Imagine this: a butterfly is flapping its wings in the rugged Amazon rainforest.

This creates a gentle and minor change in the air. An unseen chain reaction happens in the breeze.

Weeks later, this ends up creating a tornado that rips through the flat plains of Texas.

Impossible? Yes? No?

Source: Medium

Well, here’s the truth: we human beings are really bad at understanding long-term trends. Especially when we are obsessed with living in the moment.

Edward Norton Lorenz was the mathematician who first popularised the idea of the ‘butterfly effect’. He says that something seemingly small, seemingly insignificant, may actually lead to huge consequences over time.

So, our short-sightedness is doing us no favours. And the seed of future regret is being planted, even if we don’t know it yet.

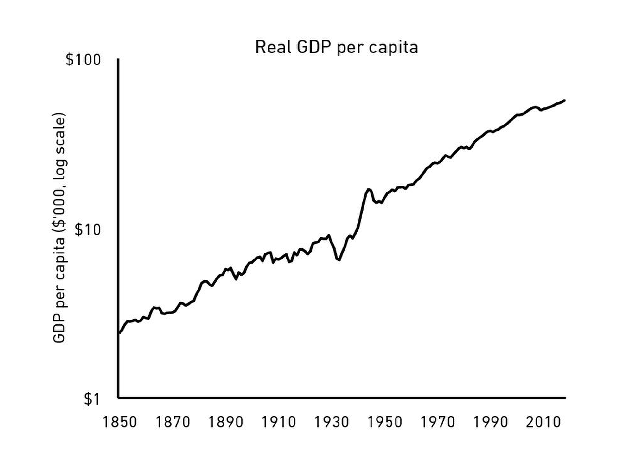

Source: The Psychology of Money, Morgan Mousel

Morgan Mousel explores this in his book, The Psychology of Money.

He reveals that the standard of living in the American economy rose 20-fold in 170 years. That’s a 2,000% increase.

However, history doesn’t move in a straight line.

In fact, when you look at the bumps in the road during that time period, there were many reasons to be pessimistic:

- 3 million Americans died while fighting nine major wars.

- 675,000 Americans died in a single year from a flu pandemic.

- 99% of companies went out of business.

- 33 recessions lasted a total of 48 years.

- The stock market fell more than 10% at least 102 times.

- Stocks lost a third of their value at least 12 times.

- Annual inflation exceeded 7% in 20 separate years.

- ‘Economic pessimism’ appeared in the newspapers at least 29,000 times.

Indeed, there was bad news all around!

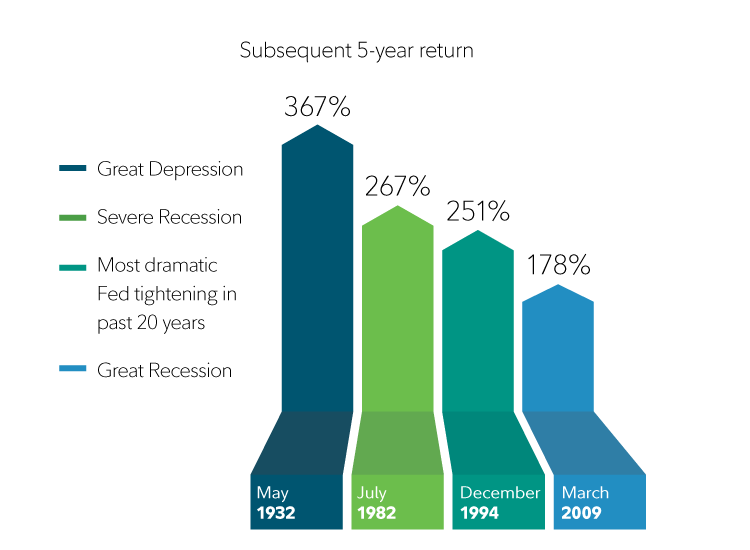

And what did people do during each crisis event?

Well, what they usually do.

They panicked. They gave into fear. They assumed the Apocalypse was happening.

They sold off their assets at the wrong time. Or they avoided investing altogether.

But guess what?

By doing so, they actually missed out on the compounding magic of the market.

Indeed, by obsessing over short-term pessimism, they missed out on long-term optimism.

The butterfly effect.

Source: Fidelity

Here at Wealth Plan, we are helping our Eligible and Wholesale Clients master the butterfly effect by building a roadmap to financial freedom.

From farmers to small business owners to property investors, we understand their hopes and fears. And we’re showing them how to transform and optimise their money so they can reach their desired destination.

We are now offering guidance in the following areas:

- Diversifying Your Wealth Base and Navigating Global Markets

- Financial Independence and Retirement Planning

- Wholesale Managed Accounts

- Wholesale Investment Consultancy

- Trusts, Structuring, and Taxation Concerns

It’s about protecting wealth. Growing wealth. Gaining passive income.

So come talk to us. We’re now offering an initial free consult for Eligible and Wholesale Clients. We’d love to hear more about your financial goals and dreams.

🌎 Click here to register your interest today.

Kind regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.