Let’s face it: As human beings, we aren’t usually the best at judging risk.

In fact, our feelings about what’s dangerous and what’s safe can be wildly inconsistent.

Consider these facts:

- The chances of dying while travelling in a car is 1 in 107.

- The chances of dying while travelling in a plane is 17 in a million.

The difference between the two is so vast, they’re not even comparable.

Yet the human perception of risk can be distorted by personal bias.

There are folks out there who are terrified of flying — but they will think nothing about driving fast once they get their hands on a steering wheel.

Source: Pixabay

Here’s a relevant statistic:

- In the immediate aftermath of 9/11, Americans were scared of planes.

- So, instead of flying, many chose to drive long distance to reach their destinations.

- Roughly 2,300 road-related deaths happened as a result.

This is a paradox. A self-fulfilling prophecy. In trying to minimise their risk profile, they have actually increased it manifold.

This is what psychologists call cognitive dissonance. Our perception of reality is malleable, like putty. We rationalise what makes sense to us, and we reject what we don’t want to acknowledge. Often to our detriment.

The thrill of the chase

It’s no secret: Everyone wants to make more money. We have a cultural obsession with this. The accumulation of money as the measure of success. The accumulation of money as the gateway to happiness.

Yet the stats reveal how elusive the feverish pursuit of profit actually is:

- 80% of day traders lose money in the stock market over the course of a year.

- 90% of actively managed investments fail to beat the market over a 15-year period.

Now, these numbers may sound abysmal.

But therein lies the contradiction.

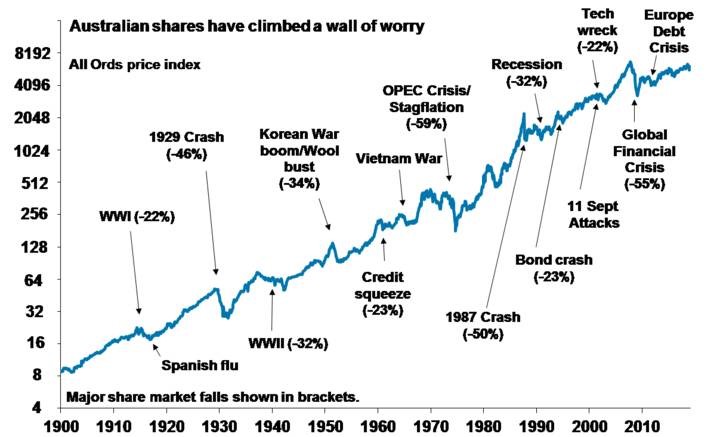

For the global economy, history has repeatedly shown us that there have been more good days than bad days. In other words, we have more cause for optimism than pessimism.

Consider this:

- Economic booms are more powerful than economic recessions.

- The upward trajectory of the market has been incredibly resilient.

- Humanity has overcome wars, crashes, pandemics — reaching greater heights.

Source: AMP Capital

Yet, despite this long-term positivity, why do investors stumble so often? Why has rising markets not translated into slam-dunk success for everyone?

It can be baffling. But here’s the truth: Even in the best of times, human beings often misjudge risk. They mistime it. They misprice it.

The greed and fear dynamic

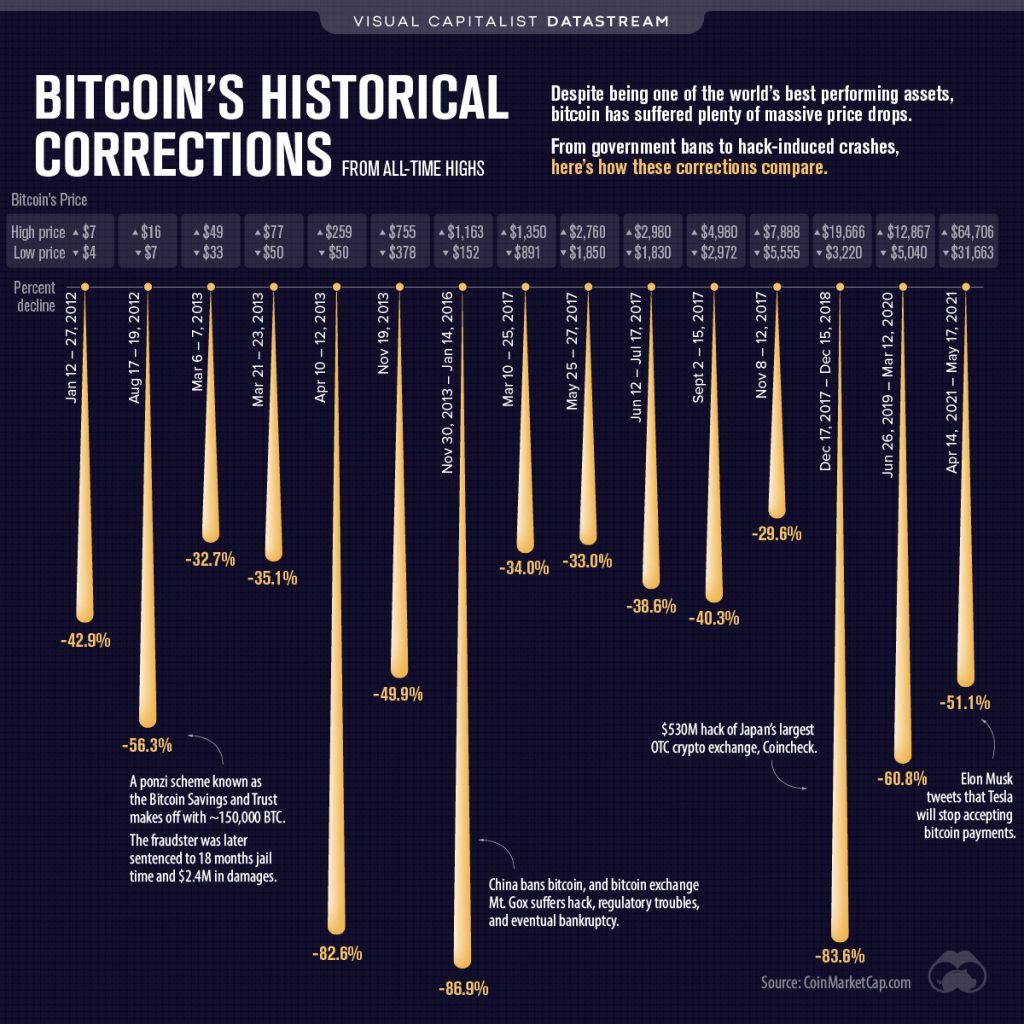

What’s the biggest speculative bubble of this generation?

There’s an argument to be made that cryptocurrency takes the top spot.

The frenzied pursuit of Bitcoin is a case in point:

- Most people are attracted to Bitcoin because they have heard that it’s an easy way to make money.

- ‘So-and-so became a millionaire through Bitcoin, so I think I’ll give it a go.’

- The price of Bitcoin is inflated and expensive — but most people don’t care.

- They invest in it anyway, hoping there’s more profit to be made.

- Soon enough, negative rumours and sentiments swirl.

- A sizeable number of punters lose faith and begin to sell off Bitcoin.

- The rest of the herd follows, and the panic accelerates, causing a steep decline.

- Huge sums of money are lost, catastrophically.

Source: Visual Capitalist

To date, there have been over a dozen separate fear events for Bitcoin.

The reasons behind them can seem random and haphazard. Take your pick — Ponzi schemes, Chinese crackdowns, unruly tweets.

As a result, the number of people who have lost money on crypto may actually outweigh the number of people who have ever made money on it.

Given the frequency and depth of these crashes, the financial pain is not to be underestimated.

Of course, Bitcoin millionaires do exist. These are daring and aggressive investors with a high tolerance for risk. They were fortunate enough to capture crypto’s potential at the beginning of its life cycle. That’s before the general public had even heard of Bitcoin.

Never discount a gambler’s luck.

But here’s the unfortunate truth: By the time you hear of someone becoming a millionaire by investing in some magical asset, chances are, it’s already too late. If you follow blindly, you risk getting burned. Badly.

Remember:

- Past performance is no guarantee of future performance.

- People have a habit of buying high as a result of greed.

- People have a habit of selling low as a result of fear.

- They misjudge, mistime, and misprice risk.

Time in the market versus timing the market

So, given the fact that our human impulses are so prone to distortion, what’s the best way forward?

I believe that it comes down to three things:

- Finding value.

- Developing conviction.

- Maintaining patience.

We should stop thinking of investing as a ‘get-rich-quick’ scheme.

Instead, we should develop a ‘get-rich-slowly’ strategy.

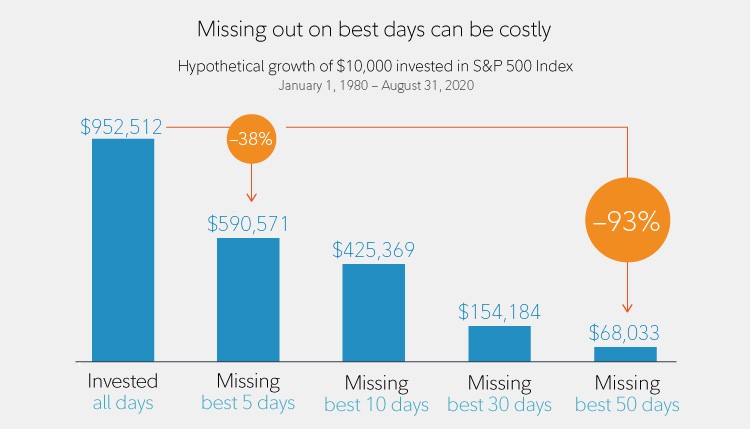

For example, let’s consider what would happen if you had the patience to invest an imaginary sum of money in the S&P 500 and hold it for 40 years:

Source: Fidelity

If you had stayed invested throughout — without speculating, without making greedy mistakes — you would increase your money by a factor of 95. The compounding effect is incredibly powerful.

But what’s truly remarkable is this: If you missed the 10 best days of your investment journey, your return could potentially be slashed by almost half. And, whoa, imagine your anguish if you missed the best 50 days. That’s a 93% cut!

So, if you’re in habit of compulsively buying on Mondays, then selling on Fridays, you’re actually harming yourself much more than you know.

Think of it as death by a million papercuts. You may not feel it at first, but you’re really bleeding yourself dry in the long-run.

The bottom line

Your investment journey is not a sprint. It’s a marathon. And it must be defined by three critical decision points:

- Which value stocks are you going to invest in?

- Which assets will provide you with sustainable growth and income for the rest of your life?

- How do you diversify your holdings so you have a balanced, risk-managed portfolio?

At Vistafolio Wealth Management, we can help you if you qualify as an Eligible or Wholesale Investor.

Our mission? To seek out global assets that we have the strongest conviction in. Buying and holding them for the long-term. Protecting and growing wealth in a measured way.

We are sceptical of wild trends that rely on gambling. Fashions come. Fashions go. We prefer to invest in companies with solid track records, strong management, and hard tangible assets.

That’s why we like businesses rooted in property and infrastructure.

This sensible approach has served us well.

For more information 👉 Click here to get in touch with us.

Our philosophy is clear and pragmatic. It’s about using a wholesome strategy that will stand the test of time; helping you reach your destination safely and smartly.

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.