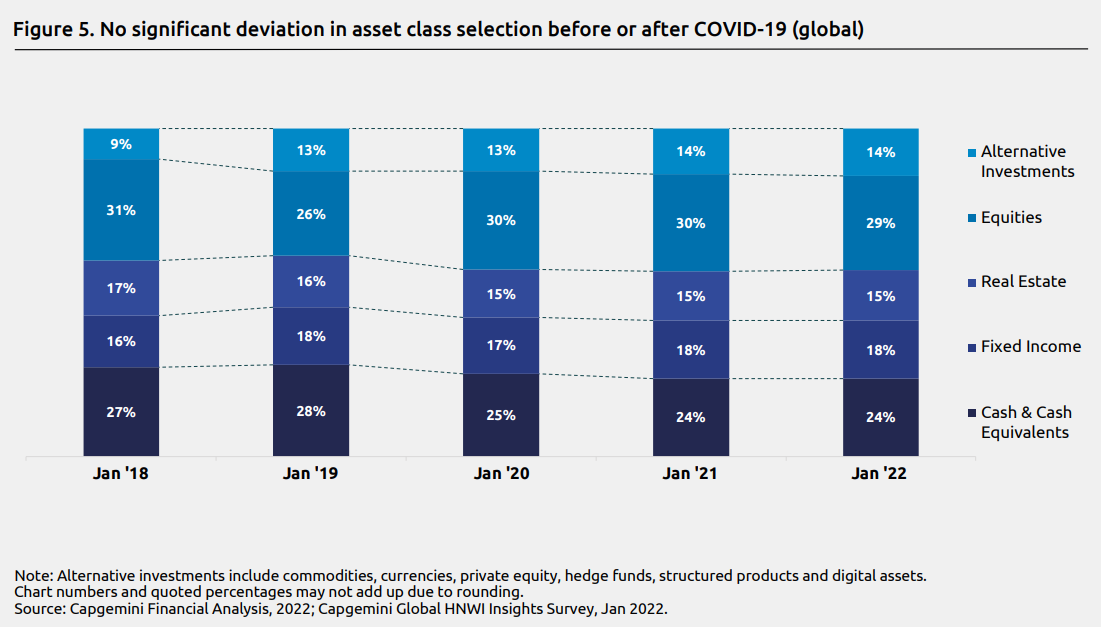

Here is how these investors, on average, allocate their wealth:

What we clearly see is allocations of around 15% of HNWI equity to real estate. Not the 80% of equity we’ve seen across households in New Zealand.

The largest allocation area is to equities (shares) at around 30% of wealth. These are the growth instruments of modern economies. Not residential houses.

Because it is businesses that ultimately generate wealth. That take goods, services, and property — and convert them into value that improves lives.

Our opportunity for you

Prosperous clients usually have some track record with courage and decisiveness.

Often, in business or the markets, they’ve generated wealth beyond increases in the New Zealand housing market.

If you’re interested in building wealth and need a plan to optimise this, I’d like to offer you a free consultation.

Wealth Plan is an opportunity for Wholesale or Eligible investors. (With some previous experience in investing).

As a reader of Wealth Morning, you’ll likely be in this category.

We can help you identify opportunities to go further. Much further.

Take control of a courageous financial future today by requesting a free consultation.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. Wealth Plan services are for Wholesale or Eligible investors as defined in the Financial Markets Conduct Act 2013. Please request a free consultation if you would like to discuss your eligibility).

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.