Are you a pessimist?

Do you wake up in the morning, feeling grumpy and anxious? Are you convinced that this market correction is the Apocalypse? Do you believe that the world is finished and will never recover from this?

Or…are you an optimist?

Do you wake up in the morning, feeling cheerful and excited? Are you convinced that this market correction is a healthy pause? Do you believe that the world will adapt and overcome in the long-term?

Source: Entrepreneur

Well, whichever way you lean, there’s no hiding it: we have experienced a terrible first half for 2022. In fact, generally speaking, it may well be the worst first half we’ve seen since 1962.

It’s been so awful that every asset class has taken a hit — property, gold, crypto, stocks, bonds. The fear has seeped into anything and everything. I dare say, it’s even more infectious than Covid!

At the time of writing:

- The Dow Jones is down over 15%.

- The S&P 500 is down over 19%.

- The Nasdaq is down over 28%.

But here’s the trillion-dollar question: has the fear actually been oversold? Has it been exaggerated?

The current situation

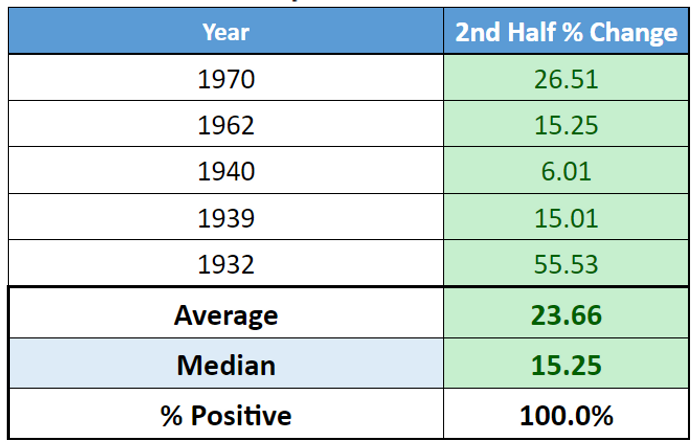

According to research by Dow Jones Market Data, there may well be a silver lining to be found.

Historically, the S&P 500 index has tended to rally back into the green after first-half falls of 15% or more.

On average, going from red to green looks like this:

Source: MarketWatch

Past performance is no crystal ball, of course. It doesn’t promise us the future.

However, it’s worth considering what Ken Fisher from Real Clear Markets has to say:

Crossing the official -20% bear market threshold sounds scary but changes nothing about what you should do ahead. If you needed equity exposure before this downturn, avoiding stocks now likely doubles your trouble. Investment decisions must be forward-looking—not backward.

Being in a bear market now doesn’t imply big downside ahead or a long decline. Since MSCI World data start in 1969, the median time from piercing -20% to a downturn’s low is 0.8 months. From there back to -20% has taken a median 0.3 months. The median drop to the bottom after crossing that -20% threshold? Just -7.6%. The rally is very likely at hand soon—maybe it already started. Regardless, selling now risks missing it, potentially making this year’s slide harder to recoup. Look now to the recovery.

Hmm, pretty bold words from Fisher.

Why does he sound so confident?

Well, here’s one reason: the big institutional investors are currently holding cash at their highest level since 2001.

In other words, it’s the biggest stockpile of cash in 20 years.

If history is any indication, this cash will need a home, sooner or later.

The bottom line

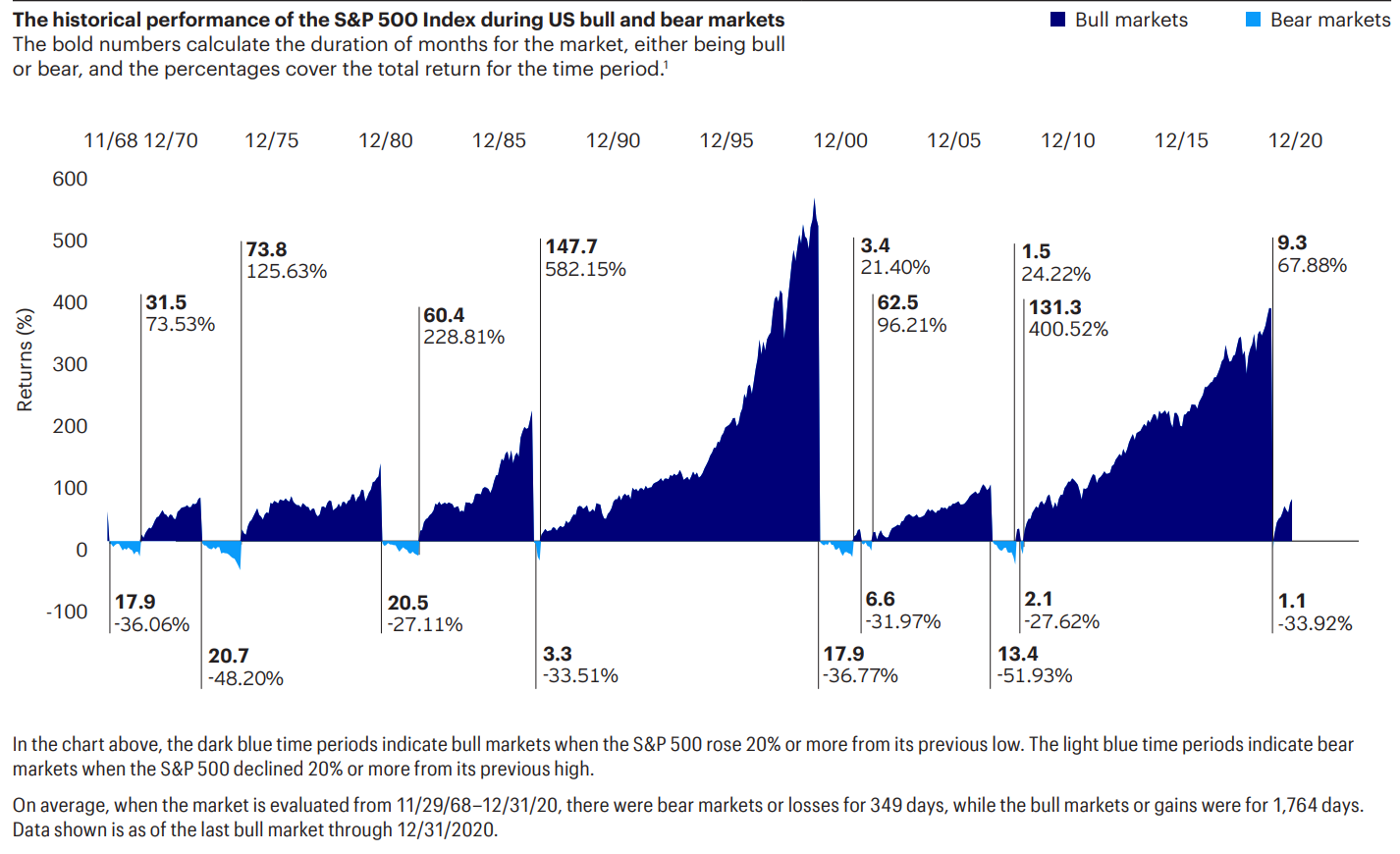

Source: Invesco

The average bear market lasts roughly a year.

The average bull market lasts roughly five years.

But let’s face it: we’ve been spoiled rotten this past decade.

From 2009 to 2021, we have enjoyed from the longest bull run since the Second World War. An incredible 12 years. We’ve never been so lucky!

So a healthy correction is to be expected. Welcomed, even.

In the words of Warren Buffett:

‘Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons. And that we will do.’

Buffett appears to be taking his own advice to heart. During the first quarter of 2022, he deployed over $51 billion in a shopping spree.

Indeed, the darker the clouds, the bigger the potential rainfall.

If you are an optimist, this could be the ideal time to invest with courage.

Here at Vistafolio Wealth Management, we’re seeing a range of golden opportunities in property, infrastructure, energy, and technology. By nibbling carefully into fearful markets at the right time, it’s possible to selectively capture good assets at a discount. This may yield positive results in the long-term.

We want to protect and grow the wealth of our clients in a careful way, while earning good passive income along the way.

So come talk to us. We’re now offering free consults for Eligible and Wholesale Investors.

🌎 Click here to register your interest today.

Regards,

John Ling

Analyst, Wealth Morning

(This article is commentary and the author’s personal opinion only. It is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please consult a licensed Financial Advice Provider.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.