Quantum Wealth Summary

- Asset prices have climbed sharply over the past 20 months, hitting record highs

- It’s getting harder and harder for the discerning investor to find value in this expensive market

- However, pockets of hidden opportunity still exist — if you only know where to look

- We examine 2 stocks in Australia that have experienced a drop in price lately, which could offer bargain-minded investors the rare chance to capture value

Fear. Anxiety. Distress.

This is how the world reacted when the pandemic first struck.

Covid felt like an existential danger. A civilisation-ending threat. Just like a plot ripped out of an apocalyptic Stephen King novel.

No one liked staring into an abyss.

No one liked the uncertainty.

But…as it turns out…the existential terror didn’t last very long.

My colleague Simon has observed that once governments took action with aggressive money printing and fiscal stimulus, fear quickly morphed into greed.

Let’s put this into perspective:

- From 14 March to 20 April, 2020, the S&P 500 index plunged over 31%

- Then the trend line began to reverse, and we saw an incredible upswing

- Since then, the S&P 500 has surged over 107%

- Investors who had the courage to buy into the market during this time have experienced big gains

So, clearly, we’ve transitioned from one end of the spectrum to the other. Gravitating from despair to euphoria.

And now…?

Well, now we are certainly feeling the aftermath of the grand feast that we so eagerly partook in.

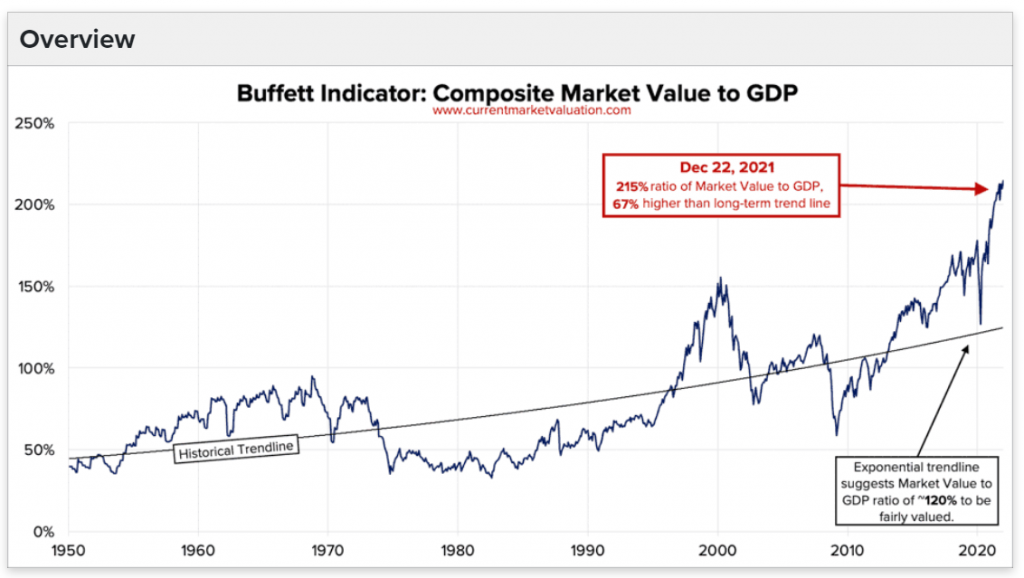

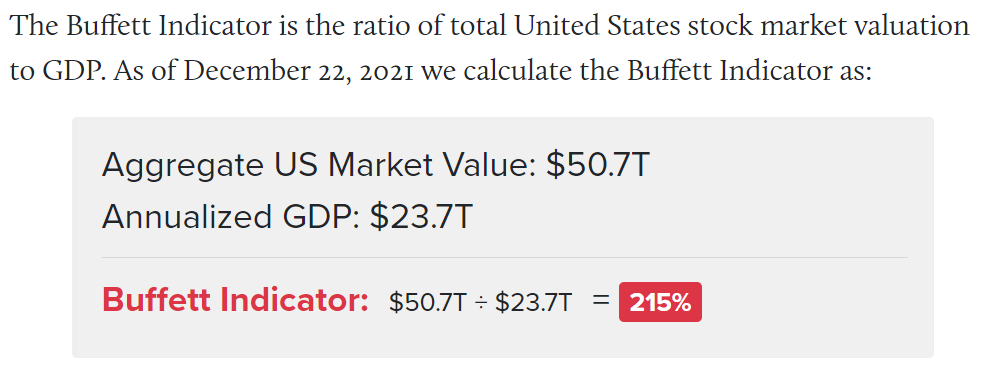

Just take a look at the Buffett Indicator:

Source: Current Market Valuation

In terms of valuation, the stock market is now sitting at a record high. It is outstripping economic growth. It is outstripping company earnings. Some say it is even outstripping common sense.

This has led the pundits to make predictions of looming disaster:

- Harry Dent — of The Great Depression Ahead fame — previously predicted that the biggest crash in human history would happen in June 2021

- Robert Kiyosaki — of Rich Dad Poor Dad fame — previously predicted that the mother of all crashes would happen in October 2021

- And…not to be outdone…personalities like Michael Burry, Jeremy Grantham, and Leon Cooperman also pitched in with their own doomsday predictions throughout 2021

Of course, the End of Days did not happen. We saw stocks continue to climb. And 2021 drew to a close without disaster striking, even despite the emergence of Omicron. Ultimately, greed proved to be a more compelling emotion than fear.

But now, as we say hello and welcome to 2022, what does the road ahead look like?

No doubt, we are experiencing a frothy market. An elevated market. And we are contending with inflationary pressures and rising interest rates.

None of us have a crystal ball. And as the experts have proven, not even they can predict with absolute certainty what will happen next.

Still, one thing is for sure: the easy pickings that we saw in the wake of the March/April 2020 drawdown no longer exist.

If you’re a discerning investor, you’re going to find it harder and harder to capture value. It’s no longer as obvious, nor as readily available.

Fortunately, though, there are still pockets of opportunity lurking out there. It is still possible to track down companies that are relatively cheap, despite the froth.

But here’s where a bit of skill and judgement is needed.

You will need to think differently. Because while everyone else is still focused on the Teslas and the Facebooks of the world, maybe it’s time to go below the surface. Study the undercurrents. Plumb the depths.

So, with that in mind, here are 2 contrarian stocks on the ASX that could still offer value in this expensive market…

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.