We read with interest. A former politician is joining with former adult entertainment purveyors to build hundreds of homes a year.

The hundreds of homes a year is welcome.

But what smells slightly off is the wider question of how New Zealand reached such a dire need for homes. Such that adults renting in this country now exceed adults owning.

When you allow a starved landscape, then sell expensive food — well, there are some questions to answer in my book.

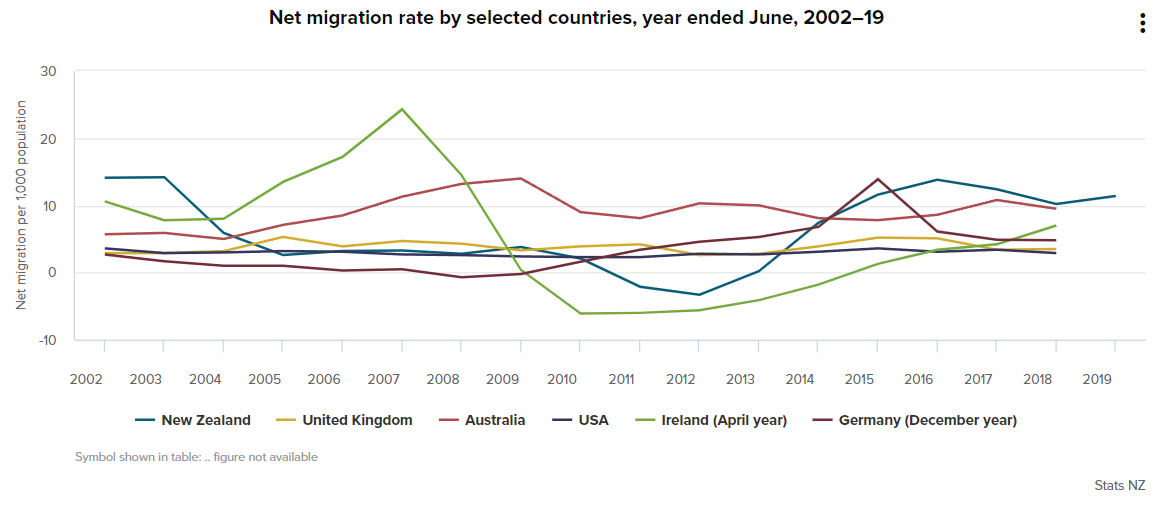

There’s been decades of leaving the housing market to its own devices. Floating homes on a global market. And encouraging very high net migration (since 2014 — at around 3x the rate of the US and the UK):

In 2009, Ireland suffered a house price collapse after migration expectations dried up.

In 2009, Ireland suffered a house price collapse after migration expectations dried up.

Source: Stats NZ

Here in New Zealand, mass immigration since 2012 has stoked a fire of unsustainable house price growth. A fire that cannot easily be put out, but is generating hot profits for the wealthy.

Justly, this could be about to change — though that could damage the economy.

Unsold estate in Ireland. Things came to a head there back in 2009.

Source: Critical Media Review

In Ireland, the property bubble collapsed in 2009, aggravating the wider Irish economic collapse. Then prime minister Bertie Ahearn was asked why he did nothing in relation to the tax incentives that fuelled the boom.

He replied:

‘We probably should have closed those down a good bit earlier but there were always fierce pressures, there was endless pressures to keep them. There was endless pressures to extend them.’

Were certain political parties and politicians beholden to the property lobby in New Zealand?

Many still are.

An extraordinarily large proportion of voters own rental properties. That lobby is omnipresent.

Credit to the current government. They have taken some steps to try and manage the Kiwi housing bubble. In particular, scaling back tax incentives and limiting foreign demand.

But they were likely thwarted by a heavy-handed central bank and failure to respond to the greater problem: It is damned difficult to build anything, anywhere in this country.

A property-owning democracy and immigrant nation

Former politicians will tell you this country is a property-owning democracy. It has ongoing need for positive immigration. Demand for housing will trend ever upward.

Actually, we need a vision for a population policy.

What is the desired population of New Zealand?

And how will we house this projected population?

After years living in Europe, I’m not sure encouraging dense population and constant growth is the answer.

I spent a great deal of time driving around rural France and Italy. That is, on balance, a pleasant experience. The living seems affordable. People look happy.

Then you cross to Switzerland. More densely settled. Much higher rates of net migration.

At the time, one needed a CHF 40 (approx. NZD $65) sticker to use the motorways. The motorways themselves are clogged anthills with queues for major tunnels. Then, when you stop, a cup of coffee can cost CHF 6.50 (approx. NZD $11)!

The mood changes as you traverse the borders. From joie de vivre and la dolce vita to organised tension.

Following Covid, and net migration last year at -3,900, some of the pressure is coming off here in New Zealand. But the government will be looking to open borders soon. And we could see the records of 70,000+ we saw in previous years again.

Or face an Irish-style property cliff.

Now, I’m certainly not anti-immigration. I’m married to an immigrant. And I have been a migrant. Good quality people are gold for a country.

But we need a conversation on what is the right population for this country. And how can we plan accordingly?

As with a high performing business — it is not the quantity of the people that count. It is the quality.

So you still want to invest in housing?

I’m not sure you need to lock into a housing fund. Diversification may be lacking.

There are listed options in the public markets where you could manage your risk while capturing upside (or downside) and income.

One housing developer, among several we follow, is AVJennings [ASX:AVJ].

Mainly Singapore-controlled, it has a good track record of building affordable communities.

Many people will be familiar with the Company’s Ara Hills development near Orewa. Or the Company’s Hobsonville Point project in West Auckland.

Source: AVJennings

It is the affordable stock metrics that attract me to AVJennings at the current price:

- Projected dividend yield: 6.4%

- P/E (price to earnings ratio): 10.9

- Price to tangible book ratio: 0.6

Of course, the stock could go up or down. Dividends can be cut.

This is going to depend on continued growth in the housing market — primarily in Australia where AVJennings has the bulk of its activity.

What is attractive is the low price-to-book ratio. This tends to suggest that the Company’s holdings of land, unsold sites, and development sites could be available at a discount in the price. Which may be prudent given storm clouds ahead — or profitable given further migratory boost.

Now, this is not a recommendation in any respect, since there are many risks you would need to consider. This is just an example.

You should do your own research and seek independent financial advice. Before considering any investment.

Now, we are exploring these sorts of opportunities every day for our wholesale investor clients. Updating them on the best companies we see. If you would like to register for a free consultation, seize that opportunity here.

Regards,

Simon Angelo

Editor, Wealth Morning

Important disclosures

Simon Angelo owns shares in AVJennings [ASX:AVJ] via portfolio manager Vistafolio.

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.