When you run money in the markets, you navigate fear.

Very few fears are real. Many are fake. Stoked by media seeking to draw eyeballs.

Think about it. You walk past an ordinary house every day. You don’t really notice it.

Until it catches fire!

That’s how a lot of alarmist reporting operates about economic situations. And financial markets.

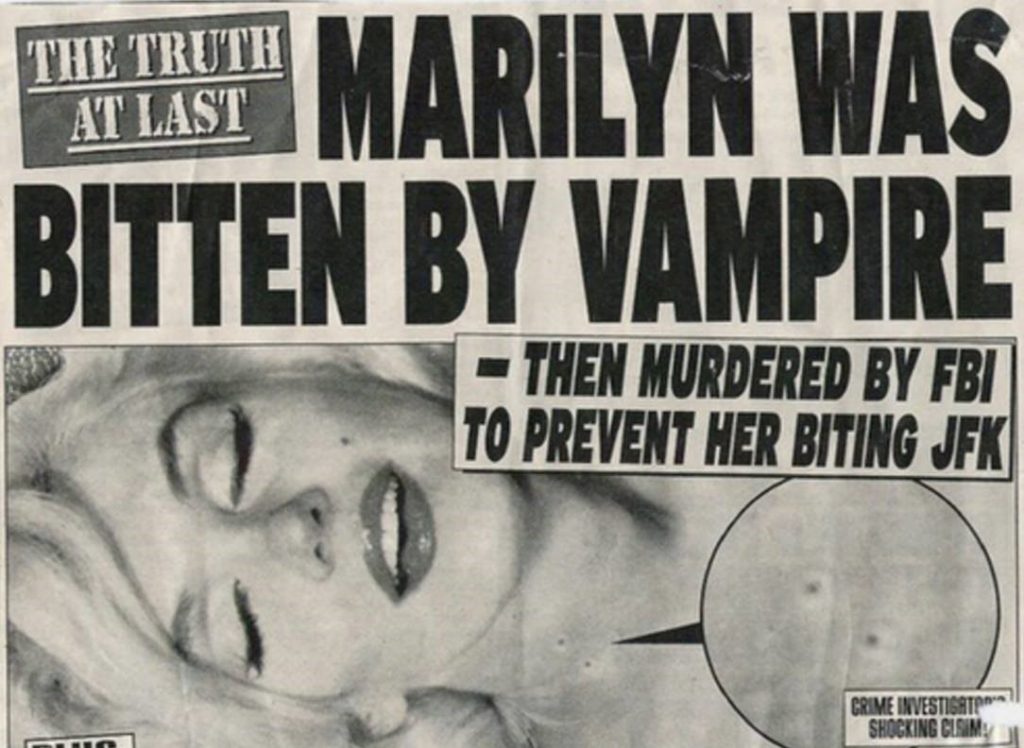

Sometimes evidence is extrapolated beyond any reality. Leading to various theories, conspiratorial or illogical. As was once done following the untimely death of Marilyn Monroe…

Beware of fear vampires in the media. Source Vampire News

The lines I’m hearing now are:

- ‘The economy is heading for 1970s stagflation quicksand that will pull it under!’

- ‘The eurozone will collapse as Russia cuts off German oil!’

- ‘The US dollar as a reliable reserve currency is going to be replaced soon!’

- ‘Asset prices will tank as they’re only supported by unstable debt!’

- ‘New Zealand’s housing market will crash and sink the economy into deep depression!’

Very few of the most financially pernicious threats and events are immediate. Or sudden.

They tick away over a long period of time, which I’ll get to in a moment.

Markets recovered from 1987, the tech crash, the GFC, and Covid 2020.

They’ve gone on to rise following depressions, during world wars, and on the brink of nuclear calamity.

Life goes on.

- We’re not going to see stagflation when we’re close to full employment. When there are so many areas of growth, simply constrained by capacity. Here in New Zealand, employment constraints could be getting even tighter.

- While Germany does rely on Russian gas, with over half coming from that source before the Ukraine war, the country is not without options. These include running nuclear plants longer, fracking, increasing coal, wind and solar generation, and reducing consumption.

- Energy is an ongoing issue around the world. The desired transition to renewable is not keeping up with growing demand. But this also creates opportunities. Some of which we’re reporting on for investors in our Quantum Wealth Report.

- The US dollar shows no signs of meaningful decline as the leading reserve currency. The dollar is dominant because the issuer is large and trusted more than most. While no currency is perfect, I do not see another issuer offering any comparative level of size, transparency, or trust.

- Some asset prices and certainly New Zealand housing has overshot on the back of cheap and easy leverage. A period of repricing may be expected. But given the overall health of household and corporate balance sheets, this correction should not pose widespread devastation.

Here’s the real risk to your wealth. And it happens over a long time…

It’s best encapsulated in a story former Reserve Bank Governor Don Brash tells.

His uncle was an orchardist in Nelson all his life.

He sold his orchard in 1971 for $30,000.

At the time, this was enough money to buy 11 Toyota Corollas.

The uncle invested the money into 18-year government bonds at an interest rate of around 5.4%.

When those bonds matured in 1989, they could only buy 1 Toyota Corolla.

As Brash says, his uncle ‘was robbed blind’, even though he put his money in what was thought to be a good, conservative cash investment.

The great erosion of cash during times of inflation: 11 Corollas in 1971 vs 1 in 1989.

Source: Car Throttle, Car from Japan

Alternatively, periods of high inflation can create an opportunity to grow your wealth.

Despite the pandemic, despite these supposedly dreadful times, Bank of America and Morgan Stanley just reported something entirely different.

Rich Americans are borrowing more.

Yes, in the second quarter of this year, they saw double-digit growth in loans to wealth-management customers.

These are well-heeled clients taking out loans or mortgages backed by assets such as stock portfolios. Probably to buy more assets, like equities at sharp prices. Opportunities appearing in these times.

But they’re borrowing, not only to acquire bargains, but to take one of the few free lunches from inflation.

While interest rates have gone up, so has inflation.

If your interest rate is 5% — likely less on a stock portfolio — but inflation is 7%, you’re going to soon eat your interest.

Of course, any leverage to any investment adds risk. That’s not a strategy for everyone.

But the signal is clear: people want to invest in real assets to grow and protect their wealth.

After nearly two decades, they want to go from being able to buy 11 cars, to being able to buy 111 in real terms.

This means a strategic approach to putting your money to work. And generating income and growth.

In that regard, I wanted to share with you our new service:

Here at Wealth Plan, we are helping our Eligible and Wholesale Clients position for financial freedom.

From farmers to small business owners to property investors, we understand their hopes and fears. And we’re showing them how to transform and optimise their money so they can reach their desired destination.

We are now offering guidance in the following areas:

- Wholesale Financial Planning

- Retirement Planning

- Taxation and Accounting

- Wills and Trusts

It’s about protecting wealth. Growing wealth. Gaining passive income.

So come talk to us. We’re now offering an initial free consult for Eligible and Wholesale Clients. We’d love to hear more about your financial goals and dreams.

🌎 Click here to register your interest today.

Regards,

Simon Angelo

Editor, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.