Quantum Wealth Summary

- Which stocks in our portfolio performed best across 2021?

- Which stocks could outperform in 2022?

- What were the key forces that shaped recovery and growth in 2021?

- What key forces will create opportunity in 2022?

You thought 2020 was bad?

2021 was actually a harder year to be in the markets for experienced investors.

Let’s go back to the beginning and explore why.

2020 saw the coronavirus emergency

The lockdowns caused widespread fear. How could businesses survive this when many couldn’t even open?

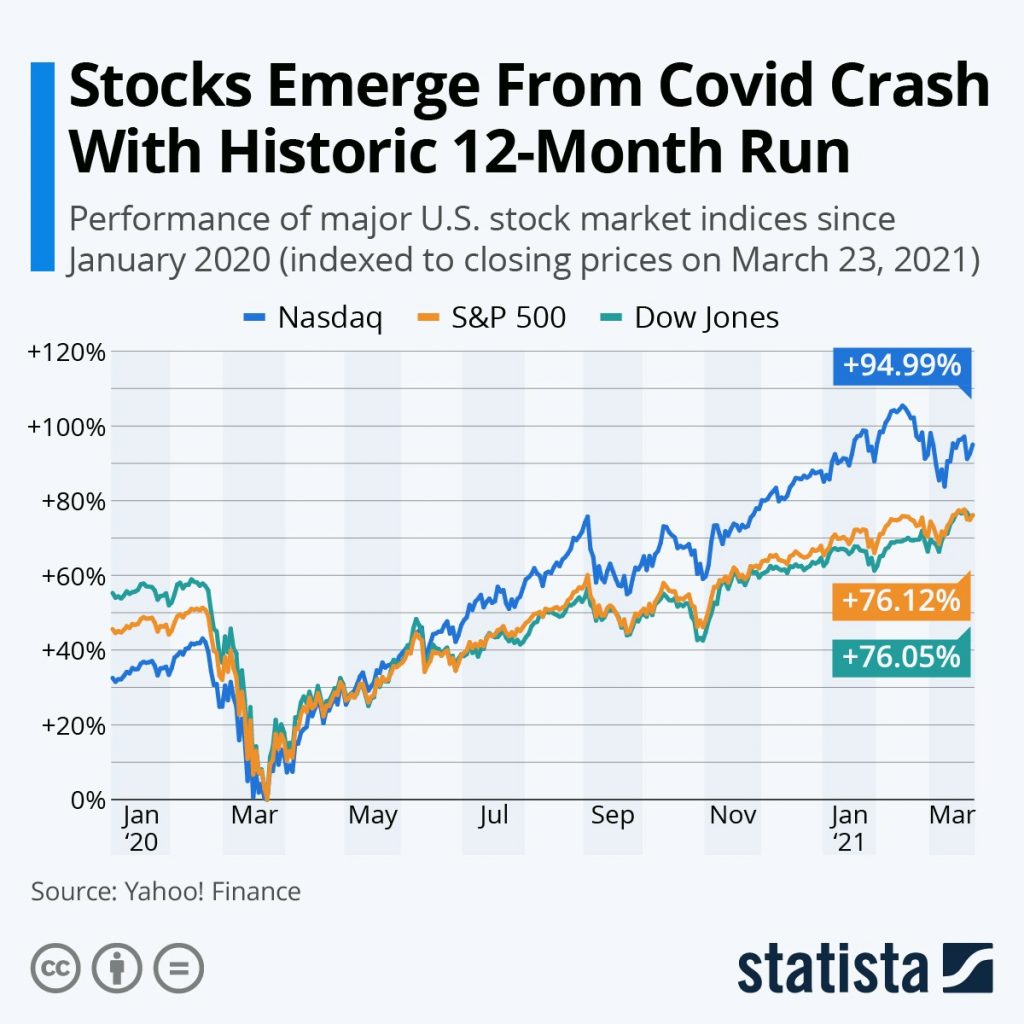

We saw drawdowns of around 35% in March 2020. We saw investors with portfolios of $1 million lose $300k on paper.

The human mind often responds badly to fear. Especially if it is not experienced or trained in dealing with it.

There were 3 possibilities:

- Some investors sold during the March 2020 coronavirus crash and crystallised their losses.

- Some held on as governments and central banks provided emergency support to economies.

- Some bought and topped up on discounted positions to varying degrees.

In the case of that million-dollar portfolio, the worst choice was to crystallise and make the loss permanent.

A better choice was to hold on. Many of those investors are almost back to where they were before 2020.

But an even better choice was to buy the fear. Although few could predict the level of monetary support that would follow, many stocks doubled from their March 2020 price into 2021.

Someone with a $1 million portfolio could now see that move towards $2 million.

In this way, 2020 was an opportunity for investors.

2021 has been much harder

The opportunity of many stocks being on a massive sale has passed. 2021 has seen volatility and hazardous uncertainty as investors ask:

- Can there be sustainable recovery when so much stimulus cash has flooded the global economy, causing lethal inflation?

- What will happen in markets when interest rates rise?

- Is the world a more dangerous place now that states are seeking to secure their supply chains and increase their military capabilities?

- Will we get control of the virus? Or will it continue to mutate beyond vaccines into more transmissible and hazardous variants?

- Debt levels have increased again, beyond the already dangerous levels we saw during the GFC. Is another reckoning coming?

Today, we’re going to look at which companies have done well since March 2020. But also those companies that could prevail beyond the highly uncertain outlook of 2021…and into 2022…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.