When it comes to fearful life events, cancer is the world’s number one killer. It is indiscriminate. Unjust. And it has touched my family and friends, as I’m sure it has yours.

For a while now, I’ve been monitoring global pharmaceutical companies involved in oncology. Beyond prevention and treatment, diagnostics is one of the most important areas.

There is, in fact, a leading cancer diagnostics business on our doorstep: Pacific Edge Ltd [NZX:PEB].

The Company is headquartered in Dunedin, New Zealand, with offices also in Hershey, USA. It was established in 2001. It uses genetic biomarkers in urine to detect the presence of cancer. It markets this technology as being much less expensive than other diagnostics.

Since listing, the firm has had a number of capital raises, and the success of their products has not been guaranteed. Yet, recently, the tide has been shifting as a slew of regulatory approvals have added weight to their work.

This April also saw a worthwhile boost. The huge United Healthcare insurance group in the US, with 14.1% market share, added coverage for Pacific Edge’s Cxbladder test.

Why has the Pacific Edge [NZX:PEB] share price risen?

Since mid-2020, Pacific Edge has had a great run on the stock market:

Source: Google Finance

The Company’s annual report to 31 March 2021 shows the level of traction the Company has been making, clearly in a growth phrase following development and regulatory approvals:

- ‘Strong growth in operating revenue and cash reimbursement from July 2020 driven by CMS coverage and growing commercial adoption of Cxbladder.

- ‘Total revenue increased 101% to $10.4 million.

- ‘Operating revenue from test sales up 76% to $7.7 million.

- ‘Cash receipts from customers increased 52% on pcp to $6.7 million.

- ‘Total operating expenses increased 2% on pcp to $24.7 million.

- ‘Significant reduction in Net Loss, down 25% to $(14.2) million.

- ‘Strengthened balance sheet following $22 million placement to ANZ NZ Investments in July 2020.

- ‘Net cash, cash equivalents and short-term deposits increased 56% to $23.1 million as at 31 March 2021.’

More recent financial reporting for the Company came in July for Q1 FY22.

Laboratory throughput has risen over the last five quarters:

- 179% on the same time last year.

- 109% increase on the preceding quarter (Q4 FY21).

Cash Receipts from Customers also continue to grow:

- 242% on the same time last year.

- 121% increase on the preceding quarter (Q4 FY21).

The Company is seeking to grow the use of Cxbladder by large-scale healthcare providers. And to encourage customers to include multiple products from the Cxbladder test suite.

There is an addressable market in the United States of US$3.5 billion.

The business could also see recovery growth following the pandemic, since cancer testing and access has been more restricted due to Covid-19 lockdown conditions.

Where could Pacific Edge go from here?

This is the big question.

It remains a speculative investment relying on continued adoption of its products. Yet the business does have a very focused and niche strategy. Toward this strategy, it is focusing and growing capital resources.

This mission was noted in the letter to shareholders on 30 June 2021:

‘Our vision remains for Cxbladder to become the most trusted and preferred diagnostic test for the detection and management of urothelial cancer. We are well positioned to capitalise on the opportunities available to the company. Growth initiatives are being deployed in all Pacific Edge’s target markets, with the US remaining the primary focus. Our commercial priority remains on growing adoption and reimbursement of Cxbladder by Medicare, the Veterans Administration, Kaiser Permanente and other large healthcare institutions and private payers in the US.’

Alongside a clear vision, we also see potential and growing market access through large organisations like Medicare.

Clearly, the Company has some way to go to show profitability and demonstrate strong and sustainable margins. It is a speculative pick.

But last week, Pacific Edge made a major move that could accelerate things further. On Thursday, it announced a further capital raise to ‘accelerate execution of growth opportunities’ and dual-listing on the ASX. Further detailed information on this is accessible here.

This alone may present a unique growth opportunity through access to a much larger and deeper capital market.

Pacific Edge is not the only New Zealand company that has done this. Xero [ASX:XRO] is a well-known Kiwi name that has also gone down this road:

- In 2007, Xero first listed on the NZX.

- In 2012, it moved on to dual-list on the ASX.

- In 2018, it decided to discontinue its NZX listing.

- Since then, it has been listed solely on the ASX.

While many other growth factors were obviously at play, Xero has had a good run as an ASX stock:

Source: Google Finance

At the moment, Pacific Edge is clearly a company in growth mode. It is a speculative and high-risk investment reliant on continued growth and success with a narrow range of products.

But, in my view, promise is evident for investors with headroom and risk profile to make such allocations.

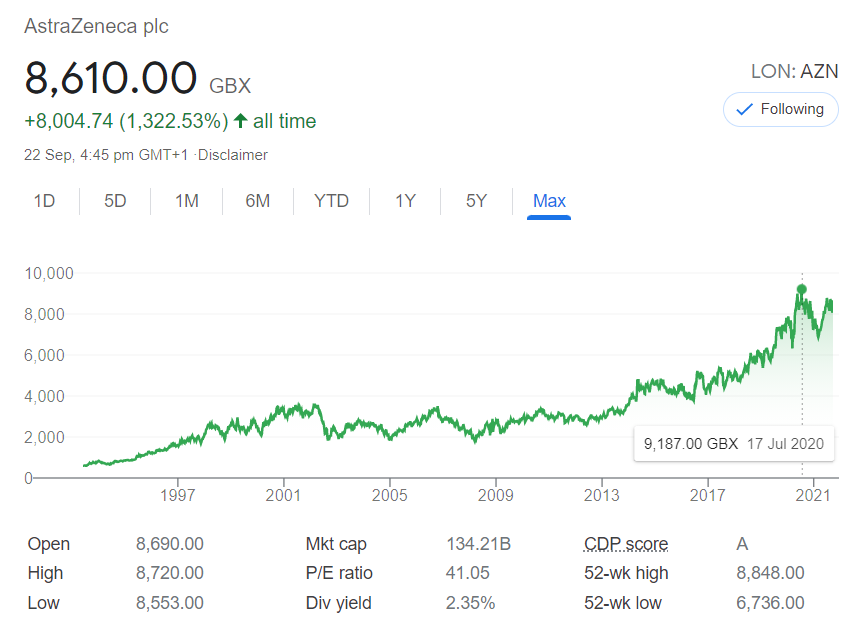

Will I be investing? To date, my focus has been on larger, more diversified businesses with medicines to treat cancer. In particular, AstraZeneca plc [LSE:AZN], which has also delivered strong growth with income over the past several years.

Source: Google Finance

But as a local business with growth ahead and a specific opportunity, I shall continue to monitor developments at Pacific Edge.

Regards,

Simon Angelo,

Editor, Wealth Morning

(This article is commentary and the author’s personal opinion only. It is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please consult a licensed Financial Advice Provider.)

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.