Quantum Wealth Summary

- The markets have wobbled this month. This could present an opportunity for the courageous.

- Where is the economy likely to go next? Simon weighs in.

- We also explore an emerging business with high potential. This company has a dominant position in its market, as well as robust and growing income. What is its future outlook?

- As a bonus: we also reveal our Weekly Top 5 Quantum Trends. These are the most impactful global opportunities that we are currently watching this week.

June 2022. March 2020.

These months are seared in my mind.

This June, the S&P 500 dropped over 10%, bringing a 20% fall since the start of the year.

In March 2020, it fell over 30% on the arrival of Covid-19 and the ensuing lockdowns.

The March 2020 risk event was a natural disaster. A global pandemic and a sudden shock crash. Then the market steadily rebuilt to dizzying heights in December 2021.

Much of this gain has come from a plethora of cheap money. Thanks to the loose monetary policies and quantitative easing (‘money printing’) of central banks.

But, equally, some of it came from the announcement of vaccines, which promised a return to normal life. And the hope of business recovery back to 2019 levels.

The good news is that many businesses have now returned to 2019 earnings. Some are well surpassing those.

So what is the problem? Why has the beginning of this year — and in particular June — brought us such an aggressive bear market?

The answer is inflation

Caused by the perfect storm of a war bumping oil and food prices. And, simply, there still being too much of that loosened money supply flooding the system.

Of course, the Fed and other central banks are now applying the blunt instrument of interest-rate hikes. Investors are petrified this could throw the economy into recession and are dumping stocks.

Not so fast…

Interest rates, by historic standards, are now only approaching their median rate. If we go back to 1311, when we have the first recorded interest rates, the all-time average since then is 4.78%.

As I write, a 15-year fixed-rate mortgage in the US averages 4.81%. Though, a year ago, it was 2.24%.

This is not the stagflation of my childhood in the 1980s, where interest rates reached 16% following the 1970s oil crisis.

Western economies are less dependent on oil now than they were then.

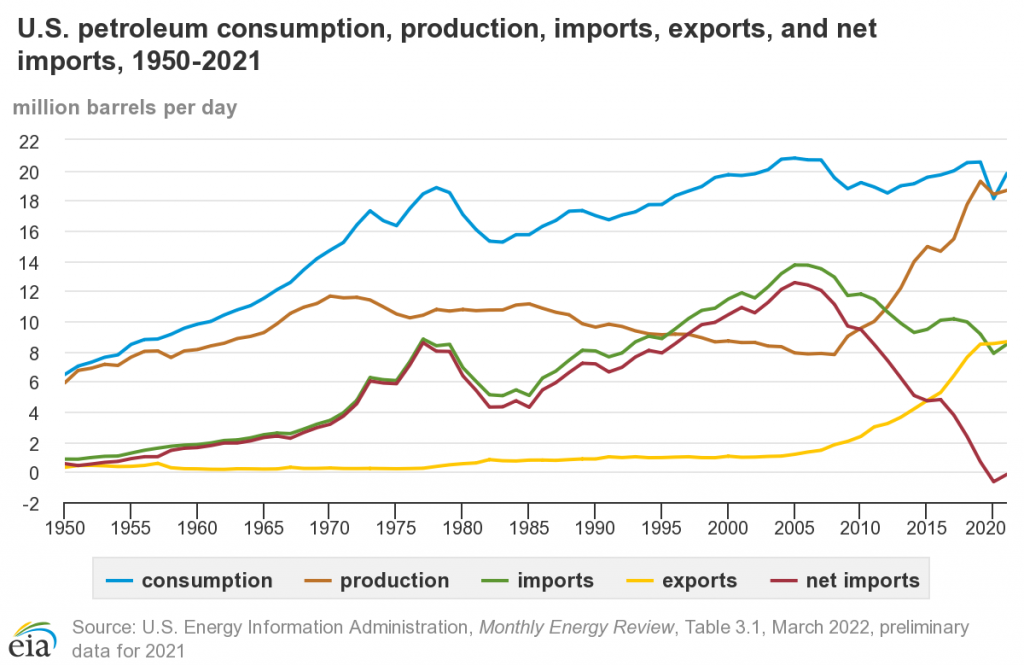

In fact, in 2021, the US was a net exporter of oil. It has dramatically increased its production since the 1980s:

So it doesn’t seem likely that the oil price alone is going to plunge us into a market-breaking period of hyperinflation.

Rather, people are now having to adjust to higher interest rates. That are around twice what they were during Covid money printing.

This will be a difficult period of change, and there may be more sell-off to come

But employment so far is remaining very high. Company earnings are proving strong. And it may be that we’ve simply seen economies attempting to recover from the pandemic faster than their capacity allows.

An optimist (me) will tell you that the central banks will get this under control. Yes, there will be a period of pain. Then markets will jump again.

So now this is the best opportunity we’ve had to buy at value for a long time.

A pessimist, though, may see the housing market collapse, liquidity dry up, and a GFC-style crash. But even then, within a few years, the market had recovered and was climbing again.

All we can do as investors is to continue to monitor earnings. And find instances where you can buy into high-quality and growing companies at discounted prices.

Over the longer-term cycle, these blips are simply opportunities to deploy. Though I do acknowledge seeing balances of portfolios, KiwiSavers, or 401ks plunge is unsettling.

But if you’ve been through enough cycles and a bear market before, you learn to accept temporary paper losses. Real losses are only incurred if you sell stocks during losing periods.

Today I want to look at a business that is seeing growth in earnings and market share, but is being discounted by today’s market…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.