It was thunderous.

The biggest rumble that anyone in the New Mexico desert had ever heard.

It was July 16, 1945. The local time was 5.29am. The code name was Trinity.

America had just detonated the first nuclear weapon in history.

Source: Wikipedia

The ground shook from the test explosion. A mushroom cloud plumed and swelled. The flash from the blast was searing, almost like a second sun.

The immediate area was uninhabited. Government and military personnel had gathered in shelters at a safe distance, watching with protective goggles.

Among them was J. Robert Oppenheimer. He was the head of the Manhattan Project, the scientific team that had given birth to the atomic bomb.

Oppenheimer had been brought up in a secular Jewish family. He was agnostic when it came to matters of Abrahamic religion.

Still, the weight of this moment — the sheer significance of it — demanded divine reverence.

So Oppenheimer recited a line from the Hindu sacred text, the Bhagavad-Gita:

‘Now I am become Death, the destroyer of worlds.’

It was a sobering verse. It summed up not just Oppenheimer’s personal feelings on the matter — but the feelings of his colleagues as well.

Months later, Hiroshima and Nagasaki would be on the receiving end of this new weapon of unusual destructive force. And the scientists who had participated in the Manhattan Project were, in equal turns, thrilled and terrified by what they had unleashed.

Source: Quartz

For the first time in human history, mankind had the ability to destroy itself many times over with the press of a button. This was no longer within the realm of mythology. This was reality.

As they obsessed about the potential for extinction, these scientists knew they had to do something bold. Something to remind the general public of the looming danger.

So they created an eternal symbol, which they have maintained since 1947.

They call it the Doomsday Clock.

It’s the most haunting reminder of our nuclear age.

Source: The Globe and Mail

Tick-tock

The imagery of it is simple but effective.

Every time humanity takes a step closer towards total annihilation, the hand on the clock creeps nearer to midnight. And every time humanity eases away from self-destruction, the hand inches back.

Here are some of the most significant highlights of the Doomsday Clock:

- In 1949, the clock is set to 3 minutes to midnight. The Soviet Union becomes the second nation to test an atomic weapon, sparking an arms race with America.

- In 1953, the clock ticks forward to 2 minutes to midnight. America tests a next-generation thermonuclear weapon, and the Soviet Union retaliates with the same. The arms race heats up.

- In 1969, the clock suddenly reverses in a rare show of optimism, sitting at 10 minutes to midnight. Most nations recognise the danger of nuclear weapons and collectively sign the Nuclear Non-Proliferation Treaty.

- In 1991, there’s a cause for great celebration, and the clock sits at 17 minutes to midnight. The Berlin Wall falls, and the Soviet Union dissolves. The Cold War is over.

- In 2018, the clock leaps forward to 2 minutes to midnight. World leaders have failed to address the issue of nuclear war and climate change, raising the ugly spectre of global annihilation once more.

- In 2022, the clock inches closer, sitting a mere 100 seconds from midnight. Putin’s invasion of Ukraine has upset the geopolitical balance of power, increasing the threat of escalation between East and West.

Keep calm and carry on

Source: MoneyWeek

So…what if there’s a 10% chance of civilisation ending over the next 12 months?

Does that make you anxious?

Should you still make financial plans?

Well, Peter Berezin and his team of risk analysts at BCA Research have studied the odds. And here’s what they say:

‘If an ICBM is heading your way, the size and composition of your portfolio becomes irrelevant. Thus, from a purely financial perspective, you should largely ignore existential risk, even if you do care about it greatly from a personal perspective.’

In other words, keep investing!

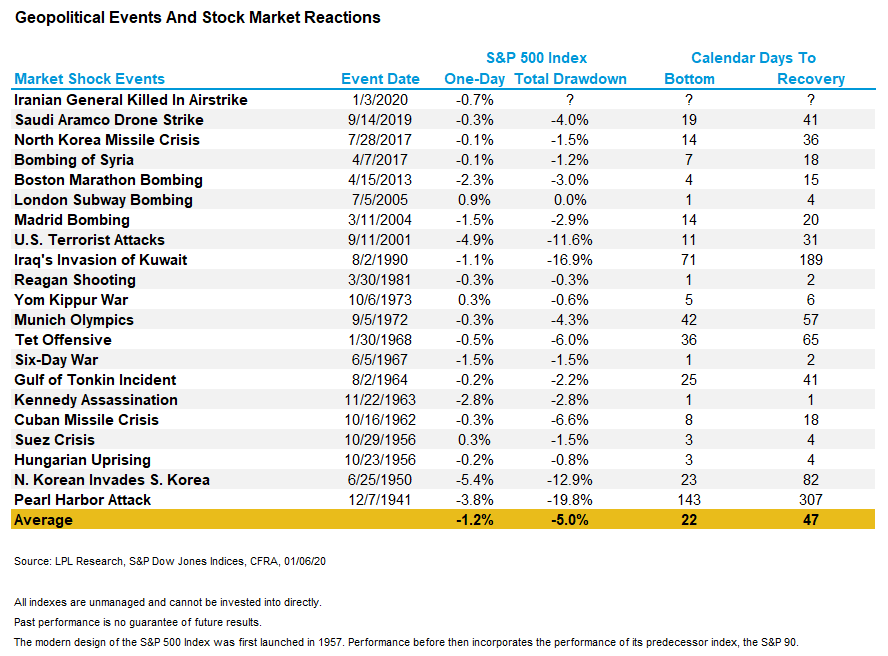

You can take comfort in the fact that history is on your side.

In the long run, the stock market has proven to be remarkably resilient. It has bounced back from every crisis event imaginable. It has even bounced back when the Apocalypse itself looked imminent:

Source: LPL Research

Of course, geopolitical fear — like what we’re seeing right now with the Russia-Ukraine conflict — is never easy to deal with emotionally.

But if you need wisdom and courage, well, listen to Samwise Gamgee from The Lord of the Rings:

‘It’s like in the great stories Mr. Frodo. The ones that really mattered.

‘Full of darkness and danger they were, and sometimes you didn’t want to know the end.

‘Because how could the end be happy?

‘How could the world go back to the way it was when so much bad happened?

‘But in the end, it’s only a passing thing, this shadow. Even darkness must pass.

‘A new day will come. And when the sun shines it will shine out the clearer.

‘Those were the stories that stayed with you. That meant something. Even if you were too small to understand why.’

Humanity, for all its flaws and frailties, has proven itself to be adaptable and forward-looking. Which is why there’s a 90% chance that the sun will still be shining and the birds will still be singing 12 months from now.

So here’s the upside: macroeconomic disruption might just offer savvy investors the rare opportunity to pick up quality assets at a discount. Especially if you’re looking at safe havens like the USA, the UK, and Australia.

If you want to place a bet, why not bet on optimism and hope?

From microchips to shopping malls, from self-drive cars to vineyards — we’re currently exploring a whole range of assets that we believe exhibit strong value.

If you qualify as an Eligible and Wholesale Investor and would like to have a chat with us about what’s happening in the world, now’s a great time to do so.

🌎 Click here to register your interest today

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.